This article is contributed by Shan Saeed, Chief Economist at Juwai IQI

As we enter 2025, the question looms; What does the future hold for global investors? That’s the big question. A recent analysis by Mike Bell of JP Morgan London paints a clear picture of the global economic outlook.

The global economic landscape is marked by significant divergence. While the US demonstrates resilience, Europe faces increasing risks of recession. Central banks are expected to continue cutting rates, and we anticipate that the Federal Reserve (Fed) and the Bank of England (BoE) will implement more rate cuts than currently priced in by the markets between now and the end of 2025.

In Europe, the recent PMI business survey data highlights a contraction in activity, particularly in the manufacturing sector. The service sector is also slowing, heightening concerns about a potential recession. The risk of US tariffs on European exports further exacerbates these concerns. We expect the European Central Bank (ECB) to implement an additional 25 basis point rate cut this year. However, internal debates within the ECB about the neutral rate suggest that rate cuts may proceed more cautiously than markets currently anticipate.

The UK economy is also under strain, as business surveys point to a slowdown. The recent budget has influenced the BoE’s stance, leading to expectations of more gradual rate cuts. The focus remains on inflation and wage growth, with the potential for deeper cuts if wage growth continues to moderate

In contrast, the US economy remains robust, driven by strong consumer spending and potential policy measures from the Trump administration. While some concerns persist about the labor market, overall growth prospects are positive, with the potential for above-trend growth in the coming year.

Credit Fundamentals and Investment Strategies

Despite the risk of a European recession, European banks are likely to remain resilient, supported by strong regulatory capital ratios and healthy profitability. With an average common equity tier 1 ratio of 15.4%, these banks are well-equipped to withstand economic shocks. The regulatory buffer to requirements is substantial, averaging 400 basis points, providing a significant cushion against potential downturns

Our investment strategies prioritize maintaining high credit quality, focusing on single-A-rated names and above. This approach enhances portfolio resilience amidst tight spreads on lower-rated credits. We are also selectively adding duration to our portfolios when market conditions present favorable opportunities, particularly in the US and UK, where rate cuts are less aggressively priced.

Conclusion

While recession risks have increased in Europe, the US outlook remains strong. Our liquidity strategies are

well-positioned to navigate these conditions, focusing on credit quality and active duration management to

optimize returns.

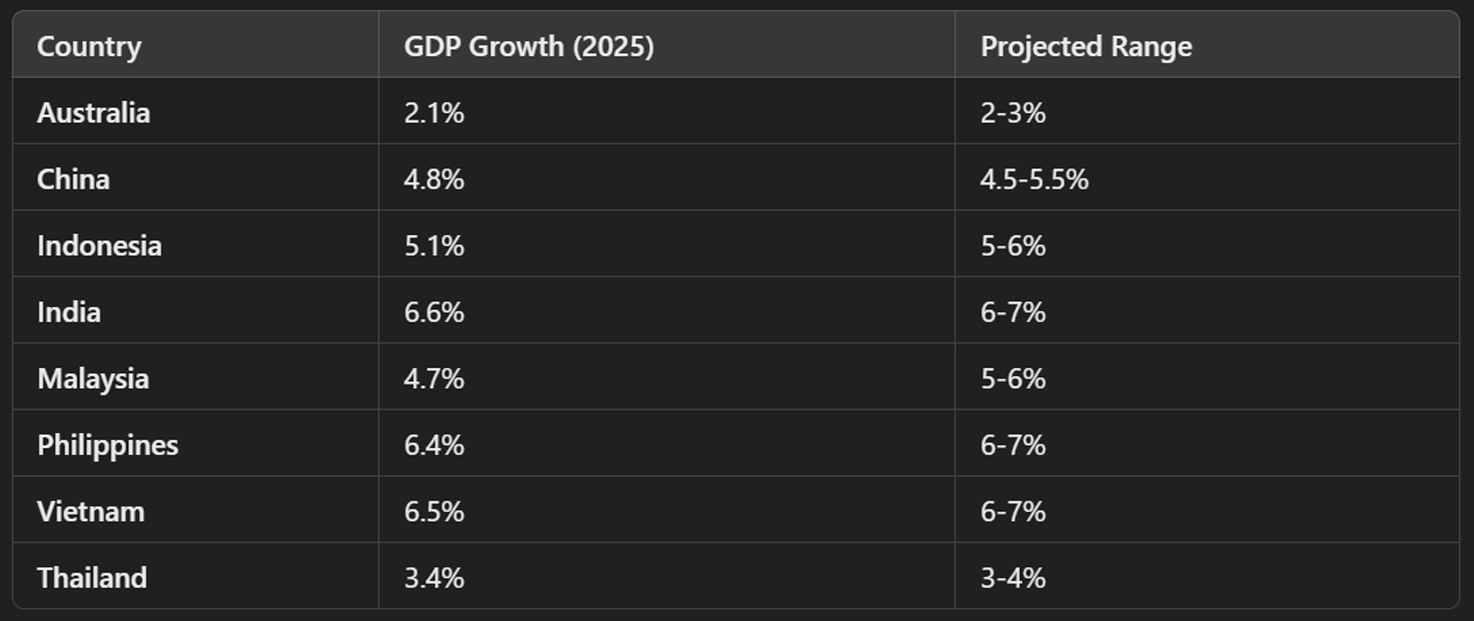

GDP Outlook for 2025