When you decide to sell a property—be it an exciting moment for new sellers or a bittersweet memory for those departing from a childhood home—you’ll have to pay specific fees before your property becomes someone else’s. That’s why our agents are telling you about the fees.

Costs such as property agent fees, Real Property Gains Tax, and more come into play, and you’re in luck: we have a guide for you! The agent fees for selling a house in Malaysia.

Essentials Fees When Selling a House in Malaysia 2026

Why do people sell their properties?

Selling your property is a substantial decision that involves careful consideration and planning. Before delving into the important fees associated with selling a property, it is essential to understand why individuals decide to part with their homes.

This decision is rarely made lightly, as a property investment and a repository of personal memories and experiences.

People choose to sell their properties for many reasons, each influenced by personal circumstances and external factors. The motivation can be categorise into several key areas:

Home-Related Reasons:

- Downsizing: Homeowners may sell to downsize due to financial pressure or changes in their life stage.

- Upgrading: Some sell to move into a larger or more desirable property.

- Relocation: Changes in job location or lifestyle can prompt a sale.

- Safety and Security: Concerns about safety or neighborhood security may lead to selling and moving elsewhere

Financial Reasons:

- Financial Hardship: Losing a job or facing financial difficulties can necessitate selling a property.

- Interest Rate Changes: Fluctuations in mortgage interest rates can significantly affect affordability, prompting homeowners to reconsider their current housing arrangements.

Personal Reasons:

- Relationship Changes: Separation, divorce, or changes in family structure can lead to property sales.

- Health Issues: Falling ill and being unable to work may impact a homeowner’s ability to maintain the property.

- Emigration: Moving to another country often involves selling one’s property

Life Cycle Reasons:

- Life Transitions: Births, deaths, and other life events can prompt property sales.

- Retirement: Some choose to sell and downsize after retirement.

- Changing Priorities: Lifestyle adjustments or new goals may influence the decision to sell

Understanding these varied motivations helps to appreciate the complexity of selling a property. Each seller’s situation is unique, and these factors often intersect in ways that profoundly influence the timing and nature of their selling decision.

Simple Step To Sell Your Property in Malaysia

Selling property in Malaysia involves a series of strategic steps designed to ensure a smooth transaction and optimal financial return. Whether you’re a seasoned property owner or a first-time seller, understanding the process can significantly enhance your experience and success rate.

From settling any outstanding financial obligations to engaging the right professionals, each step is crucial in effectively navigating the Malaysian real estate market.

Below, we outline a simple guide which will provide you with the necessary insights to prepare your property for sale and maximise its market potential.

Understanding real estate transactions is essential to ensuring a smooth selling process, emphasising the need for efficient, streamlined processes, personalised attention, and professionalism.

Clear Outstanding Payments:

Before listing your property, ensure that all outstanding payments related to the house are settled. These may include:

- Quit Rent: An annual land tax paid to the Malaysian Government.

- Assessment Tax: Paid to the local council based on your property’s rental value.

- Maintenance Fees: If you own an apartment or condominium, settle any outstanding fees related to common facilities.

- Rental Income Tax: If you receive rental income, ensure you’ve paid the necessary taxes

Get a Property Valuation:

Engage a professional valuer to assess the value of your property accurately. This valuation will help you set a competitive selling price and increase your chances of finding a buyer.

Set Your Selling Price:

Based on the valuation, decide on a reasonable selling price for your property. Consider market trends, location, and property condition.

Remember that an attractive price can attract potential buyers more quickly.

Prepare Necessary Documents and Find a Real Estate Agent:

Compile all necessary documents, including the Sale and Purchase Agreement (SPA), title deed, and other relevant paperwork.

When selecting a real estate agent, consider partnering with a leading real estate agency that can offer the expertise of a probationary estate agent, who, under the guidance of seasoned professionals, will assist in marketing your property effectively.

They can help you reach potential buyers and negotiate terms effectively, ensuring a smooth selling process from start to finish.

Remember, each step contributes to a successful property sale. Good luck with your selling journey! 🏡🌟

Important Fees To Pay When Selling Your Property:

1. Legal fees

After securing a buyer for the property, your lawyer will draft the Letter of Offer and the Sales and Purchase Agreement – they will also handle other legal matters associated with the sale.

An example of the calculation is tabulated in the table below:

| For the first RM500,000 (price of the property) – 1.0% (rate) |

| For the next RM500,000 – 0.8% |

| For the next RM2,000,000 – 0.7% |

| For the next RM2,000,000 – 0.6% |

| For the next RM2,500,000 – 0.5% |

If your selling price is RM2 million, the calculation is as follows:

| The first RM500,000 would be one per cent of RM5,000. |

| The next RM500,000 would be 0.8 per cent for RM4,000. |

| The remaining RM1 million would be 0.7 per cent for RM7,000. |

Read: ENGLISH MARKET INSIGHTS [Latest Update] The Solicitors’ Remuneration Order 2023 (SRO 2023)

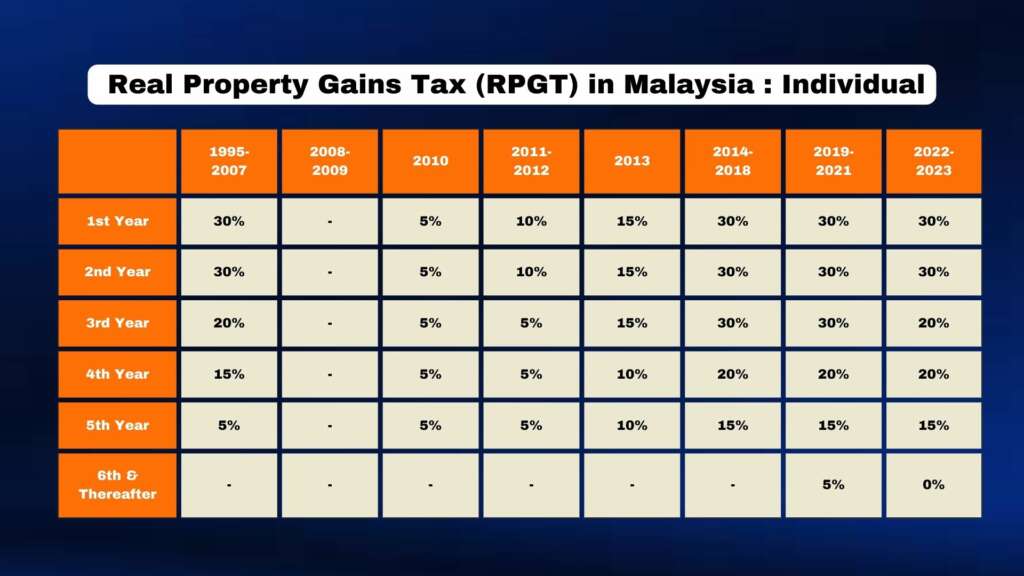

2. Real Property Gains Tax

Image source: Loanstreet.com.my

Shortened as RPGT, it is a tax you must pay to the government when you wish to sell your property—be it landed or high-rise. The RPGT was recorded in 2022, as above; in 2024, it is still the same tax.

By paying the tax, you’ll gain any profits from selling your property in Malaysia. But no tax will be paid if there’s no profit or when you receive a loss from the sale.

But how does one calculate RPGT?

- What is your chargeable gain? [Difference between the purchase price of your property and its sale price]

- Multiply this with the relevant rate for your RPGT.

If your chargeable gain is lower and you take longer than 5 years to sell your property, the RPGT would be reduced.

Whether you are Malaysian or not, this tax applies to anyone who has profited from selling Malaysian properties.

You will only be exempted from RPGT if;

- A once-in-a-lifetime exemption on any chargeable gain from the disposal of a private residence

- Exemptions on the first RM10,000 or 10% of the profit gained, whichever is higher.

- When a property is transferred by way of a gift between immediate family members

3. Malaysian Property Agent Fees

Understanding the intricacies of estate agency practice and the estate agent’s written examination is crucial for those embarking on a career in the real estate sector.

Gaining practical experience and qualifications, such as the Diploma in Estate Agency, prepares individuals for the Test of Professional Competence.

Moreover, those with property-related degrees may be exempt from the property agent’s written examination, streamlining their path to becoming qualified real estate professionals.

Property managers and real estate negotiators play pivotal roles in the real estate industry, contributing significantly to the success of property sales through their expertise and dedication.

Hiring a Malaysia property agent from a real estate agency who will provide an all-in-one service package, such as pricing and advertising your property, arranging for viewing the property, and negotiating with potential buyers on behalf of the seller, usually incurs a cost.

So how much is agent fees for selling house in Malaysia? The registered estate agent of your choice will charge a commission – usually 2-3% of the property’s selling price is capped at 3%.

The property agent from your chosen real estate firm may also charge you for additional costs, such as marketing materials and transport. Still, they should let you know about these charges beforehand.

Read More

4. Fees for renovation and repairs

Spending money to make your property presentable and appealing to your target buyers will help raise its value and get it sold quickly!

Try a fresh coat of paint in the living room to picture how a family can spend their free time, or brand new decor in the master bedroom to entice a new couple to find their perfect home.

You’ll also want to repair minor inconveniences such as leaking pipes, wonky doors, or small cracks in the walls to ensure a satisfied buyer, not including plant and machinery.

You could also consider hiring a professional cleaning service to give it a good cleanse – ready for its new owners to move in the next day.

Essential things to prepare your property before selling it

Preparing your house before putting it on the market is crucial to attracting potential buyers and securing a successful sale. Implementing a series of targeted improvements can significantly enhance the appeal of the property, making it more attractive to prospective buyers.

Here are the essential steps to follow to ensure the property is in its best possible condition:

Repair, Remodel, Redecorate:

Ensure your property looks its best:

- Repair any visible damages.

- Consider remodelling or redecorating to maximise your potential sale price

Deep Cleaning and Decluttering:

- Deep clean the entire home, including carpets, windows, and appliances.

- Declutter by removing personal items, excess furniture, and unnecessary clutter.

- Stage the house to create an inviting atmosphere for potential buyers.

Take High-Quality Photos:

- Capture appealing photos of your property to use in marketing materials.

- Plan your marketing strategy to attract potential buyers

Remember, a well-prepared house significantly increases your chances of attracting buyers and achieving a successful sale. Following these steps ensures that your property stands out in the competitive real estate market.

Now, you are ready to sell your property!

After determining your house’s value and calculating the necessary fees, congratulations are in order as you are one step closer to finding the perfect buyer! The next step is to let people know that it’s for sale.

Try advertising it via social media or the traditional way by getting your friends and family to spread the news via word-of-mouth.

Either way, we wish you the best of luck!

Frequently Asked Questions

Can Foreigners Buy Properties in Malaysia?

Yes, there are foreign properties in Malaysia. Foreigners can own 100% of the property as long as the requirements are met. Foreigners can buy all property except that valued below RM 1 million.

How Much Is The Estate Agency Fee?

The Malaysian Institute of Estate Agents (MIEA) stated that the sale and purchase of land & buildings cost a maximum of 3% of the property’s sale price. However, the above fee scale shall not apply to foreign properties in Malaysia.

Does Malaysian Property Agent Have Basic Salary?

A property agent or real estate agent’s salaryonly depends on closed deals. An agent only earns by completing a more significant number of property deals.

Can Foreigners Buy Properties in Malaysia?

How Much Is The Estate Agency Fee?

Does Malaysian Property Agent Have Basic Salary?

A property agent or real estate agent’s salaryonly depends on closed deals. An agent only earns by completing a more significant number of property deals.

Are you interested in selling your property? Or are you seeking professional help to find the perfect buyer? Leave your details below, and they will contact you soon.

Continue Reading: