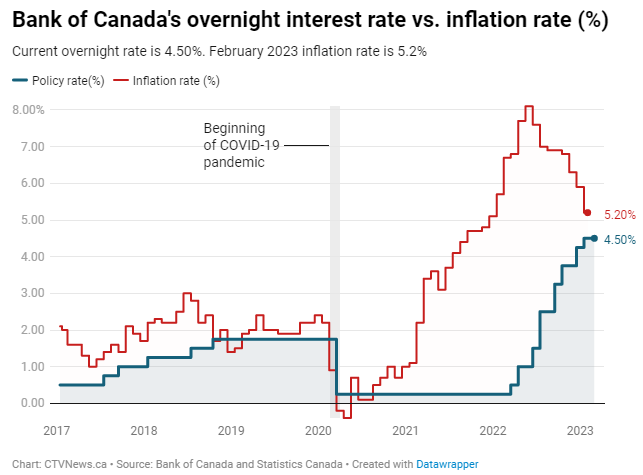

The Bank of Canada kept interest rates unchanged for the first time, maintaining to 4.5% saying it’s prepared to hike again if the economy veers off its forecast course.

The Canadian government pledge to hold the benchmark overnight rate at 4.5% in the early weeks of March – the first pause among major central banks that was expected by both markets and economists.

What are the current data?

Officials kept the door open to further rate increases, however, reiterating that they’re willing to raise borrowing costs again if necessary.

The stay-the-course message suggests officials are confident their aggressive tightening over the past year will keep dragging on economic growth and bring inflation to heel.

That’s at odds with the US Federal Reserve (Fed), which is signalling further hikes to come.

That’s at odds with the US Federal Reserve (Fed), which is signalling further hikes to come.

The loonie sank as low as C$1.3795 (RM4.52) per US dollar, the lowest since Nov 3. The yield on benchmark two-year government bonds declined more than 2.5 basis points to 4.301% in Ottawa.

Impact on Canadians

The fact that rates didn’t rise again on Wednesday offers “some relief” to borrowers – but a pause doesn’t lessen the economic pain from higher rates that is already setting in.

Canada’s housing market has already started absorbing the higher interest rates and will continue as more people’s fixed-rate mortgages come up for renewal.

That impact, as more and more people renew every quarter, is going to weigh on household spending for a couple of years.

People will also notice higher borrowing costs as they seek to finance other major purchases like cars and appliances.

People will also notice higher borrowing costs as they seek to finance other major purchases like cars and appliances.

There is an anticipation of a “short and shallow recession” in Canada this year as the economy slows down in response to the rate increases – which will in turn weigh on workers as jobs become more scarce.

Canadians will “feel the pinch” of rates in their mortgages, wages and job prospects in 2023 but people can also expect some relief while shopping for goods and services if inflation continues to come down.

There’s some economic pain, particularly for those with big mortgages that are renewing at higher rates, but there is a broader benefit to consumers from not facing ever-escalating prices.

When will the bank cuts happen?

The central bank stressed that it is “prepared to increase the policy rate further” to get inflation down to its two per cent target.

Economists said they largely expect the Bank of Canada to leave its key interest rate at 4.5 per cent in the year ahead, even as it left the door open to more tightening.

At some point, likely by this summer, the bank will be more definitive in its projection that they’re done with rate hikes – the key interest rate will remain unchanged through 2023 if the economy progresses as expected.

Currently it will take a couple of months of disappointing inflation data or “indications that that the economy is still barreling forward” to prompt more tightening from the central bank – but the move clearly has not been ruled out.