Everyone dreams of buying a home they can call their own. But with the increasing properties prices, it is a challenge trying to own a property if you belong in the B40 and M40 income group.

But hold up! What do B40, M40, and T20 mean? How can you figure out which group you belong to?

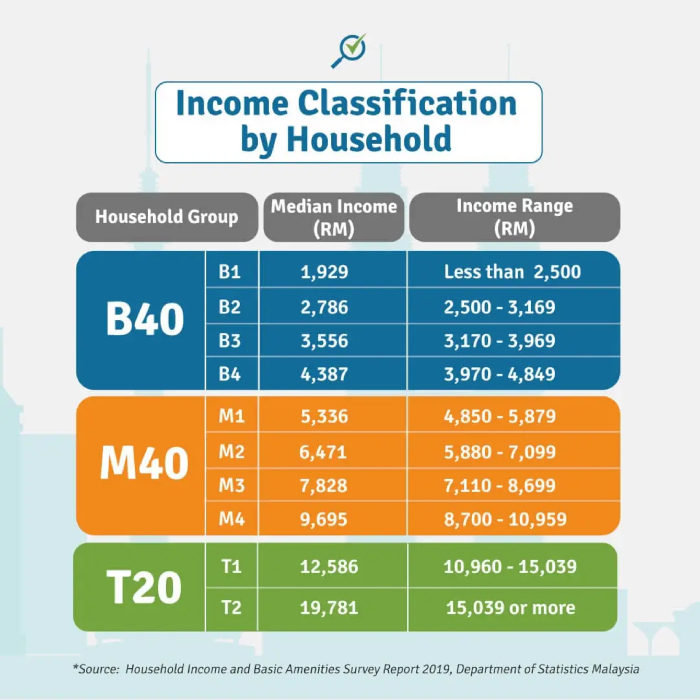

Well, Malaysian citizens are classified into three main income groups:

Bottom 40% (B40), Middle 40% (M40) and Top 20% (T20) according to their median monthly income per household.

Here’s a table to make you understand them fully:

If you are part of the B40 or M40 group, you will be happy to know that the government has created various housing schemes to help these groups.

Below are some of the housing schemes catering to the B40 and M40 groups.

Malaysian’s Govt’ Housing Schemes

1. Rumah Mesra Rakyat (RMR)

Rumah Mesra Rakyat (RMR) is a government program that helps lower income earners like fishermen, farmers, poor families without a place of residence or run-down homes.

This program gives them access to land, to build and own comfortable, affordable homes.

Requirements to qualify for Rumah Mesra Rakyat (RMR):

- Malaysian citizen

- 18 years to 65 years old.

- Monthly household income below RM5,000

- Applicant and spouse does not own any property OR owns a run-down house

- Owns a suitable land that is free from mortgage/burdens

- Land size must be bigger than 3,000 sqft

- Subject to financing budget

Malaysians can apply through SPNB website for a single storey house with 3 bedrooms and 2 bathrooms.

For Malaysians in Peninsular Malaysia, the house will be RM75,000; For Malaysians from islands in Peninsular Malaysia, it will be RM85,000; For Malaysians from Sabah/Sarawak/Labuan, it will be RM75,000 – RM106,000.

2. Youth Housing Scheme by Bank Simpanan Nasional (BSN)

BSN MyHome or Bank Simpanan Nasional MyHome is a homeownership scheme targeted towards first-time homebuyers aiming to own their very first home.

Under the Youth Housing Scheme, BSN is offering a low-cost house from RM 100,000 to RM500,000 with a tenure of 35 years, or until the age of 65 (whichever comes first).

This scheme is only open to first-time home buyers, single and married youths aged between 25 to 40 years old, with a household income not exceeding RM10,000 per month.

The government will also aid by providing monthly instalments of RM200 per month for a period of 2 years. The instalments will be credited to the customer’s financing account from the date of the first disbursement.

3. Rent-to-Own (RTO) Scheme

Rent-to-Own-Scheme (RTO) was tabled during Budget 2020 caters to homeowners who have difficulties in putting down the initial 10% down payment.

Applicants are able to rent up to 5 years and will have the option to purchase the house in the sixth year. The buyers will be able to lock in the original property purchase price for when the lease was first signed.

This scheme is only applicable for first-time homebuyers, and for properties priced up to RM500,000. Other than that, the government will also provide exemptions on stamp duty for SPA and loan agreement.

This scheme is suitable for the B40 and M40 group who are struggling to pay the initial 10% down payment.

4. Youth Transit Housing (MyTransit) by KPKT

The Ministry of Housing and Local Government (KPKT) introduced the Youth Transit Housing (MyTransit) aimed at providing housing for single and married youths in the B40 and bottom M40 range.

The difference between the MyTransit scheme and other schemes is that it provides properties for rent instead of for purchase. The rental rate for these properties is promised to be at least 20% lower than the market rate.

Another element that makes this scheme stand out is the ‘forced savings’, a percentage of the monthly rental will be set aside and returned back to the tenant as a lump-sum after their maximum five-year stay.

This scheme has approximately 2,010 studio home units in Mukim Batu and Kepong, Kuala Lumpur.

5. Rumah Selangorku (RSKU)

Rumah Selangorku is a low-cost housing scheme designed to assist the B40 and M40 groups who are interested in purchasing affordable housing within the state of Selangor.

This scheme is catered for first-time homebuyers only.

The properties under this housing scheme include high-rise apartments and landed houses with prices ranging from RM 42,000 to RM 250,000.

There are five housing types A, B, C, D, and E with different eligibility criteria based on the applicant’s monthly household income.

The maximum household income (married couple) must not exceed RM 10,000. For a single individual, the household income must not exceed RM 3,000 per month.

Since the housing scheme is designed for the B40 and M40 groups, there are certain rules that potential buyers will need to follow such as:

- The property cannot be sold within 5 years of purchase.

- The owners are not allowed to rent out the property.

- Applications are active for two years.

- After two years, if not successful, applicants may apply again.

We hope this has helped you in deciding which housing schemes is the most suitable for you and your family. With your income, you are be able to own a house you can proudly call your own.

Interested in buying the home of your dreams? Or you’re seeking for professional help when it comes to owning your first home? Our professional team will be able to help in any matters related to property. Leave your details below and we will contact you.

Read More

2. 8 questions a first time home buyer may have for buying a house in 2020