Written by Lily Chong, Head of IQI Global

Australia’s housing market saw a solid rebound in May, with national dwelling values climbing 0.5%, bringing the year-to-date increase to 1.7%. This growth was consistent across all capital cities, each registering at least a 0.4% gain. According to CoreLogic’s Tim Lawless, the momentum has been reignited by February and May interest rate cuts, lifting auction clearance rates and buyer confidence.

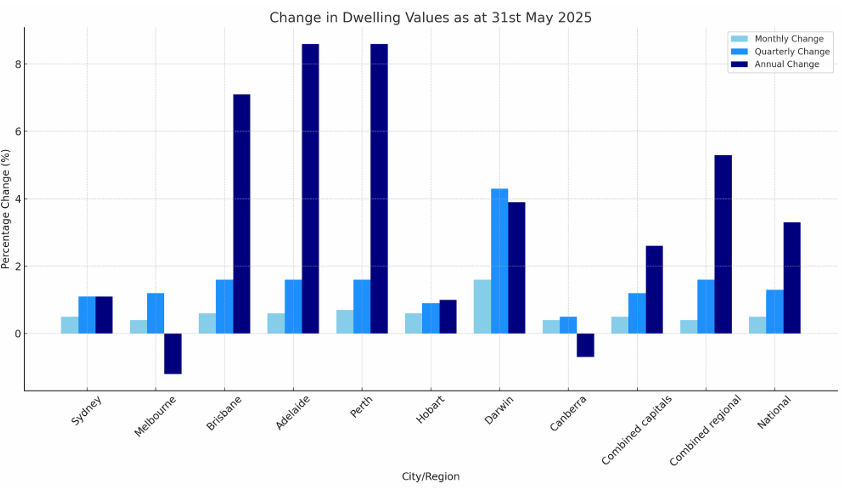

While national annual growth slowed to 3.3%—the weakest since August 2023—only Melbourne and Canberra posted year-on-year declines, underscoring the overall market’s resilience. The narrowing performance gap between cities suggests a more synchronized market recovery, with even lagging regions like Melbourne showing early signs of stabilisation.

Perth continues to dominate, supported by a robust economic backdrop, including low unemployment, diversified industry growth, and ongoing job creation. REIWA reported Perth’s median house price hit $780,000 in May—up 18% annually—while units soared 21% to $535,000. This is driven by sustained demand amid modest population growth and a solid employment base in Western Australia.

Additionally, premium housing segments are gaining momentum, especially in Sydney and Canberra, reversing earlier trends that favored more affordable homes. Across the board, Australia’s property market is showing renewed vigor, with expectations of continued upward momentum through the second half of 2025.