Written by Yousaf Iqbal, Head of IQI Canada

Canada’s housing market held steady in October 2025, with national sales dipping 0.8% and average prices settling at C$676,000, slightly higher than September but 1.5% below last year.

The Bank of Canada’s move to lower rates to 2.25% provided some relief for buyers, although affordability remained stretched in major cities. Toronto and Vancouver continued to soften as new listings increased and prices adjusted downward, while Prairie markets like Calgary and Edmonton remained notably strong.

Across the country, moderating rents and rising supply supported more balanced market conditions. Overall, early signs of stabilisation are emerging as Canada moves toward 2026 under a lower-rate environment.

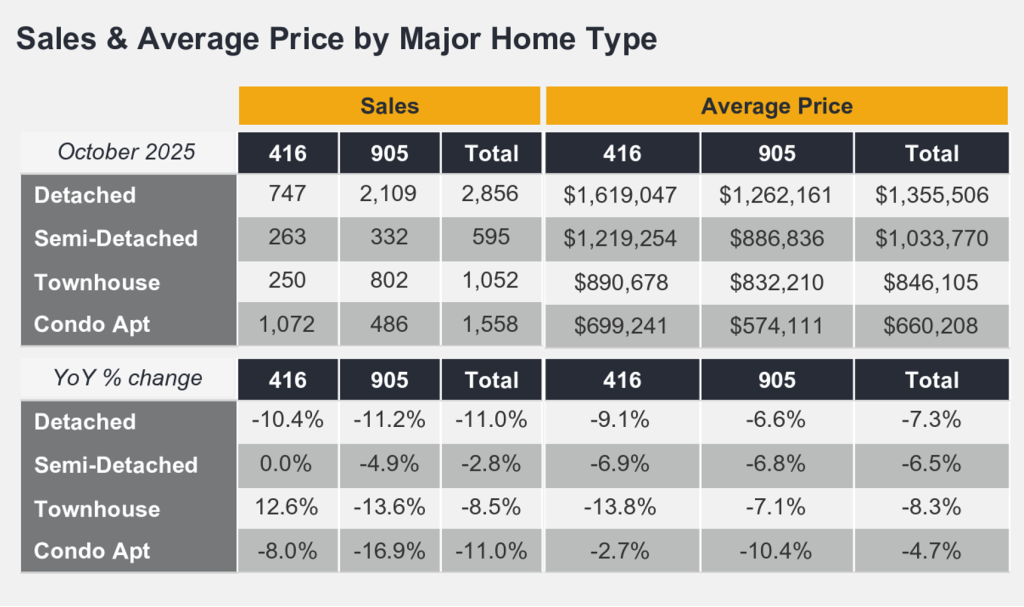

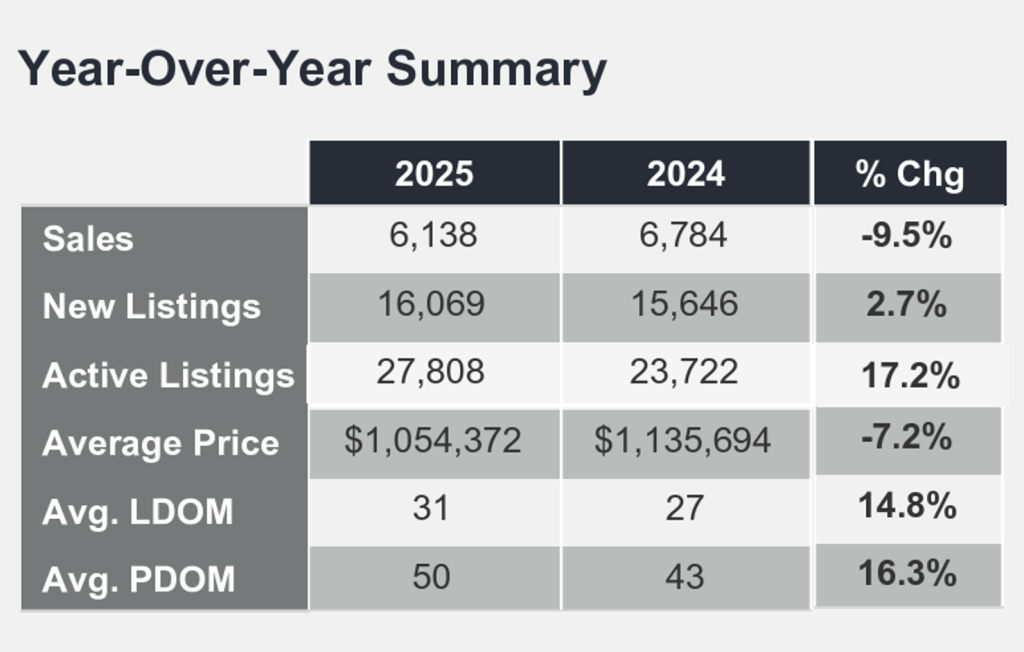

Regional dynamics showed clear divergence. The GTA saw a 9.5% drop in sales and a 7.2% decline in average prices, reinforcing a buyer-friendly landscape as inventory grew and the MLS® HPI fell 5% year-over-year.

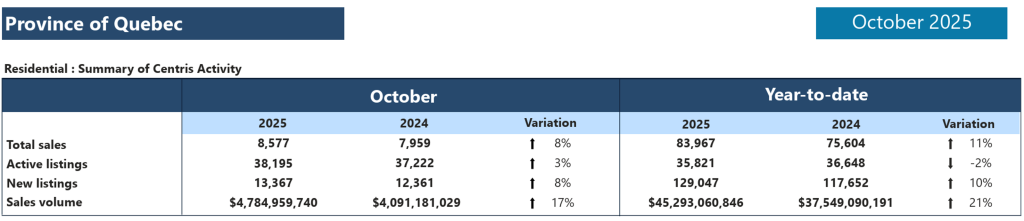

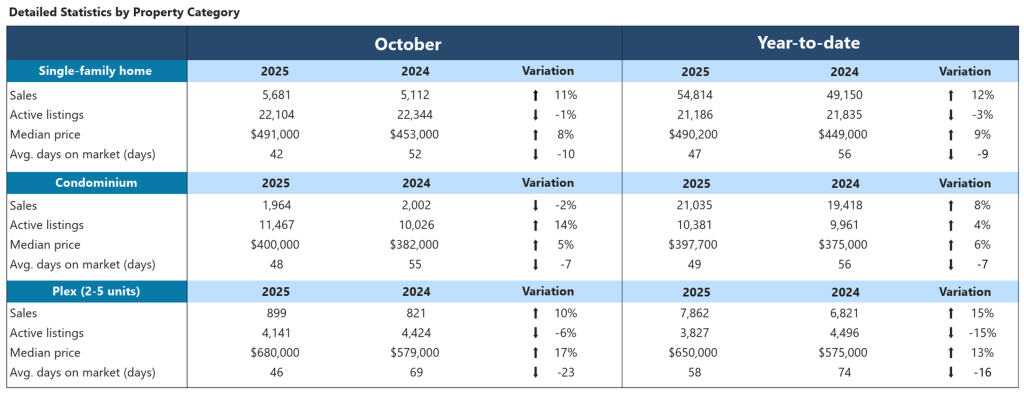

Vancouver posted a 14% drop in sales and a 13.2% rise in active listings, pushing prices lower across all housing types. Meanwhile, Quebec stood out as the strongest performer, with sales rising 8% and prices increasing across all categories: single-family homes up 8%, condos up 5%, and plexes up 17%.

These contrasting trends highlight Canada’s multi-speed market, shaped by affordability gaps, inventory shifts, and varying local economic conditions.