Written by Yousaf Iqbal, Head of IQI Canada

As of May 2025, Canada’s real estate market is showing mixed signals, with national home sales down 9.8% year-over-year and a fifth consecutive monthly decline in activity. The sales-to-new-listings ratio (SNLR) rose slightly to 47%, indicating a broadly balanced market, though regional differences persist. Ontario remains in buyer’s market territory with a 35% SNLR, while Alberta (63%) and Quebec (70%) reflect strong seller conditions. The national median price for single-family homes dipped 1.1% month-on-month and 3.1% year-on-year, led by softness in major cities like Toronto and Vancouver. TRREB highlighted economic uncertainty and high costs as challenges, urging federal reforms to improve affordability and supply.

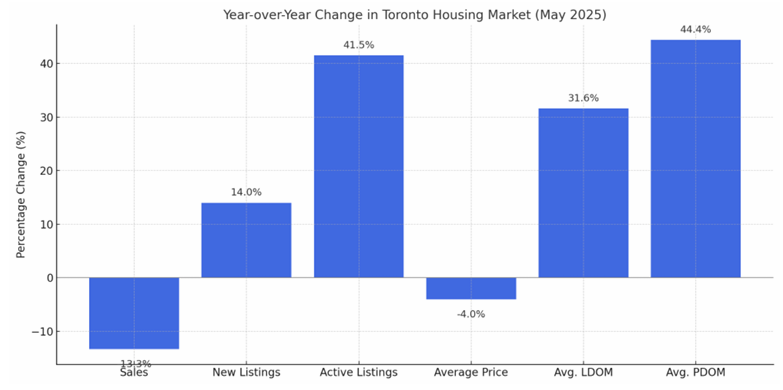

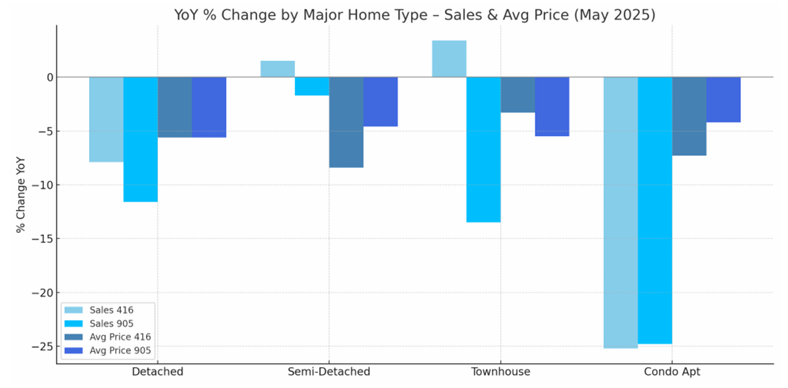

In the Greater Toronto Area (GTA), affordability improved thanks to falling prices and lower borrowing costs. May saw 6,244 transactions (down 13.3% y-o-y), while new listings rose 14%, easing supply constraints. The average price dropped 4% to $1.12 million, and the benchmark index fell 4.5%, though both metrics posted monthly gains—hinting at early recovery. Vancouver saw sharper declines, with sales falling 18.5% y-o-y and inventory hitting a 10-year high. Benchmark prices dropped 2.9%, reinforcing its buyer’s market status. In contrast, Quebec remained a bright spot, with home sales up 12% in Montreal and Quebec City, strong price growth, and limited inventory supporting a competitive seller’s market outlook.