Version: BM

TLDR: You can definitely withdraw from your EPF Account 2 to buy or build a home. But you must meet specific criteria.

For many Malaysians, buying a home remains one of life’s biggest financial hurdles, especially in this generation.

But did you know that your EPF savings can help ease that burden? Through EPF’s housing withdrawal scheme, you can use Account 2 to pay for a home purchase or even help with financing costs.

This scheme can reduce upfront expenses like down-payments and stamp duties or even assist with monthly instalments.

Curious how it works and what risks to consider? Let’s break it down.

Key Takeaways:

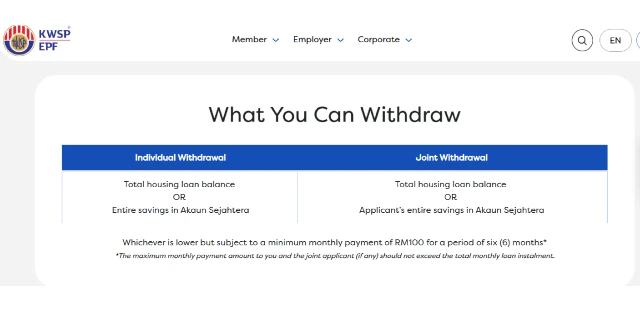

- EPF Account 2 can be used to purchase or build a residential home individually or jointly.

- As of 2025, the Flexible Housing Withdrawal allows you to use current and future EPF contributions to boost loan eligibility.

- Withdrawals are only allowed for residential properties in Malaysia.

- Minimum Account 2 balance required: RM500.

- You can only withdraw for a second home if the first is sold/disposed of unless you lost the property in a natural disaster and have verification.

Guide to Using EPF Account 2 for Housing:

What You Need to Know About EPF Account 1, 2 & 3

Since the pandemic, EPF has introduced a three-account structure: Account 1, Account 2 and Account 3.

Account 1

This is your retirement nest egg. 70% of your monthly EPF contribution goes here. It cannot be touched until retirement.

Account 2

This is where withdrawals for housing happen. 30% of your monthly contribution goes into Account 2, and this account allows early withdrawals for specific purposes: home financing, education, medical needs and Hajj.

You may also make joint withdrawals with your spouse or immediate family.

Account 3 (Akaun Fleksibel)

Introduced in 2024, Account 3 receives 10% of your monthly contribution and allows anytime withdrawals for short-term or emergency needs.

This account does not affect your housing withdrawal eligibility.

“Can I Use My EPF to Pay for a Home Loan?”

Yes! You can withdraw from Account 2 to:

- Reduce or redeem your existing housing loan

- Assist your spouse with their loan

- Pay for medical expenses

- Finance your own or your children’s education

- (For Muslims) Support your Hajj alongside Tabung Haji savings

What Has Changed Since 2023?

As of 2024 and above, EPF’s housing rules have become more practical and flexible.

The biggest improvement is the expanded Flexible Housing Withdrawal, which now let’s your current and future EPF contributions strengthen your loan eligibility.

This helps homebuyers cope with rising property prices. In addition, EPF also formalised assistance for disaster-related home losses.

If your property was destroyed by floods or other disasters, you may apply for another Account 2 withdrawal — provided the loss is verified.

On top of that, applications are now faster and mostly digital through i-Akaun.

Quick Summary:

- Flexible Housing Withdrawal strengthened

- Disaster-relief withdrawal allowed

- Faster, digitalised applications

| Feature / Rule | 2023 | 2025 |

| Flexible Housing Withdrawal | Early stage, limited use | Fully implemented; boosts loan eligibility using current + future contributions |

| Disaster Relief Withdrawal | No clear provision | Allowed with authority verification; second withdrawal permitted if home is destroyed |

| Eligible Properties | Residential homes only | Same, but enforcement stricter; third property only if first/second is legally disposed |

| Application Method | Counter + partial online | Mostly online via i-Akaun; automated checks |

| Minimum Account 2 Balance | RM500 | RM500 (unchanged) |

| Joint Purchases | Allowed | Allowed, with improved digital verification |

Step-by-Step: How To Withdrawal from Account 2 (2025 Version)

Step 1: Confirm Eligibility

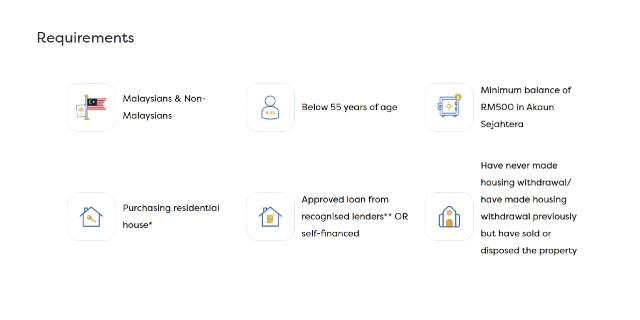

You must be under 55, have at least RM500 in Account 2 and be purchasing a residential property.

If you’re buying for a second home, ensure the first is sold or ownership is disposed.

Step 2: Prepare Required Documents

- SPA (not older than 3 years)

- Loan approval letter / Loan agreement

- Proof of self-financing (if no bank loan)

- Marriage/birth certificates for joint withdrawals

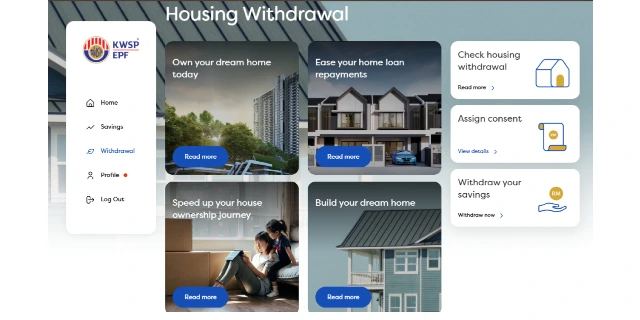

Step 3: Log In to i-Akaun

Go to Withdrawal → Housing → Choose your preferences.

Upload the necessary documents and fill in the property details.

Step 4: Verify Your Identity

If required, head to an EPF branch for biometric thumbprint verification. Bring your MyKad.

Step 5: Submit Your Application

Review everything and submit. EPF will notify you if any documents need updating.

Step 6: Track Your Application

Monitor your status through i-Akaun or the EPF app.

Step 7: Payment Released

If approved, EPF pays directly to the bank, developer or relevant party.

In Conclusion

Using EPF Account 2 for a house purchase remains one of the most effective ways for Malaysians especially first-time buyers to bridge financing gaps.

The 2025 updates, particularly the Flexible Housing Withdrawal and disaster-relief provisions, make the scheme even more relevant today.

Still, it’s important to remember that withdrawing from EPF reduces your long-term dividends and retirement compounding so weigh your options carefully before deciding.

Need help finding a property within your budget? Get in touch with IQI agents today and secure your dream home.

Continue Reading: