In December 2024, Canada’s housing market cooled, with sales down 5.8% from November but up 10% for Q4. The average home price was $676,640, a 2.5% year-over-year increase, with the Home Price Index rising 0.3%. The Bank of Canada’s interest rate cuts, including a December drop to 3.25%, are expected to boost demand and listings in spring 2025.

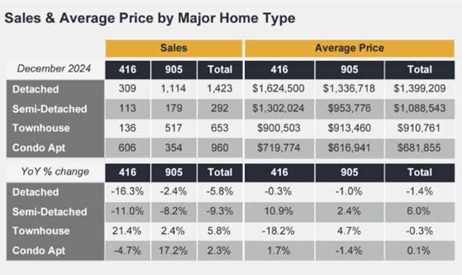

Toronto

TORONTO, ONTARIO, January 7, 2025 – The GTA housing market saw modest changes in 2024. Annual sales rose 2.6% to 67,610, while new listings jumped 16.4%, offering buyers more options and curbing price

growth. The average home price dipped slightly to $1,117,600 from $1,126,263 in 2023, with condos seeing larger price declines than ground-oriented homes. High interest rates limited affordability, but Bank of Canada rate cuts in late 2024 improved conditions. TRREB expects further rate reductions and stable prices to enhance the market in 2025. December sales totaled 3,359, with new listings up and prices steady

Vancouver

Metro Vancouver home sales rose over 30% year-over-year in December 2024, reflecting strengthening demand. Annual sales reached 26,561, up 1.2% from 2023 but 20.9% below the 10-year average. Listings increased 18.7% to 60,388, exceeding the 10-year average by 5.7%. December inventory totaled 10,948, up 24.4% year-over-year. The benchmark price for all properties was $1,171,500, up 0.5% from December 2023. Despite a slow start to 2024, late-year sales momentum and stabilizing prices suggest a more active market in 2025.

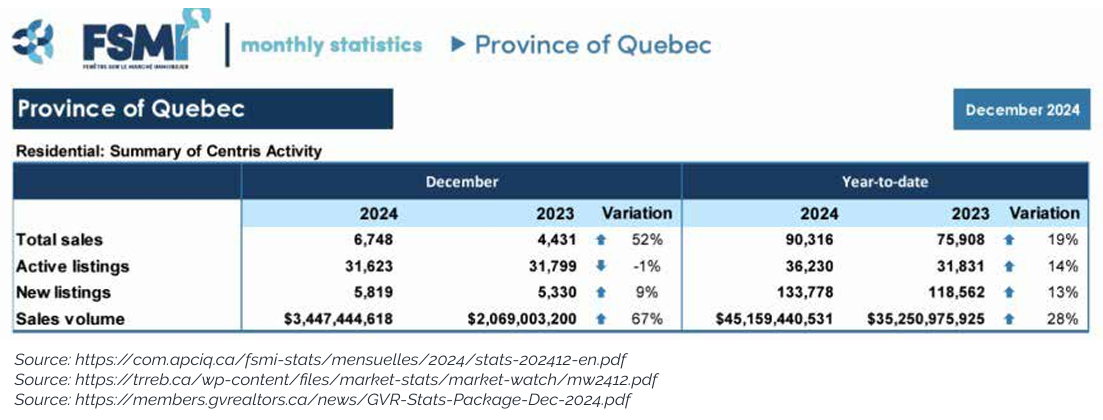

Quebec