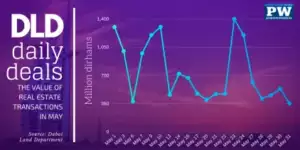

Dubai real estate transactions top Dh17b in May

The value covered both sales and mortgage transactions for land and residential and commercial property. According to the DLD, the transactions reached around Dh1.4 billion on May 23, which was the most productive business day last month.

The DLD reported over Dh57.9 billion in real estate transactions during the first quarter this year. Dubai recorded more than Dh284.52 billion in transactions last year, increasing from Dh268.71 billion in 2016.

Source: Gulf News

Dubai gears up for debut property tech show

Over the past few years, the rapid adoption of technology in the financial services sector has changed the traditional banking models and led to the emergence and widespread acceptance of mobile banking, biometric banking, and digital wallets, thereby simplifying how consumers bank in today’s day and age.

This global transformation of the banking landscape saw the rise of FinTech, said industry experts.

The various stakeholders involved in the property sector such as, property developers, banks, property management firms, real estate agents, asset management, and facility management companies are able to harness these technologies and customise offerings to provide the end customer with improved solutions, the experts pointed out.

The impact of technology in the property sector has been such that it has led to the emergence of the term PropTech, which is pegged to be the next game changer after FinTech, they added.

In the Middle East, Dubai has been a frontrunner in adopting technology to offer its citizens a better quality of life and achieve its ambition of becoming the world’s smartest city by 2021.

Across all departments within the government, various technologies are implemented to deliver better, faster and more efficient services. In line with this, Dubai Land Department recently introduced the Real Estate Self Transaction (REST) platform that enables the complete digital management of real estate transactions, thereby eliminating paper documents and reducing brokerage procedures.

Against this backdrop, Dubai is set to host the first PropTech conference from October 29 to 30 at Sofitel Dubai The Palm Resort & Spa.

Organized by Expotrade Global, the PropTech Middle East 2018 will highlight the technological innovations and digital transformation taking place in the real sector.

In its inaugural edition, over 40 industry experts will be participating as speakers and panellists at the conference, highlighting on how technology is influencing the rapid transformation of the real estate industry in the region while emphasizing on the trends and developments witnessed.

The two-day event will cover the future of the property technology industry with topics on drones changing the face of real estate, proptech transforming the traditional housing market, the impact of 3D printing in real estate, and blockchain implementation strategies, to name a few.

Proptech guru James Dearsley will deliver the keynote address at PropTech Middle East 2018.

The conference will also provide a platform for startup ventures offering solutions in the property sector to participate at the region’s only proptech event. Apart from networking with relevant stakeholders, and showcasing their marquee solutions, the two-day event offers an opportunity to budding entrepreneurs to meet investors, and participate in Startup Competition to stand a chance to win $5000.

Source: Trade Arabia

Dubai index builds on gains as buying persists

Dubai index added to its gains on Tuesday as traders continued their buying in anticipation of a rally in the short-term.

“The market could pick-up where it left with individuals picking up their pace and buying into selective stocks; based on current movement, banks and realty are favourable,” Menacorp said in a morning note.

“Emaar Properties may see a leg up towards Dh6.10 in the medium term,” said Shiv Prakash, senior analyst with First Abu Dhabi Bank Securities. FABS had a technical buy at Dh5 on May 14.

Emaar Properties closed 1.83 per cent higher to Dh5.55.

“Emaar Malls may target Dh2.24/2.38 in the short term. Traders may look to buy with stops placed below Dh2.04 support,” Prakash said.

Emaar Malls closed at Dh2.38, up 2.15 per cent, after breaching the key resistance level of Dh2.11. DFM shares closed 1.85 per cent higher to Dh1.15.

“DFM’s upmove indicate the market’s approaching recovery as the stock is highly correlated with the economy and investor sentiment aside from trading volumes that remain relatively low,” the Menacorp note added.

Among the losers, Dubai Islamic Bank closed at Dh5.18, down 1.15 per cent. The Abu Dhabi Securities Exchange general index closed 0.86 per cent higher to 4,616.53.

First Abu Dhabi Bank closed 1.66 per cent higher to Dh12.25. Etisalat closed 1.23 per cent higher to Dh16.4. Waha Capital closed 0.56 per cent higher to Dh1.78.

Elsewhere in the Gulf, Saudi Arabia’s Tadawul index closed 0.86 per cent higher to 8,406.90.

Dar Alarkan Real Estate Development Co. closed 4.63 per cent higher to 10.84 Saudi riyals. Saudi Basic Industries Corp. closed 0.15 per cent lower to 129.40 riyals. The Qatar exchange index closed 2.12 per cent higher to 9,310.51.

Source: Gulf News

Liked what you read? Check out this article next: Top 10 International Real Estate Agencies