written by Lily Chong, Head of IQI Australia

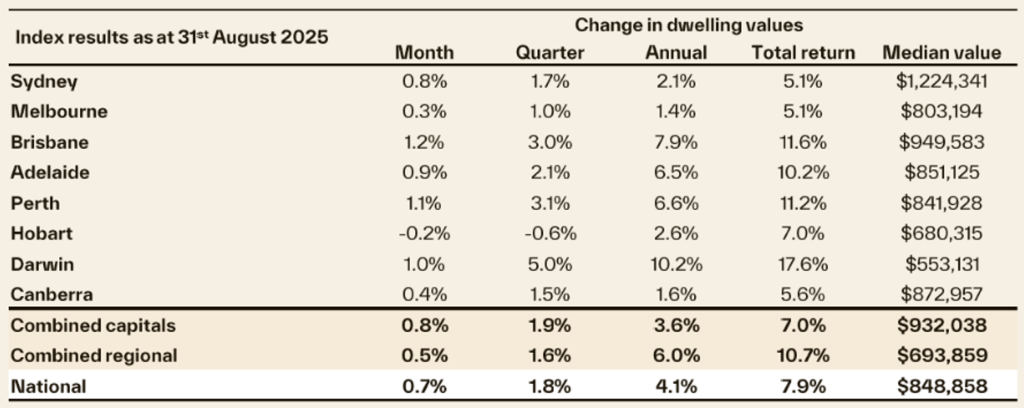

Cotality’s national Home Value Index (HVI) rose 0.7% in August, marking the strongest monthly gain since May last year and lifting annual growth to 4.1%.

The upswing has been building since the February rate cut, driven by improved borrowing capacity, rising buyer confidence, real wage growth, and limited advertised stock.

“There’s a clear mismatch between supply and demand, which continues to push housing values higher,” said Tim Lawless, Cotality Australia’s research director.

Key Highlights

- Strong vendor position: Auction clearance rates hit 70% in late August, the highest since February last year.

- Tight supply: Advertised stock levels remain about 20% below average, giving sellers an advantage despite a slight seasonal increase in new spring listings.

- Sustainable growth expected: While prices are rising, affordability constraints, cautious lending, and slower population growth are likely to keep growth more measured compared to the rapid surges seen during the pandemic.

Perth Market Performance

Perth continues to be one of the strongest-performing capital cities, with housing values rising 1.1% in August, outpacing the national average. Alongside Brisbane (+1.2%) and Adelaide (+0.9%), Perth remains a frontrunner in monthly gains.

Low advertised stock, strong buyer demand, and attractive affordability compared to other capitals are contributing to Perth’s sustained growth momentum.

Perth Rental Market

Perth’s median dwelling rent stayed stable at $680 per week in August, 4.6% higher than last year.

- Houses: Up 2.2% over the month to $700 per week (7.7% YoY increase).

- Units: Stable at $650 per week, up 4.6% YoY.

While rents remain elevated, experts note this is a seasonal trend as rental demand typically tightens towards the end of the year. However, there’s no broad surge in prices, with many landlords keeping new lease and renewal increases modest.

Source by Cotality & Reiwa