Written by Joe Pua, Business Development Manager at IQI Tender

As the world turns its attention toward Southeast Asia for growth and diversification, one emerging city is quietly gaining momentum: Miri, located in northern Sarawak, Malaysia.

What Makes Miri Stand Out?

- Miri is no longer just an oil and gas town. It is now:

One of Sarawak’s fastest-growing cities, supported by billions in government infrastructure funding - Strategically located near Brunei and Indonesia’s new capital, Nusantara – creating massive economic spillover

- Home to major education and healthcare institutions, making it a regional hub for lifestyle and wellness

- A tourism magnet, with UNESCO World Heritage parks, beaches, coral reefs, and a growing Airbnb market

- A developing port and smart city, set to transform logistics and urban living

Key Government-Driven Developments Fueling Growth

1. RM200 Million Urban Transformation Project

Launched in 2025, this project is converting 50 acres in the heart of Miri into a mixed-use zone comprising residences, commercial towers, a hotel, an international school, and a new marina—modelled after successful waterfront developments in Kuching and Singapore.

2. Kenyalang Smart City – 543 Acres of Innovation

Located adjacent to Curtin University Malaysia, this high-tech township will integrate:

- Residential, healthcare, logistics, and retail zones

- Education and research centres (including China’s Fudan University SEA Institute)

- Renewable energy infrastructure and smart technologies

3. Miri Deep Sea Port – The Future Trade Gateway

With thousands of acres earmarked for port expansion, free trade zones, and cruise terminal facilities, Miri is set to become the logistics and export gateway for Northern Sarawak and Indonesia’s Nusantara.

The Nusantara Effect: Indonesia’s Capital Move & Miri’s Advantage

Indonesia’s new capital, Nusantara, is just 400 km from Miri via air or future road links. This proximity is game-changing.

Why it matters:

- Trade & Talent Flow: Miri will benefit from spillover population growth, increased logistics demand, and regional HQ expansions from Indonesia

- New Flight Routes: Direct air connectivity between Miri, Nusantara, and Kalimantan is under negotiation

- Cross-Border Tourism: With Brunei and Indonesia nearby, Miri’s Airbnb and tourism rental market is set to boom

Nusantara is not just a capital shift. It’s a catalyst for Borneo-wide cooperation. Miri is well-positioned to ride this wave.

– Jakarta Post, 2024

Impact of the Pan Borneo Highway on Miri’s High-Rise Property Market

- Improved Accessibility

- Accelerated Economic Growth

- Potential for Transit-Oriented Development (TOD)

- Land Value Appreciation

- Boost in Cross-Border Travel & Tourism

Why Invest in Miri Real Estate Now?

| Factor | 2025 Status | Future Outlook |

|---|---|---|

| Property Prices | Still below national average | Capital appreciation expected |

| Rental Yields (Airbnb) | 8–12% in tourism zones | Increasing with improved connectivity |

| Long-Term Rentals | Steady demand from Brunei/Indonesia | Rising due to port and city development |

| Foreign Ownership | Allowed above RM500,000 | Investor-friendly and flexible regulations |

Investment Opportunities for Property Buyers

Landed & High-Rise Residential

- Strong demand from professionals, expatriates, and government staff relocating from rural to urban Sarawak

- New housing zones being developed near universities, the port, and smart city precincts

High-Rise Price Comparison by City Centre (2025)

| City Centre | Avg. RM/psf | Remarks |

|---|---|---|

| Miri City Centre | ~RM650–675 | Premium waterfront, limited supply |

| Johor Bahru (CIQ/RTS) | ~RM700–850 | Linked to RTS, near Singapore, high investor interest |

| Penang (George Town) | ~RM750–950 | Heritage premium, sea view, limited land |

| Melaka (CBD) | ~RM500–600 | Tourism-driven, mid-density |

| KLCC/Bukit Bintang | ~RM1,200–1,500 | Capital core, international demand |

| Petaling Jaya | ~RM650–800 | High-end suburban area, mature market |

Source: Aggregated data from EdgeProp.my, iProperty.com.my, and PropertyGuru Malaysia

Source: Compiled from PropertyGuru, iProperty, Mudah.my listings, and verified agent

insights (Q1–Q2 2025).

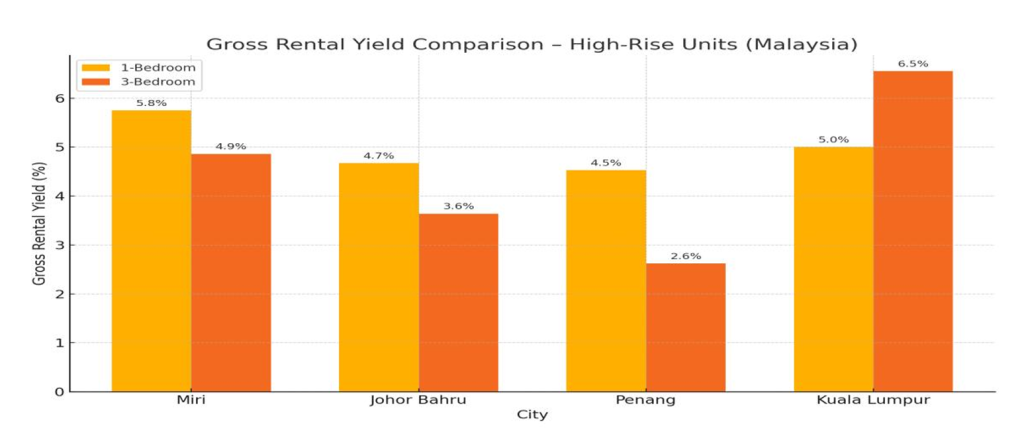

Miri offers solid rental yields of approximately 5.7% (1BR) and 4.5% (3BR) — impressive given its relatively low property prices. Johor Bahru also shows strong performance, particularly for larger units. Penang and KL have lower yields due to higher capital costs.

This positions Miri as a value-driven investment destination, ideal for investors seeking strong returns and steady cash flow.

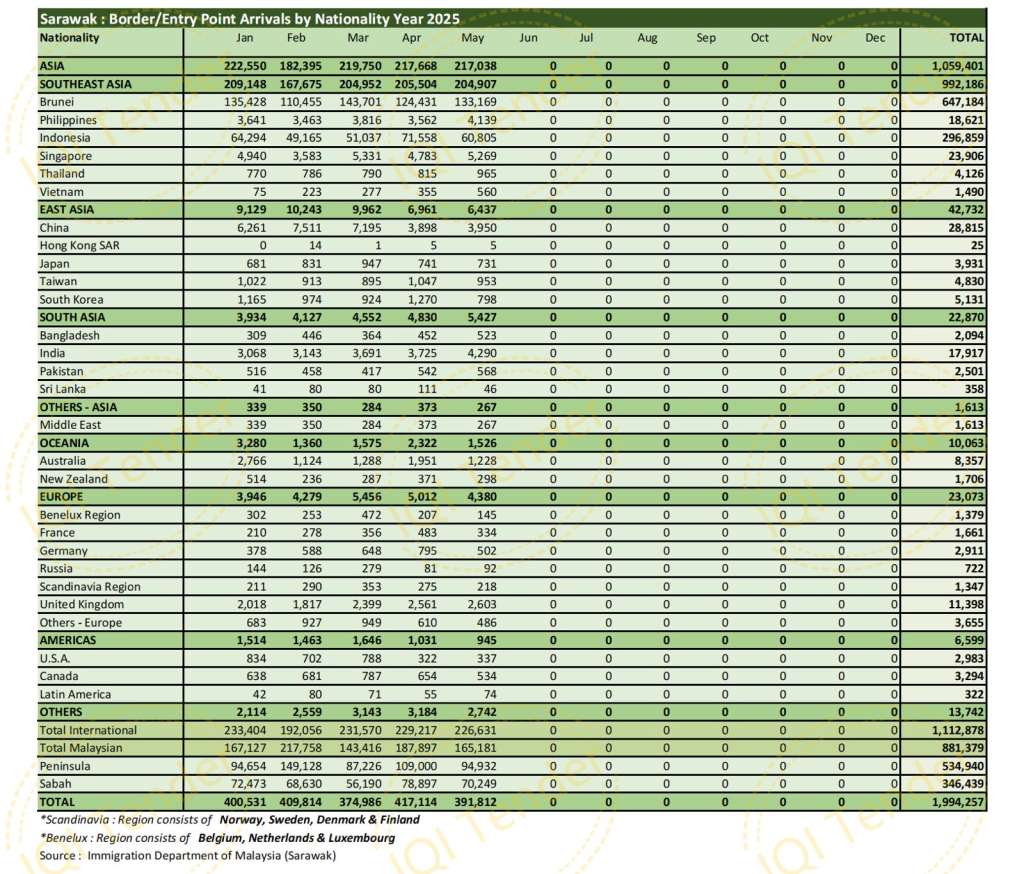

Sarawak recorded a strong 1.99 million visitor arrivals between January and May 2025, showcasing its growing profile as one of Malaysia’s leading tourism regions. This includes 1.11 million international tourists and 881,000 domestic visitors.

Brunei remains Sarawak’s top source, contributing 647,184 arrivals. Indonesia followed with 296,859 visitors, likely boosted by the ongoing development of Nusantara, Indonesia’s new capital city in neighbouring Kalimantan. China contributed 28,815 visitors, while India sent 17,917, continuing a steady growth trend.

With Miri capturing a substantial share of this through weekend getaways, nature escapes, and business travel, the case for investing in high-rise, short-stay-ready properties in Miri is stronger than ever.

Airbnb & Short-Term Rentals

- Weekend traffic from Brunei and Kalimantan visitors boost short-term rental demand

- Upcoming events and cruise tourism are expected to lift seasonal yields

Between January and May 2025, Sarawak recorded 1.99 million tourist arrivals, including:

- 1.11 million international tourists

- 647,184 from Brunei (top source)

- 296,859 from Indonesia (boosted by Nusantara)

- 28,815 from China, and 17,917 from India

Miri captures a substantial share of this tourism boom—driven by nature retreats, business events, and regional travel—strengthening the case for investing in short-stay properties.

S-MM2H Impact on Miri’s High-Rise Market

- Lower Entry Barrier: Attracts mid-range foreign retirees, especially from Brunei, China, and Indonesia

- Dual Purpose: Units often serve as both residence and Airbnb

- Bruneian Demand: Many use S-MM2H to formalise second-home stays

- No Property Requirement: Applicants are not required to purchase property, offering more flexibility

Final Word: Miri Is the Undervalued Gem of Borneo

As Malaysia and ASEAN evolve, real estate investors looking for first-mover advantage should keep an eye on Miri.

With smart cities, port expansions, and Borneo-wide collaboration gaining traction, Miri’s transformation is already in motion. The best time to invest is before prices reflect the full potential.

Ready to Explore Property Investment in Miri?

Let us help you find the right residential or commercial property to match your investment goals.

📞 Call: +6011-3328 2155

📧 Email: tender@iqiglobal.com

🌐 Visit: iqiglobal.com/tender

This article was authored by Joe Pua, a Business Development Manager with around 5 years of experience in the real estate industry. Joe specialises in market research, project development, and investment strategy, playing a key role in driving regional property growth and investor engagement.