Japan’s property market stands firm in 2025 as a compelling location for real estate investment in Asia. Undergoing a transformative period surrounding demographic change, Japan’s utilising the growing foreign interest and sustainability initiatives to create a resilient and stable property market.

Here’s a rundown of Japan’s Market Insights to help you make informed decisions about your investments.

Key Takeways:

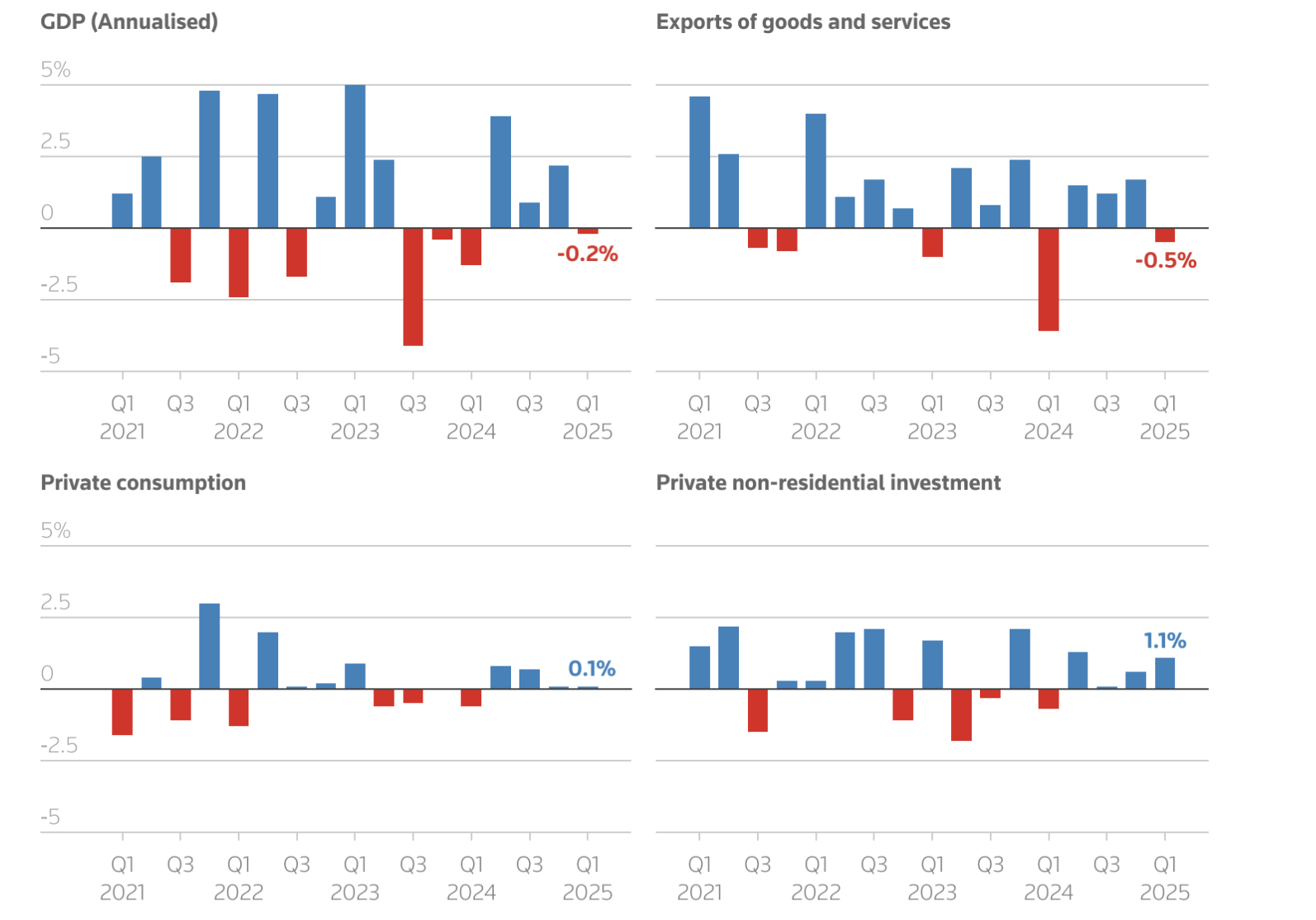

- Japan’s Economy: The GDP in Q1 2025 shows at -0.2%, a slower pace than what was estimated, largely due to the tariffs from the United States. Real GDP is projected to grow by 0.7% in 2025.

- Japan’s Development: Addressing sustainable and smart housing development, as well as the redevelopment of large areas of vacant homes

- Japan’s Job Market: A stable 2.5% unemployment rate, but an exceptionally high employment rate for new graduates at 98%, with wage increases across sectors to incentivise employment. A high demand in tech, finance & services.

- Japan Real Estate: Increased interest from foreign and domestic investors, especially in the commercial market due to stable returns

Table of contents

Japan’s Economic State

Economic Overview

- Japan’s economy is recovering with Q1 GDP at 0.0% (after -0.2% dip), projected to grow 0.7%–1.2% in 2025 depending on the source.

- Private consumption and investment remain solid despite global headwinds; domestic demand is the key growth driver.

- Inflation moderates to around 2.4%–2.8%, and wage growth supports spending.

- Yen weakness (¥150–160/USD) gives foreign investors a 20–30% price advantage.

Japan entered 2025 with cautious optimism, experiencing both risks and opportunities as they bounce back post-COVID and deal with uncertainties pertaining to global politics and economies. As of mid-2025, Japan remains the world’s fourth-largest economy, with nominal GDP projected at approximately USD 6.9 trillion for 2025.

In Q1 2025, Japan’s economy showed renewed resilience, with their GDP recorded as 0.0% quarter-on-quarter, improving slightly from a -0.2% contraction in early 2025. Exports faltered due to global tensions but consumption figures revised upwards, with private consumption, comprising more than half of Japan’s economy, grew 0.1% where it was predicted to be flat in the initial reading. The capital expenditure component of GDP (private demand) expanded 1.1% in Q1, though economists had expected 1.3%.

For the broader economy, this signals a cautious but positive shift toward recovery, supported by internal demand despite external hindrance. For domestic investors, the boost in consumption and capital spending suggests improving business and consumer confidence, which may support further economic momentum.

As for foreign investors, the combination of economic stabilisation, potential monetary policy adjustments, and relatively attractive real estate and asset prices in Japan could present timely entry points into a market that is showing signs of bottoming out and gradual strengthening.

Source: Reuters

Analysts forecasts for 2025

- IMF: The IMF expects Japan’s economy to expand 1.2% in 2025, after they experienced a 0.1% increase in 2024 owing to private spending. Headline inflation is projected to flow to 2.4% in 2025 from 2.7% last year. “After three decades of near-zero inflation, signs are growing that Japan’s economy can reach a new equilibrium with inflation sustained at the Bank of Japan’s 2% headline inflation target and growth at the 0.5% potential,” the IMF said1.

- OECD: Slightly more optimistic, OECD predict real GDP is projected to grow by 0.7% and 0.4% in 2025 and 2026 respectively. Driven by domestic demand as wages rise, supporting private consumption. Headline consumer price inflation at 2.8% this year, converging to 2% next year2.

- Bank of Japan: Revised its fiscal‑year 2025 growth outlook down to between 0.5% and 1.1%, settling around 0.5%, citing impacts of U.S. tariffs3.

What’s keeping Japan’s economy ticking in 2025?

- Private Consumption

- Household consumption has been surprisingly robust, with Q1 2025 marking the fourth consecutive quarter of rising consumption, thanks to steady wage gains of 2.3% as of April 2025, and improved employment

- Investment Momentum

- Despite global headwinds, business investment remains solid—buoyed by corporate profitability and strong order backlogs in machinery, digital transformation, and green sectors.

- Inflation and Policy Support

- Headline inflation has seen a modest decrease from its peak of 4% in January 2025, standing at 3.6% in April. This is driven by energy and food price acceleration as subsidy effects fade.

- Tourism

- With inbound tourism projected to surpass 33 million visitors in 2025 (JNTO), there is a booming interest in short-term rental properties, especially in Tokyo. This could be a lucrative opportunity for investors as hotels comprised 47% of foreign transactions in 2024.

- Trade

- Japan’s government is preparing its “summer” economic outlook for 2025, and is expected to revise its GDP growth forecast downward from 1.2% to below 1.0%, reflecting weakening global demand amid U.S. tariffs. Additional subsidies targeting energy, gas, and gasoline will roll out progressively through 2025, as detailed in an OECD report.

- Digital Expansion

- The Ministry of Economy, Trade and Industry (METI) is expanding tax incentives and direct subsidies for firms investing in AI, robotics, biotech, semiconductors, and renewables. They have also set an intellectual property strategy to maximise their capital through the use of artificial intelligence.

- Social and demographic incentives

- In response to demographic decline, new reforms aim to increase labour participation among women, seniors, and skilled foreign workers. These include childcare expansion, reskilling programmes, and visa relaxations.

- Expanding outside the region

- Government support for regional cities includes infrastructure grants, affordable housing schemes, and incentives to relocate companies outside Tokyo. These measures enhance the appeal of emerging investment hubs like Fukuoka, Sapporo, and Nagoya.

- Government support for regional cities includes infrastructure grants, affordable housing schemes, and incentives to relocate companies outside Tokyo. These measures enhance the appeal of emerging investment hubs like Fukuoka, Sapporo, and Nagoya.

How Is Japan’s Real Estate Market Performing in 2025?

Overview

- Japan’s real estate market is stable, with commercial deals up 30% YoY in 2024.

- Tokyo leads, but Osaka, Fukuoka, Nagoya, and Sapporo are rising stars due to infrastructure and regional incentives.

- Rental yields: Tokyo ~3.4%, Osaka ~4.5%, Sapporo ~5%, with nationwide avg. at 4.2%.

- Property prices rising steadily; Tokyo condos average ¥110 million (~$800K).

- Occupancy rates high, with central Tokyo below 5% vacancy and strong rental growth.

It’s worth noting that 37% of Japan’s population is in Tokyo, with prefectures like Osaka, Nagoya, and Fukuoka experiencing internal migration in recent years due to stabilising prices and easier entry points.

Foreign investors are important too, primarily coming from North America, Europe, Singapore, Hong Kong and South Korea. According to UNCTAD’s World Investment Report 2024, Japan was the 19th-largest recipient of FDI globally, with an inflow of USD 21.4 billion, down from USD 34.1 billion one year earlier.

The real estate sector totaled approximately USD $436 billion in 2024, with economists predicting it to rise in coming years. The average nationwide land price rose about 2.7% in January 2025 and office, retail, logistics, and residential segments in urban centers are seeing the most inflows.

In 2024, commercial real estate deals soared: $23.6 billion by mid-year—a 30% increase from 2022. Foreign capital comprised roughly 27% of total transactions, up from 21% five years ago. This recovery signals the slow strengthening of Japan’s property market, as it is the strongest gain they’ve had since 1991.

Japanese currency shows at 150-160 yen per USD – which means a 20-30% purchasing advantage for foreign buyers (compared to 5 years ago). Due to the weakened yen, foreign investment is over $10 billion, with a 45% increase in Q1 2025, showing the continued interest from foreign buyers.

A recent survey of real estate professionals revealed that 70% hold a positive outlook on current market conditions—the most favorable sentiment reported in the past five years. Many anticipate robust investment opportunities on the horizon.

Notably, 31% of experts now believe Tokyo’s property prices will reach their peak in 2025, up from 25% the previous year, indicating growing confidence among both domestic and international investors that the market upswing may persist.

The legal and tax environment of Japan aids in this growing optimism. Japan’s property market is one of the most open in Asia, with minimal restrictions on foreign ownership and clear legal procedures, making it exceedingly beneficial for international investors.

- Ownership Rights

- Foreigners can purchase freehold property in Japan without any citizenship or residency requirements.

- Title registration is transparent and legally protected, with lawyers or judicial scriveners (shiho-shoshi) typically handling documentation.

- Taxes and Fees

- Real estate acquisition tax: 3–4%

- Residential property and land have a 3% tax rate

- Commercial property has a higher rate of 4%

- Stamp tax: Ranges from ¥10,000 to ¥480,000, depending on the property price

- Income:

- Rental income is subject to progressive tax (5–45%), with deductions allowed for depreciation, maintenance, interest, etc.

- Withholding tax for non-resident individuals is 20.42%, 10.21% for residents imposed at the time of property acquisition

- Financing & Management

- Foreigners may access mortgage financing through select Japanese and international banks, typically requiring 30–50% down payment.

- Property management firms are widely available and often bilingual, charging 3–5% of gross rental income.

Tokyo property trends

- Residential prices

- Tokyo’s property price index rose 8.14% in January 2025, with inflation-adjusted growth around 3.95%, which means there is strong demand and factors leading to a positive increase in market conditions

- The average new condominium in Tokyo’s 23 wards will cost over ¥110 million ($800,000) in 2025. While this is a slight dip, it remains near all-time highs.

- Rents & Occupancy

- In Q4 2024, average mid-market rent in Tokyo’s 23 wards (its municipalities) hit ¥4,332/m² (US $29/m²), up 1.3% QoQ (quarter on quarter) and 6.4% YoY (year on year).

- The core central five wards averaged ¥5,250/m² (US $35), growing 6.7% YoY. Occupancy rates rose to 96.6% (23 wards) and 97.2% (central five)

- Vacancy in central Tokyo is now below 5%, with net effective rents rising ~3% YoY (CBRE Japan, Q2 2025).

- Rental Yields

- Nationwide average gross rental yield stands at 4.22% in Q1 2025, slightly down from 4.33% in Q2 2024. Studio/apartment yields in the Tokyo central five wards average 3.7% per CBRE data.

- Combined capital and income returns in Tokyo commercial assets reached about 4.8% by mid-2024, up from 4.4% in 2023.

- Tokyo’s central wards yield is 3.44%, compared to 4.47% in Osaka and 4.96% in Sapporo. This disparity reflects Tokyo’s status as Japan’s most mature and in-demand market for investors seeking steady returns and capital preservation.

- Payback:

- With yields in the 3.5–4.5% range, investors typically recover their capital in 22–28 years, factoring in rental growth and cap rate compression.

These property trends highlight the growing interest in Japan’s urban landscape, especially in the wards where there is a focus on redevelopment. For example, the Nakano ward, a site focused on station area projects, saw land prices increase by 16.3%, and popular tourism hubs such as Shibuya climbing exceptionally high by 32.7% in a year.

For institutional investors focused on investing in larger scale commercial property, higher returns and long-term demand visibility is crucial. These sectors are key:

- Office & Industrial

- Fueled by ¥18.8 billion in corporate capital expenditure in Q1 2025, demand remains solid in urban hubs.

- Prime locations include Marunouchi, Shibuya, Roppongi (Tokyo), Umeda (Osaka)

- Attractions include long-term leases, stable occupancy, predictable income

- Some risks are that this sector is sensitive to business cycles and macroeconomic shifts

- Logistics & Data Centres

- Continues to outperform due to e-commerce growth and digital transformation.

- Japan’s data center market is expected to nearly double by 2028, which would fuel development activity.

- Key regions of investment include Greater Tokyo, Osaka, and Nagoya peripheries.

- Demand drivers include 5G, AI, and gaming

- Some barriers include the high capital requirement and operational complexity

- Retail & Hospitality

- Benefitting from post-COVID tourism rebound and domestic consumption

- Main cities include Tokyo Kyoto, Sapporo, and Fukuoka

IQI’s View on Japan’s Real Estate Opportunities

As we move through 2025, Japan remains a rare combination of economic stability, open market access, and relatively affordable global real estate. It offers investors a sturdy legal framework, clear ownership rights, and a deep property market.

With government incentives focused on development, tourism, and sustainability being proposed, Japan is a great location to invest for consistent rental income in urban centers, attractive capital appreciation in select growth hubs, opportunities due to currency, and diversification into an expanding property market.

Tokyo continues to lead the way as a global city offering solid long-term returns, but cities like Fukuoka and Osaka are worth looking into as they are reshaping the narrative with regional innovation and somewhat attractive yields.

Investors who commit to understanding Japan’s unique ecosystem will not only preserve capital, they may very well grow it, steadily and sustainably, in a country keeping strong with resilience and determination.

Ready to Explore Investment Opportunities in Japan?

Whether you’re a seasoned investor seeking diversification or a first-time buyer exploring Japan’s property market, our expert team at IQI Global is here to help you navigate Japan’s evolving real estate landscape.

FAQs About Investing in Japan Real Estate

Where is the best place to invest in Japan?

The best places to invest in Japan are Tokyo, Osaka, and Fukuoka.

Tokyo offers long-term capital growth, Osaka gives you higher rental yields, and Fukuoka is an emerging hotspot with rising demand and affordable entry prices. Your ideal location depends on your investment goals—whether you’re looking for steady income, strong appreciation, or a balance of both.

Is it better to use my Japan property for Airbnb or student rental?

Both can be profitable, but it depends on the location and legal requirements.

Airbnb works well in tourist-heavy areas like Tokyo, Kyoto, or Sapporo, but you’ll need a proper minpaku license to comply with short-term rental laws.

Student rentals are more stable and suit cities with large universities, such as Osaka, Nagoya, and Fukuoka. They often come with longer-term leases and less turnover.

Can foreigners buy property in Japan?

Yes, foreigners can buy property in Japan with no restrictions on ownership.

You don’t need to be a resident or citizen, and you can own freehold land and buildings just like locals. Legal procedures are straightforward, and many real estate firms offer bilingual support for foreign buyers.

Is Japan a good country to invest in real estate?

Yes, Japan is considered a safe and stable market for real estate investment.

It offers clear ownership laws, strong demand in urban areas, and attractive pricing due to the weakened yen. Tokyo remains a top global city for property investment, and other cities like Osaka and Fukuoka are growing fast, providing opportunities for solid rental yields and capital appreciation.

Start your Japan property journey today. Fill in your details and let our experts connect you with the right investment.

Continue reading:

- IQI Expands Presence In 21 Countries With Launch Of IQI Japan Offices

- Survey of Japan Digital Transformation (DX) progress in the Real Estate Industry 2021

- Top 15 Best Countries for Real Estate investment

- Why a strong dollar is bad for the Global economy – By Shan Saeed, Chief Economic Consultant

References:

- Reuters: https://www.reuters.com/markets/asia/imf-sees-japan-sustainably-hitting-central-banks-inflation-target-2025-04-03/?utm_source ↩︎

- OECD: https://www.oecd.org/en/publications/2025/06/oecd-economic-outlook-volume-2025-issue-1_1fd979a8/full-report/japan_cc84dbee.html ↩︎

- Reuters: https://www.reuters.com/markets/asia/japan-government-consider-cutting-this-years-growth-forecast-sources-say-2025-06-25/?utm_source ↩︎