Thanks to the rapid emergence of AI, Malaysia’s data centre market looks even brighter in March of 2024 than it did a year ago, according to Juwai IQI’s new report on the data centre industry in Malaysia.

“The data centre market is changing at light speed,” said Juwai IQI Co-Founder and Group CEO Kashif Ansari. “It’s evolving more quickly than any other segment of the commercial and industrial real estate industry.

The industry is shifting to new types of chips and machines, higher rack densities, new methods of cooling, lower power usage, and new contracts for providing power.

Malaysia the Fastest Growing Market in the Fastest Growing Region

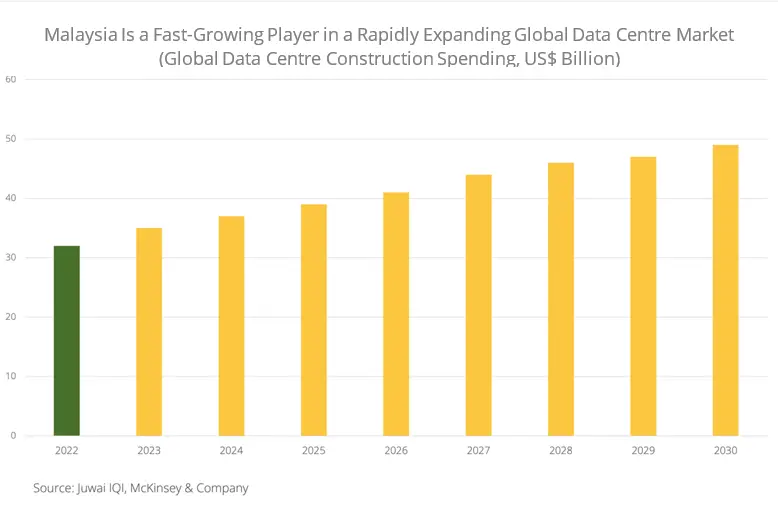

“This is a very lucrative market, and Malaysia is a fast-growing competitor. By 2030, which is only six years away, the market for global modular data centres will grow from USD$25.8 billion in 2023 to USD$81.2 billion. That’s a compound annual growth rate of 17.8%. Total global data centre storage capacity is expected to double by 2027.

“There is a credible forecast that Malaysia’s data centre sector will grow by 600% in the next 5 years. The country is a fast-growing player in the world’s fastest growing region, Southeast Asia. Malaysia is already the 22nd largest data centre market in the world and the second in ASEAN.

“Today, Malaysia has 47 facilities with 1,484,000 square feet and 168 megawatts of power, according to Baxtel, the global data centre tracking company. The biggest concentration of data centres in the country is in Kuala Lumpur. There are 33 data centres around KL and many more in the pipeline. Selangor, Johor, and Penang are also growth markets.

“Billions of dollars of investment are flowing into Southeast Asia, with twice the number of new projects launched in the past year than in 2022.

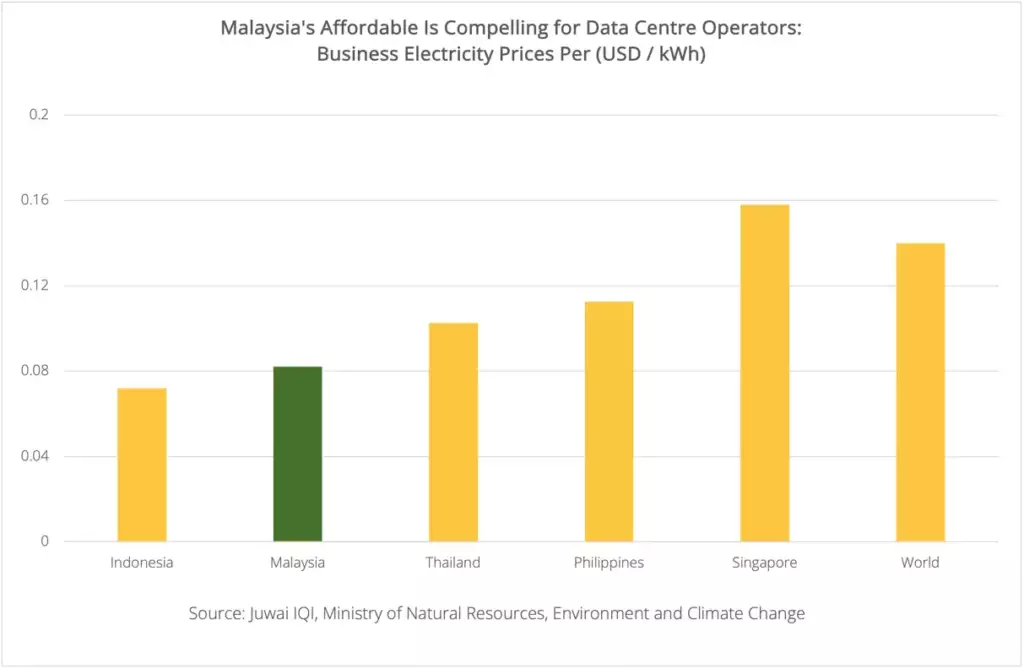

“Malaysia construction cost per watt for high end data centres is 24% less expensive than in Singapore. It costs less to build in Malaysia than in Indonesia, China, Korea, or Singapore. In Singapore, land accounts for 63% of the construction costs of a new data centre, while in Malaysia it typically only accounts for 16%.

AI Is Driving Giant Demand Growth

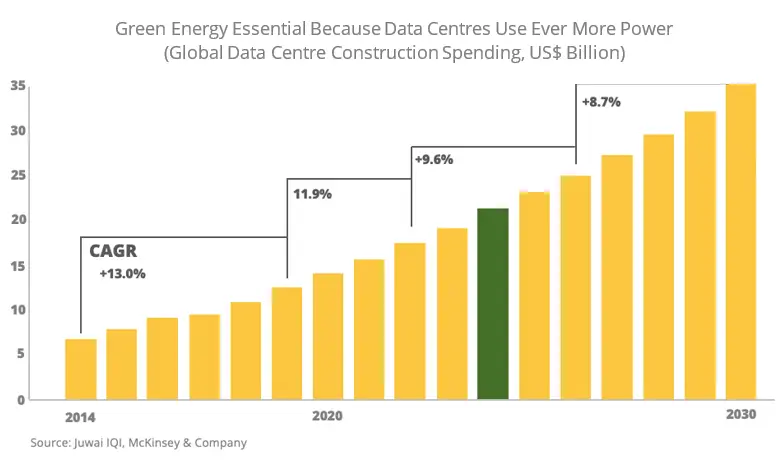

“It is still the early days for artificial intelligence tools like Open AI’s ChatGPT and Google’s Bard, but AI is already the biggest driver of data centre demand in 2024. It will remain so throughout the rest of the decade.

“Here’s an example of how AI is already shaping the data centre market. YTL and global Ai chip giant Nvidia are investing in about $4.3 billion in Kulai, Johor to build a large language model in Malay. You might call it a Malay version of ChatGPT. The new infrastructure should be running by mid-2024.

“Remember that most companies build data centres only when they have demand for them. That means all the new AI-driven demand for data centre capacity comes on top of the demand that providers had already planned for. There is very little extra capacity, and the industry is struggling to keep up.

Green Power Can Be Malaysia’s Advantage

“Abundant green energy can be a factor that helps Malaysia beat other markets in the race to attract billions of ringgits of new data centre investment.

“New data centres need secure and sustainable power and water, which is used for cooling. Malaysia is an emerging leader in producing green power for data centre operators, and that’s one reason for our rapid growth as a market.

“In February, for example, the data centre firm AirTrunk signed the country’s first ever agreement to purchase renewable solar energy from green energy developer, ib vogt. Construction should begin by July.

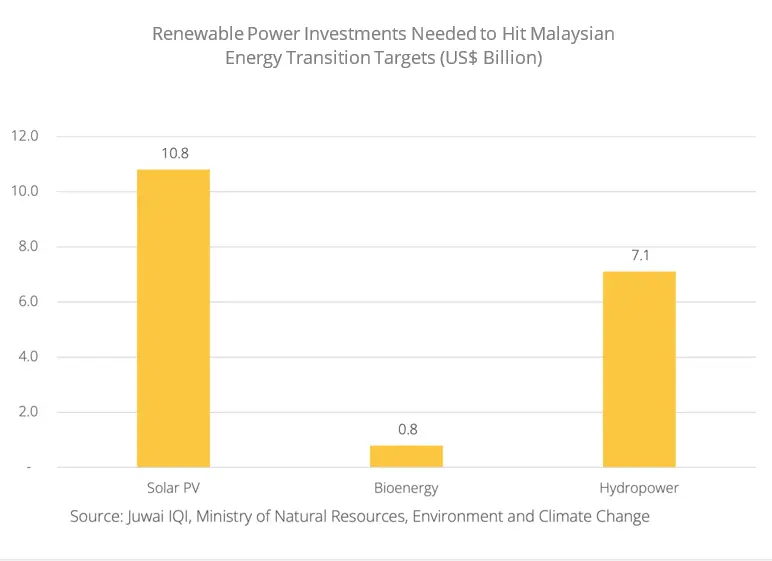

“Over the next 30 years, the amount of power Malaysia uses will increase by 60%. A significant share of that new power will go to data centres, and almost all of it will be sustainable. Luckily, Malaysia is rich in renewable energy.

“The country will invest an estimated US$20 billion in sustainable energy generation projects by 2030, according to the recent energy transition report by the Ministry of Natural Resources, Environment and Climate Change.

“The growth in sustainable energy is especially important in the era of AI because AI processes require much more power than other data centre uses. Just look at the latest advanced AI chip from NVIDIA, which are used in data centres to handle AI workloads. Its maximum power consumption is 160% higher than the previous generation of chips.

Benefits for the Economy, Residential Real Estate

“In the age of artificial intelligence, Malaysia is well positioned for rapid data centre investment that could transform it from 22nd rank into a top 10 global market. This growth will add significantly to the country’s economy, create new skilled and well-paying jobs, and thus indirectly have a positive impact on the home market by creating new demand.

“Data centres generate employment because they exist within an ecosystem that includes internet exchanges, hosting and cloud providers, energy companies, consulting firms, and providers of fibre optics and equipment. Data centres employ people directly and create other jobs that need to be filled at these other types of companies.”

Charts for “AI Drives 600% Data Centre Growth in Malaysia” Report

As the largest real estate technology company in Malaysia, IQI continues to strive to use technology to help real estate agents work more efficiently and make real estate transactions more convenient.

Want to be part of Malaysia’s largest real estate technology company? Join IQI now!