Written by Junaid Hamid, Head of IQI Karach Pakistan

Investing in Pakistan: Which Route is Best?

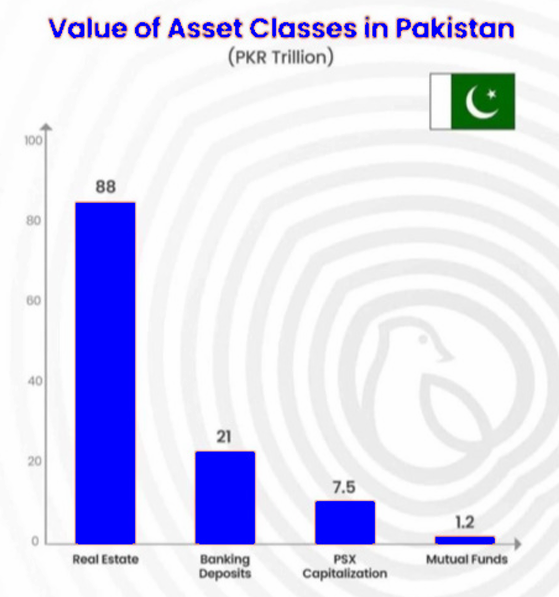

In Pakistan, real estate has emerged as a more attractive investment option compared to traditional banking deposits and other financial instruments. Offering average annual returns between 15% to 20%, it significantly outperforms bank deposit interest rates of 5% to 8%. Real estate also benefits from long-term appreciation—particularly in major cities like Karachi, Lahore, and Islamabad, where property prices have consistently risen by 10% to 15% annually over the past decade. Additionally, rental income provides investors with a reliable cash flow, with yields ranging from 4% to 6% per annum.

Beyond returns, real estate in Pakistan offers strategic advantages such as tax incentives and portfolio diversification. Investors can benefit from capital gains tax exemptions and mortgage interest deductions up to PKR 2 million. Moreover, with a low correlation to stock market performance, real estate serves as a valuable hedge against market volatility. Altogether, these factors make real estate a compelling and resilient investment choice for those seeking long-term financial growth in Pakistan.