Written by Yousaf Iqbal, Head of IQI Canada

Canada Canada’s Housing Market in September 2025: Signs of Stability Amid Affordability Pressures

In September 2025, Canada’s housing market showed signs of cautious stabilization. National average home prices edged up slightly by 0.2% to C$674,000, though they remained 1.8% lower than the previous year.

Sales rose 3.1% month-over-month, buoyed by interest rate cuts and an increase in listings. Yet, affordability continues to be a challenge, with mortgage costs still 35% higher than in 2019.

On the rental side, prices declined for the third consecutive month, thanks to an uptick in housing completions, offering modest relief to tenants.

While the market is showing early signs of recovery, it remains sensitive to affordability constraints.

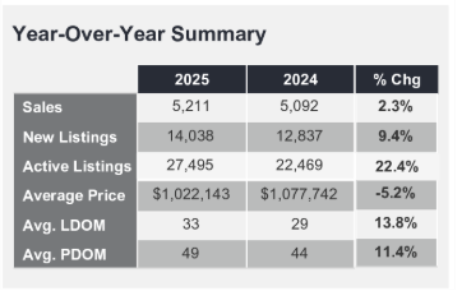

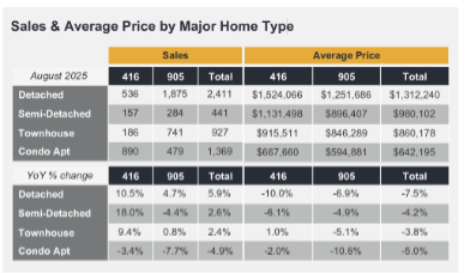

At the city level, Toronto (GTA) saw a 2.3% rise in home sales and a 9.4% increase in listings in August 2025, expanding supply and making the market more competitive.

Prices, however, fell by 5.2% to an average of $1.02 million, as affordability pressures persisted. In Greater Vancouver, September sales were up 1.2% year-on-year, but the sales-to-active listings ratio of 11.3% signalled mild downward price pressure.

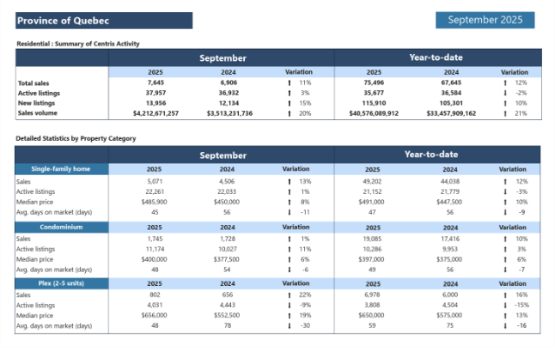

Meanwhile, Quebec stood out with a 12% year-on-year surge in transactions—the strongest September since 2020—driven by an 18% rise in listings and stable inventory.

Prices climbed across all property types, underscoring strong seller conditions in the province.

Source by FSMI