CoreLogic’s National Home Value Index (HVI) inched up by just 0.1% in November, marking the weakest nationwide result since January 2023. Although this represents 22 consecutive months of growth, the current cycle may be nearing its end.

“The slowdown is becoming evident in Melbourne and Sydney,” said Tim Lawless, CoreLogic’s Research Director. “Even the mid-sized capitals, which have driven recent growth, are starting to lose momentum.”

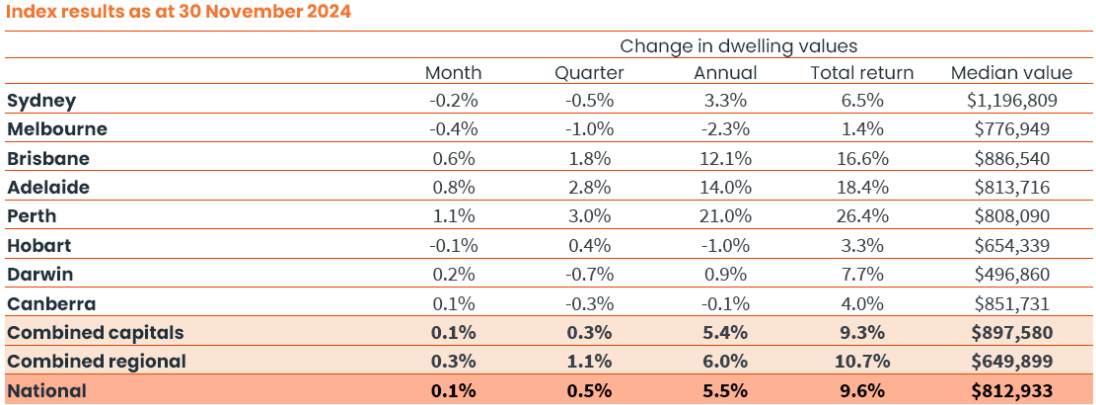

In Melbourne, housing values have declined in ten of the last twelve months, with a monthly drop of -0.4% in November, bringing the annual decrease to -2.3%. In Sydney, housing values plateaued in September after peaking in August, then fell by -0.2% in both October and November.

Quarterly figures reveal that four of the eight capitals are now experiencing declines in values, with Melbourne leading the trend (-1.0%), followed by Darwin (-0.7%), Sydney (-0.5%), and Canberra (-0.3%).

“The mid-sized capitals and many regional markets continue to provide some support to the national index, but it’s clear their momentum is also waning,” added Mr. Lawless.

Perth remains the nation’s frontrunner for capital growth, with values rising 1.1% in November and 3.0% over the past three months. However, this marks its slowest quarterly growth since April 2023 and reflects less than half the rate of the June quarter’s 6.7% increase.

CoreLogic’s latest data shows that the rental market is also experiencing a slowdown. The national rental index edged up by just 0.2% in November, with rents rising 5.3% over the past year—the slowest annual increase since April 2021. A year ago, rental growth stood at 8.1% annually and had exceeded 9% over the prior two years.

“At 5.3% annual growth, rents are still climbing at more than double the pre-pandemic decade average of 2.0%, but with such weak monthly increases, the annual trend is likely to decelerate further,” noted Mr. Lawless. “The first quarter of 2025, which is seasonally strong for the rental market, will reveal whether growth rebounds, but it appears increasingly clear that the rental boom is coming to an end.”

Perth continues to lead in rental growth among the capitals, with unit rents surging by 9.7% annually, although this is a significant slowdown from the peak of 16.6% recorded in late 2023 and early 2024. Perth also leads in house rental growth, with an 8.7% increase over the past year.

Despite Perth’s leading position in both property value and rental growth, the broader market slowdown is evident, with weaker growth across other capitals and regions. This suggests the national property market, including both sales and rentals, is transitioning into a new phase of subdued momentum.

Stay ahead of market trends—explore CoreLogic’s full report for the latest insights on housing and rental growth.

Data extracted in January 2025