REIT, aka real property trust, is the entity which owns or invests in the property sector. This REIT must comply with many requirements. Almost all REIT trading on reputable markets offers investors numerous advantages. REITs are real estate companies which own, operate or finance income-producing real estate.

Being able get stable and big profit from investment is a dream for many. However, it’s not easy to make this happen. It takes years of research, time, and effort. Along with this, the investment that’s required is hefty as well. Not everyone is able to afford real estate in this day and era.

The real estate market is on the rise, showing that owning property offers more than just a place to live—it can also be a source of income. Investors see real estate as a way to earn money regularly, especially since leaving land unused is a missed chance to make revenue.

Whether it’s developing land or selling it for a profit, there’s potential to increase earnings. Selling property can be complex, but real estate agents are there to help.

They have the expertise to connect sellers with buyers and homeowners with tenants, making the process smoother and more beneficial for everyone involved.

Real estate services can be slightly expensive but they are mostly worth it.

Despite the advantages of having a property, it’s still very difficult to invest in one. This is where Real Estate Investment Trust Fund comes in. These are a type of security deposit that invests in real estate and are listed publicly on the stock exchange exchanges.

Source: Investopedia

What is Real Estate Investment Trust (REIT)?

Real Estate Investment Trust (REIT) offer individuals the chance to invest in large-scale commercial real estate without the need to directly purchase the property. By investing income producing real estate for a smaller initial sum, investors can tap into a source of stable income and potentially attractive distribution yields. This investment model democratizes access to real estate investments, making it feasible for more people to partake in the financial benefits of owning commercial real estate.

Advantages of investing in REIT

One of the key advantages of investing in listed REIT is their liquidity. Unlike traditional real estate investments that require a lengthy and complex process to convert into cash, REIT units are traded on stock exchanges, allowing investors to buy and sell shares with ease.

This liquidity is a significant benefit, offering a level of flexibility not typically associated with direct real estate ownership. Additionally, REIT provide a stable income stream, akin to dividends, generated from the rent collected from tenants of the properties within the REIT’s portfolio, making it an attractive option for those seeking regular income.

Who managing REIT?

REIT are managed by professionals with deep expertise in the real estate sector, ensuring that both residential and commercial properties are well-maintained and strategically managed to enhance value and yield. The affordability and accessibility of REIT, coupled with the diverse range of properties they encompass, from retail centers to healthcare facilities, make them an appealing investment option.

This diversity not only allows investors to spread their risk but also contributes to the broader economic growth by supporting various sectors within the real estate industry. As such, REIT represent a compelling investment opportunity for those looking to diversify their portfolio and benefit from the real estate market’s potential.

Is Investing in REIT a Good Idea?

Investing in Real Estate Investment Trusts (REITs) has its ups and downs, and it’s important to weigh the pros and cons to see if they’re a good fit for your investment goals.

A major appeal of REITs is the ability to pool money with others to own profitable real estate, often generating steady rental income. This offers a simpler, less volatile way to earn from real estate compared to the direct purchase and management of properties.

REITs allow you to invest in real estate by buying shares, potentially leading to profits over time without the direct hassle of property management.

However, not all REITs are created equal. Some, like those focusing on commercial properties, tend to be more stable and are recommended for beginners. Industrial REITs, due to high demand for warehouse space, might offer higher returns.

Hospitality REITs in tourist areas can also be lucrative, though office space REITs may currently face challenges due to oversupply. Choosing the right REIT is crucial for investment success, highlighting the importance of informed decision-making in this area.

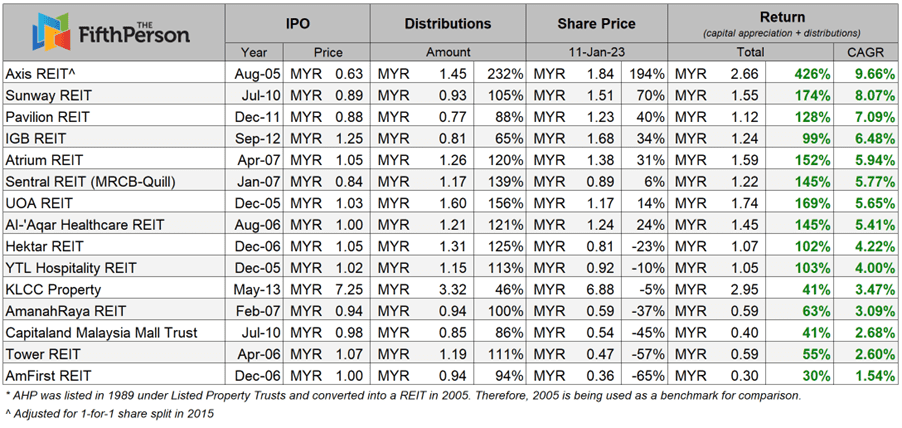

Below are some table of data with top 5 Malaysian REIT that has a possibility if you invest from their IPOs based on 2023

Source: The Fifth Person

What Benefits Does a Real Estate Investment Trust (REIT) Offer?

Investing in a Real Estate Investment Trust (REIT) comes with several key benefits, making it an attractive option for many investors. These advantages include significant tax benefits, the ability to invest with a low initial outlay, and the convenience of professional management.

One of the major perks of REIT is their favorable tax treatment. Unlike direct property ownership, which can incur hefty taxes such as income tax or real property gains tax, REIT often enjoy exemptions from various taxes, including corporate tax and stamp duty. This tax efficiency can lead to higher returns for investors.

Furthermore, REIT lower the barrier to entry into the real estate market. Direct property investment typically requires a substantial initial investment, which can be prohibitive for many.

REITs, on the other hand, allow investors to start with much smaller amounts, making real estate investment accessible to a broader audience.

Lastly, the hassle of property management and tenant relations is handled by professionals when you invest in a REIT. This means investors can enjoy the benefits of property ownership without the day-to-day responsibilities, making REIT a hassle-free option for earning income from real estate.

What are Real Estate Investment Trust Funds REIT?

After analyzing the factors which decide if REIT is a good investment and knowing the advantages in detail, it’s important to also ask a question such as what are real estate investment trusts and funds actually?

In easy words, REIT are a rather safe way to invest in real estate assets The concept came from the United States and was first introduced there. Malaysia adopted this later on and AXIS REIT came into being.

The foundation of this concept is very similar to a mutual fund, people with adequate funds come in together and invest in something expensive which can be afforded by a single party alone.

They give small investors a chance to acquire and have ownership while improving the economic growth of the industry as well. There are various advantages of this initiative.

Being able to earn passive income is one of these pros along with tax incentives and hassle-free management.

7 Step to open a REIT brokerage account

Opening a REIT brokerage account in Malaysia can be streamlined into a few essential steps:

1. Research Brokerages

Start by comparing brokerage firms in Malaysia that offer REIT trading on Bursa Malaysia. Look at their fees, services, and trading platforms.

2. Select a Brokerage

Choose the brokerage that best fits your investment needs and preferences, especially one that provides good REIT market access.

3. Open an Account

Apply for an account online or in-person, providing necessary documents like your NRIC or passport and proof of address.

4. Apply for a CDS Account

Fill out the application for a Central Depository System (CDS) account, required for trading securities in Malaysia, through your brokerage.

5. Fund Your Account

Deposit money into your new brokerage account using bank transfer, online banking, or cheque.

6. Start Trading

With your account set up and funded, you can begin buying and selling REITs through your brokerage’s trading platform.

7. Monitor Investments

Keep an eye on your REIT investments and market conditions to make informed decisions.

Opening a REIT brokerage account in Malaysia is a straightforward process that opens up opportunities for investing in real estate through the stock market.

By following these steps and doing your due diligence, you can start building a diversified investment portfolio with REITs.

Is REIT a Low-Risk Investment?

In Malaysia, many investors often overlook REITs (Real Estate Investment Trusts) as an investment option, yet they offer a low-risk opportunity, especially appealing to those with limited investment knowledge. Beginners or those wary of the complexities of real estate investment find REITs particularly attractive, largely because government support backs them, providing high yields and passive income with tax advantages.

Unlike direct property investments that can tie up funds, REITs offer high liquidity, allowing investors to buy and sell shares easily, akin to trading in the stock market.

This liquidity, combined with professional management by seasoned real estate firms, reduces investment risks. Notable low-risk REITs in Malaysia include Axis, IGB, Sunway, among others.

For those looking to diversify their investment portfolio while minimizing risk, REITs are worth considering, supported by expert advice and thorough research.

FAQs

What is the best REIT to invest in Malaysia?

Amongst their top choices are Pavilion-REIT (fair value at 1.61 USD per unit) and IGB-REITE (fair value at 1.92 USD per unit). 28 January 2023

What is the minimum investment in REIT Malaysia?

With only 100 RM it is possible for anybody. Let us look for the AHP Amanah Harta Tanah PNB REIT where 1 unit is priced at RM0. 74. Bursa Malaysia has set a minimum amount for a share that is 100 units. 20 Dec 2023.

Is REIT investment more complicated compared to buying a property?

Unlike traditional property, the REIT is trading on a stock exchange. Investors can benefit in many ways from the investment flexibility of real property. A pooling fund allows a buyer to buy real estate that investors usually cannot afford – such as commercial, industrial and retail properties. Compare it to the typical property investment, where the purchasing process takes anywhere from 6 to 8 months. There is a lot to do including buyers agents, property, lawyers, banks and the land office.

Conclusion

When it comes to avoiding risk in any investment, one should always depend on thorough research and advice from experts who understand the real estate industry very well. Risks can be a part of investments but it’s necessary to take calculated risks especially if you’re a beginner.

If you’re looking for further advice income generating real estate, and considering making an important REIT decision, IQI Global Agency offers a wide variety of options and their exceptionally talented team would be able to give you the right advice as well.

Learn more about Real Estate Investment Trust (REIT) at bursa malaysia!

We have real estate professionals who can help you own Property. Fill in the form below, to get in touch with them!