National Property Information Centre (NAPIC) released its much-awaited annual property market report on 29th April 2020. Let’s take a look at the highlights and analyse the trends of the real estate industry.

1. In 2019, both transaction volume and total transaction value increase

According to the report, the real estate transaction volume in 2019 was 328,647 transactions worth RM141.40 billion was recorded, an increase of 4.8% as compared to 2018. In terms of total transactions value, real estate transaction value in 2019 increased by 0.8%.

2. Residential property market is the only market which saw a positive value growth, with property price range of RM300,000 and below being the most favored

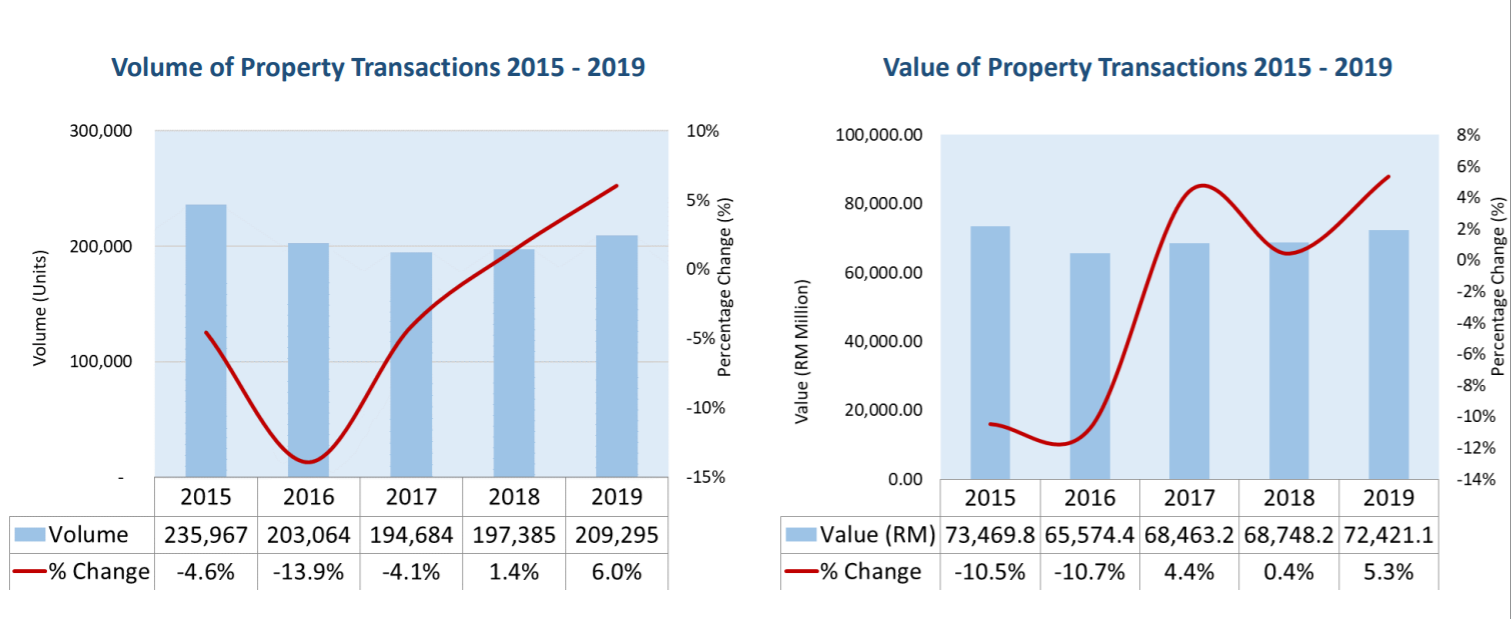

In 2019, the total number of residential transactions across the country was 209,295, with a total value of RM72.41 billion, which shows an increase of 6% in volume and 5.3% in value from 2018 (197,385 transactions with a total value of RM68.75 billion).

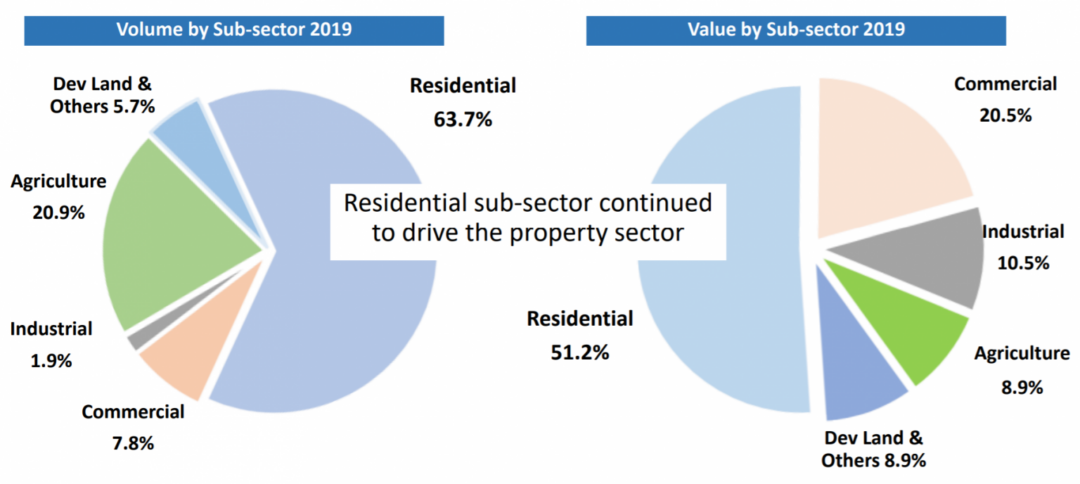

According to the report, residential sub-sector accounts for 63.7% of the total market, followed by agriculture sub-sector (20.9%), commercial (7.8%), development land (5.7%) and industrial (1.9%).

From a value perspective, the top three rankings are residential (51.2%), commercial (20.5%) and industrial (10.5%).

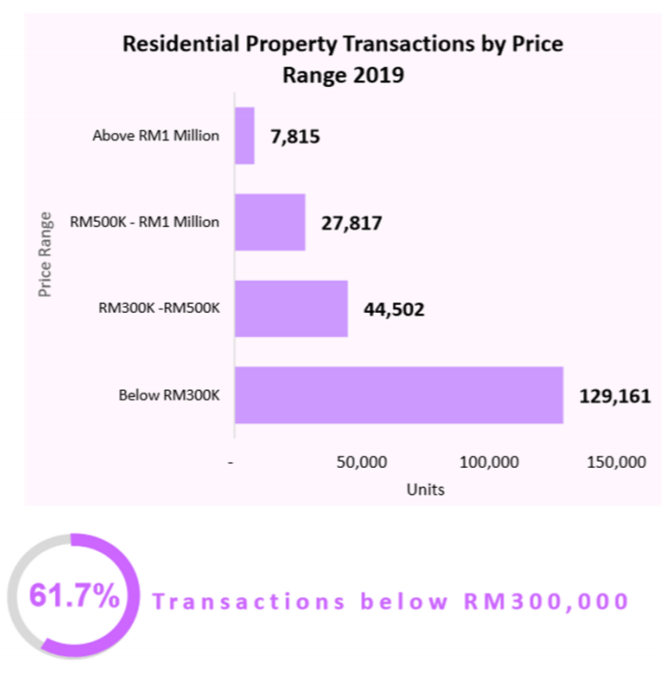

Among these sectors, affordable housing in the price range of RM300,000 and below remains a popular choice, accounting for 61.7% of the residential market transaction, followed by properties with a price range of RM300,000 to 500,000, accounting for 21.3% of the residential market transaction.

3. Most of the states recorded higher residential property sales in 2019

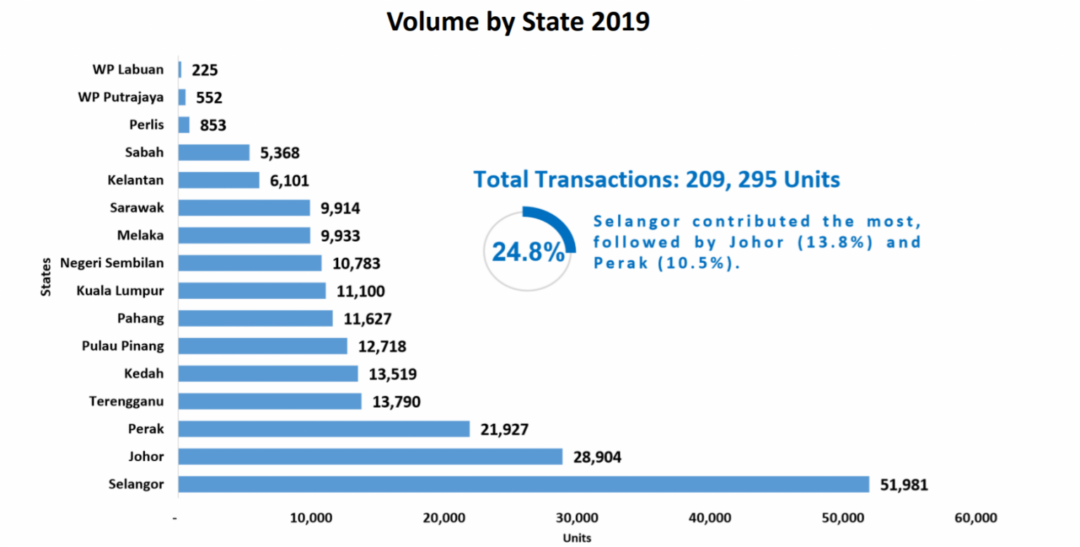

The improved property sales occurred in major states such as Kuala Lumpur (1.1%), Selangor (8.9%), Johor (7.5%) and Pulau Pinang (1.3%). These four states recorded 50% of the total residential property volume.

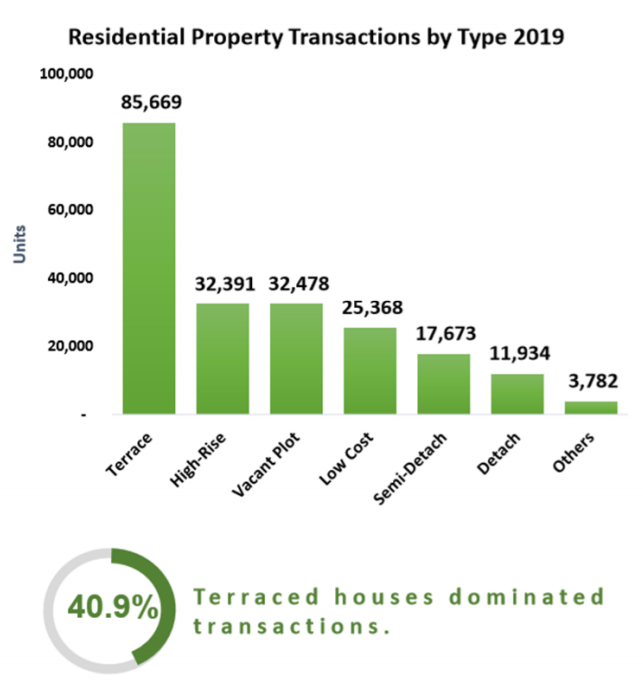

According to the chart below, it shows that the most popular types of residential property are terraced houses, which accounted for approximately 40% of the total property sales, which is then followed by high-rise units at approximately 15%.

Read More

Affordable housing: A simple guide

Why should you know about BSN MyHome (Youth Housing Scheme)

4. The overhang residential properties situation in Malaysia has improved. The number of overhang residential properties decreased for the first time after 4 years.

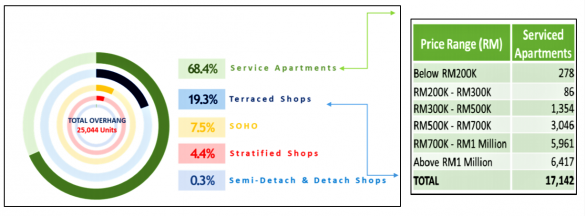

Overhang is defined as a property that remains unsold nine months after it was completed.

According to the report, there were 30,664 overhang units worth RM18.82 billion, which indicates a decrease of 5.1% in volume and 5.2% in value against 2018 (32,313 units worth RM19.86 billion).

By type, condominium/apartment units accounted for 46.6% (14,276 units) of the national overhang and most were in the price range of RM200,000 – RM300,000 (3,863 units). Two to three-storey terrace homes (8,591 units) contributed 28%, where around 1,771 units cost between RM300,000 – RM400,000.

5. Overhang for serviced apartments continues to worsen in 2019

The serviced apartments overhang continues to increase as there were a total of 17,142 overhang units with a value of RM15.04 billion. The volume and value increased by 51% and 65% respectively from 2018.

Johor reported the highest serviced apartment overhang with 71.2% share in volume (12,207 units) and 76.9% share in value (RM11.56 billion). The state held a 34.0% share (11,490 units) of the country’s unsold under construction.

Perak came second with 5,024 units worth RM 1.52 billion, followed by Selangor (4,687 units worth RM3.75 billion) and Pulau Pinang (3,353 units worth RM2.59 billion).

Units above RM1 million consisted of 37.4% of the total overhang, 20.3% of the total unsold under construction and 19.5% of the total unsold not constructed. For the latter, units in the price range of RM300,000 – RM400,000 formed 33.0% of the total.

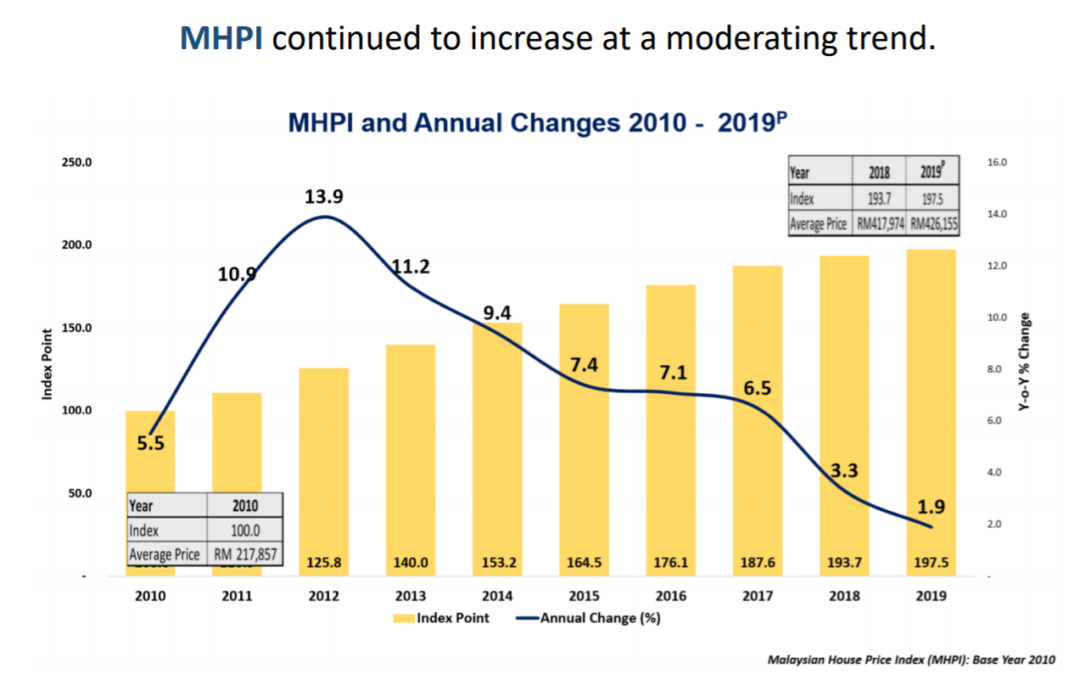

6. The Malaysian House Price Index (MHPI) increased by 1.9% in 2019

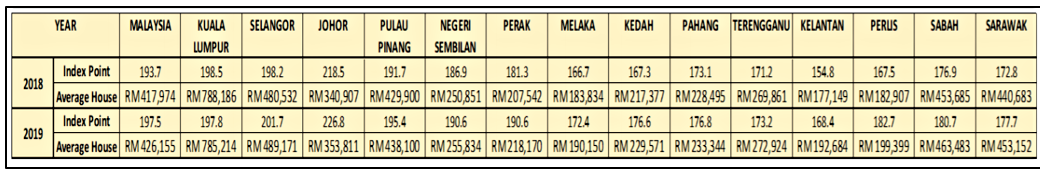

The report stated that the Malaysian House Price Index (MHPI) in 2019 stood at 197.5 points (base year 2010), an increase of 1.9% (3.8 points) as compared to (2018 (193.7 points).

The average house price in 2019 is RM426, 155. Detached houses were considered the most expensive property type with an average price of RM667, 210 which is then followed by semi-detached houses with an average price of RM664,227, terraced houses were at RM390,763 and high-rise (apartments & condominiums) at RM341,847.

According to the report, all states recorded positive annual price growth apart from Kuala Lumpur, whereby the average house price fell by 0.4%, from RM788, 000 in the previous year to RM785, 000.

Read More

7 necessary costs when buying your dream home

PEPS: Allow 100 % loan for first-time property buyers

7. The office sub-sector does not look promising

The overall performance of office sub-sector is not looking so good as the overall occupancy rate dropped to 80.6% in 2019, decrease from 82.4% in 2018 at a national level.

Private office buildings recorded average occupancy rate at 74.8%; while Kuala Lumpur and Penang secured higher occupancy rate at 76.9% and 76.5%, respectively.

While, Selangor and Johor recorded lower-than-national level rate at 70% and 65.7%, respectively. Private office buildings in Putrajaya recorded the lowest occupancy rate at 37.6%.

8. Increase the number of property loans being approved in 2019

The report shows that loan application and total loan approval for the purchase of residential property in 2019 increased by 8.3% and 8.6%, respectively.

In the non-residential sector, the number of loan applications and total loan approvals increased by 0.6% and 4.0%, respectively.

In the residential sector, the ratio of loan applications was at 43.2%, a slight increase from 43.1% in 2018. As for the non-residential property, it was at 37.5% in 2019 whereas in 2018 it was 36.3%.

9. What will the real estate market outlook be like in 2020?

Due to the unforeseeable outbreak of COVID-19, the real estate market will be going through an uncertain time. Despite the uncertainties, the report predicts that the Malaysian property market will maintain resilience for the coming year.

In the report, it further clarified that Malaysia is expected to face several challenges including:

- Residential, commercial and leisure industries are predicted to face challenges

- Market activity and absorption may be slower due to current economic and financial conditions

- Overhang and unsold properties may probably rise in 2020

- Prices are expected to soften

- Expected pressure on rents

However, the Malaysian government is implementing various measures to assist the real estate market to cope with this challenging period, including focusing on affordable housing, revising the base year for Real Property Gains Tax (RPGT), and also the reduction of the OPR by 50 basis points to 2%, extend HOC & stamp duty incentives given to first time home buyers and enhancing government-assisted housing programmes and financing/rental programmes.

Source: Napic

Interested in purchasing a home or investing but unsure of how to begin or what steps need to be taken? Our team of professional real estate agents will be able to help you every step of the way. Provide your details in the form below and we’ll be more than happy to assist you.