Canada’s real estate market closed 2025 in a more balanced and stable position, supported by earlier interest rate cuts, easing inflation, and gradually improving buyer confidence.

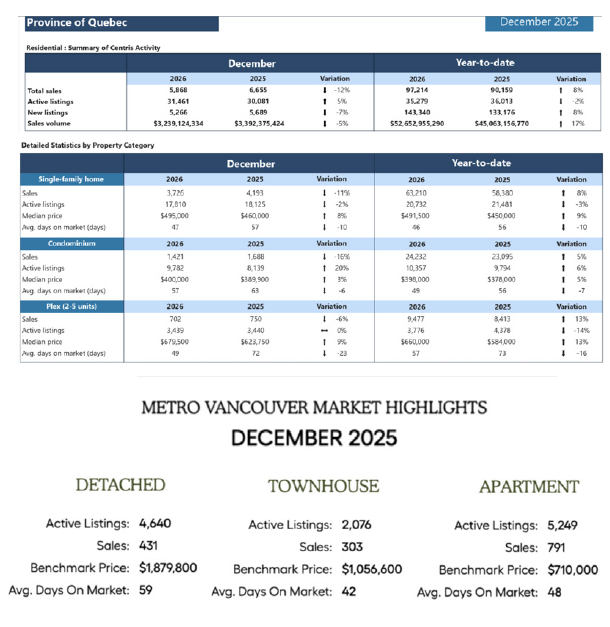

Across major cities, conditions varied but remained resilient: the GTA saw steady demand within a well-supplied market, Vancouver experienced elevated inventory with limited price pressure, and Montreal continued to outperform, driven by favourable financing conditions and population growth.

Overall, the national market ended the year on solid footing, setting a measured tone for 2026.

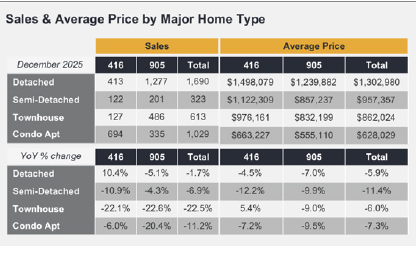

At the city level, Toronto closed December 2025 with lower year-on-year sales and prices, but rising listings and improving affordability are positioning the market for a potential recovery once economic confidence

strengthens. Vancouver remained firmly buyer-friendly, with high inventory levels and softer sales keeping conditions balanced-to-soft. Quebec continued to show resilience, with stable transaction activity and price growth supported by strong demand for multi-unit and urban housing. Taken together, Canada’s housing market is entering 2026

with greater stability, improving affordability trends, and pent-up demand that could support activity as confidence returns.