Juwai IQI expects an increase in Singapore-Malaysia cross-border property investment of at least 40% in 2022, compared to 2021 levels.

Kashif Ansari, co-founder and chief executive officer of Juwai IQI Group said in the statement, this investment should continue to climb in 2023, probably reaching pre-pandemic levels that year.

“In 2022 we expect both Malaysian ex-pats living in Singapore and Singapore nationals to increase their property acquisitions in Malaysia, especially in Johor and secondarily in Kuala Lumpur,” he said.

He said that the border’s re-opening will have three important impacts on the Malaysian economy.

“It will lead to a complete resumption of pre-pandemic trade and travel between the nations. It will once again make it possible for Malaysians to seek opportunities in Singapore and for Singaporeans to seek opportunities in Malaysia by enabling the cross-border lifestyle that so many took for granted before 2020.”

Kashif also claimed that buyers in Singapore are seeking for alternatives to the extremely expensive property in their own market.

“The pandemic fueled housing demand and reduced the supply of housing on the market in Singapore. The result has been new highs for private residential real estate prices.

“In 2021, overall Singapore private home prices jumped 10.6 per cent. Singapore hasn’t seen such fast price growth since 2010. Meanwhile, the number of transactions increased by 68% compared to 2020,” he said.

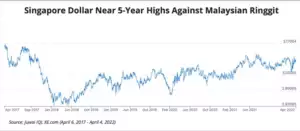

Besides, the Singapore Dollar is near its five-year high against the Malaysian Ringgit at RM3.10 to $1, higher than at the beginning of the pandemic in February 2020 when the Singapore dollar fell to RM2.98.

For a buyer holding Singapore dollars, Kashif said, the exchange rate represents a 4% to 5% increase in buying power.

“Further enhancing the buying power of purchasers holding Singapore dollars is that the Malaysian real estate market offers excellent affordability at the moment. While Malaysia’s real estate market did surprisingly well during the pandemic, Ministry of Finance data shows that transactions were none-the-less lower than in prior years.”

Kashif stated, total residential transaction value dropped more than 26% in H1 2020 compared to the same period in 2019.

Despite the total transaction value still lower in H1 2021 than 2019’s level, Kashif said, although Malaysian home prices dropped 1.2% in the second quarter of 2021, they still remained in line with 2019 levels.

“Malaysian home prices have remained in the same band since about 2019, but fewer sales and less new construction, combined with a rising economic optimism in the country, suggest that the property market could be at the beginning of a new up cycle.

“As employment, household income, and GDP all increase in 2022 and beyond, we expect the home market to also perform well,” he said.

Singapore is Malaysia’s largest source of foreign direct investment. In 2020, Singapore accounted for 22% per cent of Malaysia’s total FDI stock.

“Singapore also benefits, and received more Malaysian direct investment than any other country. Malaysian investment in Singapore reached RM110.38 billion, or about 21% of the total, in 2020,” Kashif added.

Thank you for the media coverage: BERNAMA, NST, The Sun Daily, Money Compass, Urdu Point, BOL News, NAMPA, Xin Hua Net