Written by Shan Saeed, IQI Chief Economist

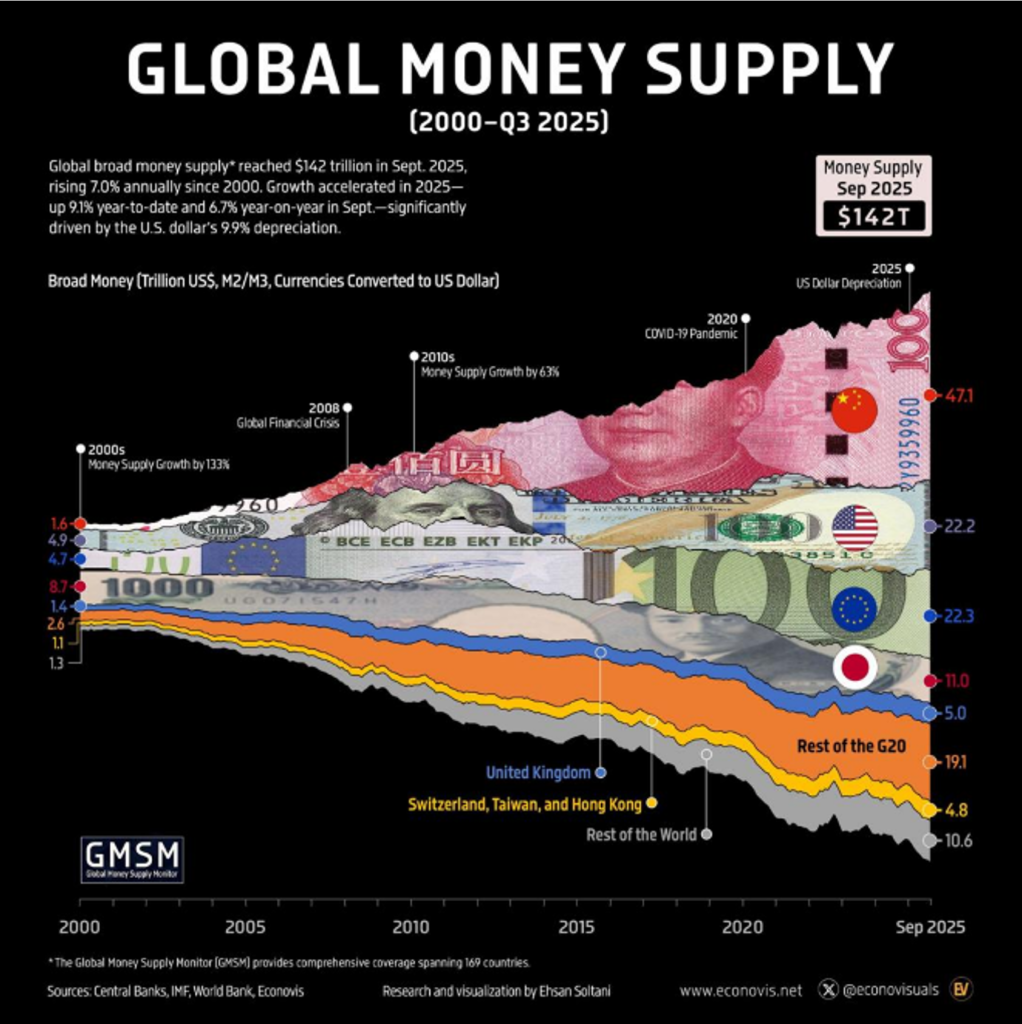

Central banks have got the limelight again. Since 2008, global central banks have taken sole responsibility in delivering economic outcomes, not out of choice but nobody else is taking the responsibility. Global Broad Money Supply (2000–Q3 2025).

Global broad money supply* rose to $142 trillion in September 2025, up from$26 trillion in 2000, reflecting a robust compound annual growth rate (CAGR) of 7.0%. Growth accelerated notably in 2025, increasing 9.1% year-to-date and 6.7% year-on-year in September, significantly boosted by the U.S. dollar’s 9.9% depreciation.

China accounted for the largest share at $47.1 trillion (33.1%), followed by the European Union ($22.3 trillion, 15.7%), the United States ($22.2 trillion, 15.6%), Japan ($11.0 trillion, 7.7%), and the United Kingdom ($5.0 trillion, 3.5%), together comprising three-quarters of global liquidity.

Between February 2020 and February 2022, money supply jumped 25%, before leveling off around $125 trillion through 2022 and 2023. From 2021 to 2024, growth slowed to a muted 1.4% CAGR, pulling the 2019–2024 rate down to 5.3%, below the long-term trend. Data covers 169 countries and territories, representing 99% of global GDP. All figures are converted to U.S. dollars.

1970 ERA IS BACK IN STYLE. TANGIBLE ASSETS ARE IN VOGUE.

Bank of America analysts reiterated their “long gold” recommendation, predicting that gold prices will peak at $6,000 per ounce by mid-2026.

Meanwhile, Wall Street has been raising its gold price targets. Goldman Sachs expects gold prices to reach $4,900 per troy ounce by the end of next year, up from its previous forecast of $4,300. JPMorgan analysts said gold prices could reach $6,000 per ounce by 2029.

CHINESE INVESTORS ARE HEADING FOR DUBAI.

According to the Financial Times, Chinese investors are heading for Dubai.