Version: CN

Ready to take control of your finances with a digital bank? Malaysia’s banking landscape has exploded with exciting new options, and two stand out from the crowd: AEON Bank, Boost Bank, and GX Bank.

This guide will break down everything you need to know about AEON Bank and Boost Bank, from their origins and offerings to their current promotions.

By the end, you’ll have a clear understanding of what each bank brings to the table, helping you choose the best fit for your banking needs.

AEON Bank Vs. Boost Bank Vs. GX Bank 2024

1.0 AEON Bank

1.1 What is AEON Bank?

AEON Bank is Malaysia’s pioneering Islamic digital bank.

It operates entirely online, meaning you can access all your banking needs through its user-friendly mobile app – no physical branches required.

AEON Bank focuses on offering a wide range of Shariah-compliant financial services, catering to both personal and business needs.

1.2 AEON Bank Launch Date

AEON Bank officially opened its doors to the public on May 26, 2024.

This marked a significant milestone for Malaysia’s digital banking scene, as AEON Bank became the country’s first Islamic digital bank.

1.3 Who Owns AEON Bank?

AEON Bank is a joint venture between two subsidiaries of Japan’s leading retail group, AEON Group:

- AEON Financial Service, Ltd. (AFS)

- AEON Credit Service (M) Berhad (AEON Credit)

1.4 CEO of AEON Bank

The current CEO of AEON Bank (M) Berhad is Raja Teh Maimunah Raja Abdul Aziz. She assumed the role in December 2022, bringing over 30 years of experience in the financial services industry.

Before joining AEON Bank, she held leadership positions at various prominent financial institutions in Malaysia and the GCC region.

Click here to preview the AEON Bank’s full committee members

1.5 AEON Bank Partner and Collaboration

AEON Bank has partnered with several key players to expand its offerings and reach a broader customer base. Two notable collaborations include:

- Visa: This partnership resulted in the launch of the AEON Bank x Visa Debit Card-i, a Shariah-compliant card offering access to Visa’s vast network of merchants and payment solutions.

- Zurich Malaysia: This collaboration focuses on expanding access to Syariah-compliant takaful (Islamic insurance) solutions through AEON Bank’s platform.

1.6 Is AEON Bank Shariah-compliant?

AEON Bank is fully Shariah-compliant. It operates under the Islamic Financial Services Act 2013 (IFSA).

AEON Bank has a dedicated Shariah Committee comprised of experts in Islamic finance, ensuring all its products, services, and operations adhere to Islamic principles.

1.7 Is AEON Bank under BNM?

AEON Bank is licensed and regulated by Bank Negara Malaysia (BNM). This means it operates under BNM’s guidelines and is subject to their oversight, ensuring stability and security for its customers.

1.8 Interest Rate for AEON Bank Savings Account

Currently, AEON Bank offers a profit rate of 3.88% per annum on its Savings Account-i and Savings Pot. This rate is valid until August 31, 2024.

The profit is calculated based on the total balance in your account at the end of each day and is credited to your account on the last day of the month.

AEON Bank hasn’t announced the standard profit rate that will apply after August 31st. We’ll need to wait for an update after the campaign ends.

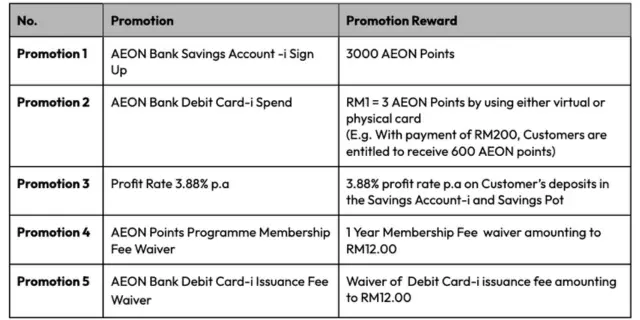

1.9 Current Promotion

AEON Bank is currently running several enticing promotions for new customers:

- Sign-up Bonus: Receive 3,000 Aeon Points upon registration, which you can convert to cash.

- 3X Aeon Points: Earn triple the AEON Points for every RM1 spent using the AEON Bank x Visa Debit Card-i until August 31, 2024.

- 3.88% Profit Rate: Enjoy a 3.88% per annum profit rate on your Savings Account-i and Savings Pot until August 31, 2024.

- Free Debit Card: Get the physical AEON Bank Visa Debit Card-i for free during the introductory period.

- Free AEON Points Membership: Enjoy a one-year waiver of the RM12 annual membership fee for the AEON Points Programme.

1.10 How to Sign Up for AEON Bank

Signing up for AEON Bank is a simple process:

- Download the App: Download the AEON Bank app from your preferred app store.

- Register: Create an account by providing your personal information.

- E-KYC Verification: Complete the e-KYC (electronic know your customer) process by providing your MyKad details and taking a selfie.

- Bank Transfer: Make a minimum transfer of RM20 from your existing Malaysian bank account to your newly created AEON Bank account.

1.11 Download Platform

AEON Bank’s app is available for download on both Android and iOS platforms:

- Android: Google Play Store

- iOS: Apple App Store

2.0 Boost Bank

2.1 What is Boost Bank?

Boost Bank is Malaysia’s first homegrown digital bank, a joint venture between Axiata Group’s fintech arm Boost and RHB Banking Group.

Boost Bank aims to revolutionize banking by offering accessible and integrated financial services to all Malaysians.

2.2 Boost Bank Launch Date

Boost Bank officially launched on January 15, 2024, with its app available on the Apple App Store and Google Play Store.

2.3 Who Owns Boost Bank?

Boost Bank is owned by the Boost-RHB Digital Bank Consortium, with Boost holding a 60% stake and RHB holding the remaining 40%.

2.4 CEO of Boost Bank

The CEO of Boost Bank is Fozia Amanulla, who was appointed to the position shortly before the bank’s launch.

2.5 Boost Bank Partners and Collaboration

Boost Bank’s primary partner is RHB Banking Group, a well-established Malaysian bank with a strong track record.

This collaboration leverages Boost’s fintech expertise and RHB’s banking experience to provide a unique and robust digital banking solution.

Boost Bank also announced exciting partnership promotions launching in the coming months.

These collaborations aim to empower both unbanked and underbanked individuals by offering rewards and savings on essential everyday purchases.

The partnerships will include CelcomDigi, MYDIN, Bataras, Sdn Bhd, CKS Retail Sdn Bhd, Farley (KCH) Sdn Bhd, Servay Hypermarket (Sabah) Sdn Bhd, and Boulevard Hypermarket and Departmental Store Sdn Bhd.

2.6 Is Boost Bank Shariah-compliant?

Boost Bank offers a range of Shariah-compliant services, including its PayLater solution, Boost PayFlex, which allows for QR code payments and in-app transactions.

2.7 Is Boost Bank Under BNM?

Boost Bank is licensed and regulated by Bank Negara Malaysia (BNM), ensuring its operations adhere to strict regulatory standards.

2.8 Membership Tier

Boost Bank offers three membership tiers:

- Boost Basic: Open to anyone who signs up for a savings account.

- Platinum President: Requires a minimum deposit of RM2,000 in your savings account or Savings Jar, maintained for at least 25 days within a calendar month.

- Platinum President with Partner Benefits: Similar to Platinum President, but requires monthly shopping with selected partners through Boost e-wallet to unlock higher interest rates and additional perks.

2.9 Interest Rates for Boost Bank Savings Account

The interest rates for Boost Bank’s Savings Account and Savings Jar depend on your membership tier:

Boost Basic:

- Savings Account: 0.5% p.a.

- Savings Jar: 1.5% p.a.

Platinum President:

- Savings Account: 2.5% p.a.

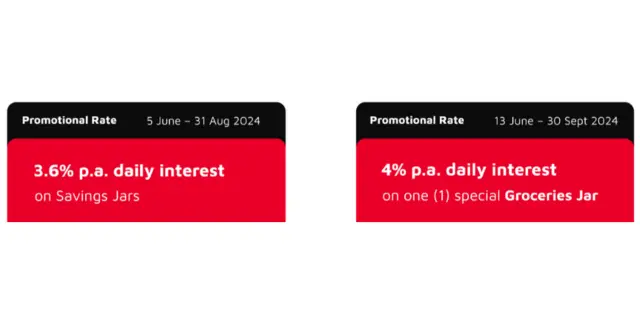

- Savings Jar: 3.2% p.a. (Promotion: 3.6% p.a.)

Platinum President with Partner Benefits:

- Savings Account: 2.5% p.a.

- Savings Jar: 3.6% p.a.

- *Special Groceries Jar Promotion: 4% p.a.*

2.10 Current Promotion

Boost Bank is currently offering a promotional interest rate of 3.6% p.a. on Savings Jars for Platinum President tier users, starting from June 5 until August 31, 2024.

This promotion has a deposit cap of RM200 million.

Additionally, a Special Groceries Jar Promotion with 4% p.a. daily interest rates is announced for Platinum President with Partner Benefits users, starting from June 13 to September 30, 2024.

2.11 How to Sign Up for Boost Bank

Signing up for Boost Bank is straightforward:

- Download the app: Get the Boost Bank app from the Google Play Store or Apple App Store.

- Create an account: Follow the on-screen instructions to register your account.

- Verify your identity: Complete the eKYC process by providing required documents.

- Open a Savings Account: Choose your desired membership tier and start your banking journey.

2.12 Download Platform

Boost Bank’s app is available for download on both Android and iOS platforms:

- Android: Google Play Store

- iOS: Apple App Store

3.0 GX Bank

3.1 What is GX Bank?

GX Bank is a bank that you can access fully on your phone app with no physical branches needed. Being the first fully digital bank in Malaysia, it is launched by Grab, the e-hailing service.

PS; GX Bank is not shariah-compliant.

GX Bank main focus in a nutshell is to make banking accessible and beneficial for all Malaysians.

They also aim to help people save money and reach their financial goals.

3.2 GX Bank Launch Date

GX Bank officially launched their digital bank to the people on 1st September 2023.

This marked GX Bank in the history books as it is the first approved digital bank in Malaysia adding in that an e-hailing service company made it happen!

3.3 Who owns GX Bank?

GX Bank is a joint venture that has a few key players which includes:

- Grab Holdings Limited

- Singapore Telecommunications Limited (Singtel)

- Consortium of Malaysian Investors

3.4 CEO of GX Bank

The CEO of GX Bank is Lai Pei Si who is involved extensive experience in the banking industry before becoming the CEO of a digital bank.

Lai Pei Si was positioned senior roles within Standard Chartered which includes Branch & Priority Banking management, Wealth Product Development, and Channel Strategy.

Click here to continue browsing through GX Bank’s committee members.

3.5 GX Bank Collaborations

As of 24th July 2024, GX Bank has no direct collaborations with other established bank companies. However, future collaborations are possible.

DuitNow Integration: GX Bank integrates with DuitNow, a national interbank funds transfer network.

This allows GX Bank users to send and receive money from users of other banks using DuitNow.

In a way, we can say that this is an indirect collaboration for specific functionalities.

3.6 Is GX Bank under BNM?

Yes, GX Bank is licensed and regulated by Bank Negara Malaysia (BNM) ensuring that GX Bank functions safely and soundly within the Malaysian financial system.

3.7 Interest Rate for GX Bank Savings Account

GX Bank offers a daily interest rate of 3% per year on their savings account balance. This is a competitive rate compared to traditional banks in Malaysia.

The interest is calculated and credited daily, which means your money grows rather faster than other banks.

You don’t need to have a minimum amount of money in your account to earn interest.

Your money is readily accessible, making it penalty-free when you want to withdraw your money.

3.8 How to Sign up for GX Bank

It will only take you less than 4 minutes to apply as GX Bank says!

- Download the app: Get GX Bank from the Google Play Store or Apple App Store.

- Create your account: Open the app and click on “create account” to start.

- Prepare your info: Have your valid MyKad (Malaysian Identification Card), Malaysian-registered mobile number, and a valid email address ready.

You’ll also need an existing bank account from other traditional bank in Malaysia ready.

4. Verify your identity: You will need to take a selfie and picture of your Mykad for verification.

5. Activate your account: Once approved, you’ll need to make a small deposit into your account to activate it!

3.9 Download Platform

GX Bank’s app is available for download on both Android and iOS platforms:

Android: Google Play Store

iOS: Apple Store

4.0 AEON Bank vs. Boost Bank vs. GX Bank: A Side-by-Side Comparison

To help you make the best decision for your needs, here’s a quick comparison table highlighting the key differences between AEON Bank, Boost Bank and GX Bank:

| Feature | AEON Bank | Boost Bank | GX Bank |

| Focus | Islamic digital banking, Shariah-compliant services | Homegrown digital banking, accessible financial services for all | First digital banking, accessible to everyone in Malaysia. |

| Ownership | AEON Financial Service, Ltd. (AFS) & AEON Credit Service (M) Berhad | Boost & RHB Banking Group | – Grab Holdings Limited – Singapore Telecommunications Limited (Singtel) – Consortium of Malaysian Investors |

| Launch Date | May 26, 2024 | January 15, 2024 | September 1, 2023 |

| Interest Rate | Up to 3.88% p.a. on Savings Account-i and Savings Pot (with promotion) | Up to 4% p.a. on Savings Jar (Platinum President with Partner Benefits with promotion) | Up to 3% pa. on Savings Account Balance |

| Membership Tiers | N/A | Boost Basic, Platinum President, Platinum President with Partner Benefits | N/A |

| Shariah-compliant | Yes | Yes (for specific services like PayLater) | No |

| Current Promotion | – 3X AEON Points -Free Debit Card – Free AEON Points Membership – 3.88% p.a. interest rates | – 3.6% p.a. on Savings Jar for Platinum President tier users – 4% p.a. on Special Groceries Jar for Platinum President with Partner Benefits tier users | – 1% unlimited cashback on Eligible Spend – 1.5x GrabRewards points for every RM1 spent using GX Card (physical only) |

| Key Partnerships | Visa, Zurich Malaysia | RHB Banking Group | – Singapore Telecommunications Limited (Singtel) – Consortium of Malaysian Investors |

Interested in property investment? Need assistance from us? We are happy to help you! Sign up below and our investment expert will approach you soon. let’s become a wise investor and secure your favorable return for a better future!

Continue Reading: