cover image source: Saimatkong

Amanah Saham Bumiputera (ASB) is a well-known unit trust fund for Malaysian Bumiputeras. Let’s get started with a brief primer on all you need to know about ASB!

| What Is ASB?

What If You Lack The Resources To Invest In ASB? Your Money Can Be Withdrawn From ASB in Two Ways: |

What is ASB?

source: Glassdoor

Amanah Saham Nasional Berhad, or ASNB, introduced ASB on January 2, 1990, for all Malaysian Bumiputeras, with the aim of giving the majority of the public a substitute savings vehicle. ASNB is Permodalan Nasional Bhd’s wholly-owned unit trust management business (PNB).

For its investors, this unit trust fund seeks to produce long-term, reliable returns that are competitive. As a result, ASB was created as a fixed-price equity income fund, meaning that there are no sales taxes or redemption fees and that the price per unit of the fund is set at RM1.

Investors can only raise their investment amounts up to the ASB’s maximum input cap of RM200,000. The account’s worth is not restricted by the fund, though. As a result, capital gains held in the ASB account may be greater than RM200,000. Investors can choose their investment amount at any time and can top it up or subscribe to more units through the appropriate ASB agents.

The ASB dividend is calculated on a monthly basis using the minimum amount of the month, however, it is delivered annually.

Why should invest in ASB?

Investing in ASB has the following benefits:

- zero upfront costs: There are no up-front costs associated with investing in ASB. As a result, investing receives a larger portion of your funds than paying fees.

- minimal management costs: The ASB fund only pays a 0.35 percent yearly management charge. Other equity unit trust funds, meanwhile, may charge yearly management fees of as much as 1.5 percent.

- regular returns: Since 1990, ASB has paid out dividends ranging from 5% to 14% annually.

- rapid withdrawal: ASB funds are readily available and liquid. Online withdrawals are limited to RM500 per month. For bigger withdrawals and rapid money transfers, visit an ASNB counter or branch.

- Applying for an overdraft facility: When applying for an overdraft facility (a sort of loan where the bank permits you to take more money than what is in your account), you can use your ASB funds as collateral.

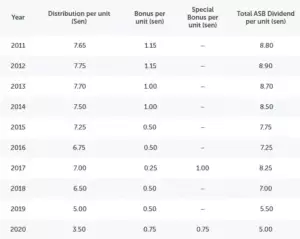

Dividend History Examination:

source: iProperty

Let’s examine the ASB dividend history data for the previous 10 years. You may have noticed that the number has been declining, with the dividend distribution in 2020 being the lowest it has ever been.

PNB’s Chairman, Tan Sri Zeti Aziz, announced an ASB distribution in December 2020 that would comprise a total payout of RM7.6 billion to more than 10.2 million unitholders and would be based on a unit price of 5 sen.

She claimed that despite the volatile market situation, ASB continues to provide this competitive number. As it stands, ASB’s performance is rather impressive, especially when compared to other low-risk assets available on the market and how severely Covid-19 has affected Malaysia’s economic performance.

Despite the market collapse and a global pandemic, ASB is still able to pay out a dividend of 5 sen per unit, or 5%, which is quite an accomplishment.

What is ASB2?

source: ASNB

Generation Y Bumiputera between the ages of 19 and 34 are the target audience for ASB2. If you already own ASB units and would wish to invest more after reaching your 200,000-unit investment cap, you can do so under this unit trust program. You can invest up to RM200,000 in unit trusts for ASB and ASB2, since each unit costs RM1.00, with a minimum of 10 units and a maximum of 200,000 units.

Therefore, the ASB2 is a fantastic alternative to earn more for individuals who have already purchased all 200,000 units and still have money to acquire more.

The main distinction between ASB and ASB2 is that whereas ASB obtains its funding from stock, ASB2 does so through mixed assets, which includes not just equities but also fixed-income securities and money market instruments. It guarantees that you will receive returns with very little risk, this makes ASB2 seem safer.

Only Maybank is currently in charge of the ASB2 account. There hasn’t been any official word about other banks taking over the account.

Is it worth it?

It is not now necessary, to begin with, ASB 2 if you are a Bumiputera and have not yet opened an ASB account because they are both essentially the same. Despite what could appear to be a lesser level of risk in ASB 2, ASB nevertheless offers one of the highest interest rates in Malaysia, with a net payout of 7.70 sen for every sen of bonus per unit. As there has been no news on the rates for ASB2, ASB is still the best choice unless you’re trying to diversify your investment portfolio.

What is the difference between ASB and ASB2?

ASB2 was first released in 2014. It is a fixed-price fund for Bumiputera people, comparable to ASB, with a unit price of RM1. Additionally, there are no up-front costs and a yearly administration charge of 0.35%.ASB2 has a little different asset allocation. ASB2’s approach is to invest in a mixed asset portfolio, as opposed to ASB, which has a strategy of “investing in a portfolio of several asset classes, predominantly securities.”

How do you invest in ASB?

source: Wealth 101

There are two types of authorized agents from which you may acquire ASB:

- Banks

- Non-banks

The ASB fund is represented by the following agent banks:

- Maybank

- RHB

- Affin Bank CIMB

- Incorporated Bank Muamalat Malaysia

- Bank of Hong Leong

- Islamic Bank of Hong Leong, Berhad

- Alliance Bank of Simpanan Nasional

- AmBank

You must sign up for an ASNB Account in order to invest in ASB. You can accomplish this by going to a branch or representative of ASNB (your bank or post office). Two different account options are given to you and only RM10 is all that is required to begin investing with ASB.

You must physically visit an ASNB branch or an ASNB agent to create an account; however, you can make additional investments online.

The majority of agent banks currently provide internet banking services for ASB investors to top up or subscribe to extra units for their ASB investment. Investors can also invest on behalf of another ASB account using internet banking.

Pos Malaysia is the sole agent who is not a bank. The majority of PosNiaga’s stores now provide Shared Banking Services (SBS) thanks to collaborations between Pos Malaysia and numerous institutions. Investors can thus use the kiosk service at PosNiaga’s shops in Malaysia to verify the status of their ASB fund application approval.

What if you lack the resources to invest in ASB?

source: Entrepreneur

For individuals who want to invest but don’t yet have the funds to start their financial goals, ASB offers a few possibilities for them.

EPF Members’ Investment

You can use this online tool to withdraw funds from your EPF Savings Account 1 that are suitable for investment into unit trusts. An investment account may be opened by any EPF member who is at least 18 years old. You may put up an additional 30% of your savings in Account 1 beyond the minimum necessary for Basic Savings. Prior to the release control being issued by the EPF, members up to the age of 55 are only eligible for the Basic Savings Amount. It is available to everyone who is an eligible EPF member and has an EPF i-Akaun subscription. They might be both new clients of Principal Asset Management Berhad (“Principal”) and all current Principal account holders for EPF schemes.

Salary Deduction

This program allows unitholders in the public and commercial sectors to automatically remove a portion of their monthly wage to invest in ASB or ASB2.

Public sector personnel must complete the Authorization Letter for Salary Deduction, get it approved by their employer, and then visit an ASNB location to apply for the program. Employees in the private sector must complete the authorization letter and apply through their company.

ASB Loans

Similar to the ASB fund, only Bumiputeras are eligible for ASB loans. The consumer will need to create an ASB account with the bank after providing the necessary income documentation to the lending institution, such as Maybank or CIMB. The lending bank will deposit the loan amount straight into the client’s ASB account if the loan application is accepted.

The borrower is required to pay back the loan on a monthly basis in the form of installments. For processing ASB loan applications, certain banks may also impose administration and documentation costs.

As basic term loans, ASB loans are calculated for interest using the declining balance technique, much like housing loans and fixed-rate investments. These days, the majority of ASB loans have variable interest rates, which means that they will fluctuate in line with the Basic lending rate.

Customers can opt to have conventional or takaful insurance that is subsidized by the banks to cover their ASB loans, just like mortgage insurance can. In the case of death or total and permanent incapacity, these insurances will pay the outstanding loan balance (TPD).

Your money can be withdrawn from ASB in two ways:

a) Take cash out in person

You must go to an ASNB office, an ASNB agent, or the bank you used to make your investment to withdraw your money in person. You don’t need to fulfill any conditions to withdraw your money.

c) Online withdrawal of money

Through the myASNB portal, you may also make a withdrawal of money online. But there are certain restrictions that apply to your

Conditions for the withdrawal of ASB funds are:

- The monthly withdrawal cap is RM 500.

- The minimal withdrawal limit per transaction is RM100.

- There can be a maximum of three transactions each month.

- You can only take money out of your unit trust account (redeem).

- Withdrawals from any ASNB unit trust may be made online, with the exception of ASN Equity 5 and ASN Sara 2.

- Zero extra fees (for now).

Can those who are not Bumiputera invest in ASB?

Non-Bumiputera persons are not permitted to invest in the ASB. Amanah Saham Malaysia (ASM) is the right choice for you, this unit trust fund is open to all Malaysians and shares ASB’s investing philosophy. It is also seen as a low-risk investment that will produce steady returns just like you get through ASB.

ASM, on the other hand, has a little lower average dividend payment than ASB and a higher overall management charge of 1% vs 0.35% for ASB. Due to the small number of ASM units for sale, they are famously difficult to purchase. You may have to verify with an ANSB representative or browse the myASNB site several times before you can secure units.

Conclusion:

Despite the fact that ASB produced its lowest income ever last year, it is still a potential investment option because of its low risk and steady returns. Undoubtedly, we must invest our resources in order to attain our long-term financial objectives as well as to keep them from being eroded by the rising cost of living.

We have real estate professionals who can help you own Property. Fill in the form below, to get in touch with them!