Vietnam Global Market Insights - Vietnam

Vietnam is a vibrant country in Southeast Asia known for its rich culture, stunning natural landscapes, and delicious cuisine. From the bustling streets of Hanoi and Ho Chi Minh City to the peaceful rice terraces and beautiful coastlines, Vietnam perfectly blends tradition and modern growth.

Table of contents

- TL;DR

- What Makes Vietnam an Attractive Investment Destination?

- How is the Economy in Vietnam Performing Right Now?

- What's Happening in the Vietnam Property Market in 2026?

- How Much Can You Earn from Property Investment in Vietnam?

- Where Are the Best Places to Invest in Vietnam Right Now?

- What Do Our Local Experts Say About the Market?

- Can Foreigners Buy Property in Vietnam? What Are the Rules?

- A Practical Guide for Foreign Buyers: Checklist and Tips

- Frequently Asked Questions

Key takeaway

- A New Cycle Begins: Vietnam's property market is in a recovery and growth phase, stabilized by new laws such as the Land Law 2024, which improves transparency.

- Hanoi Heats Up, HCMC Stabilizes: Hanoi apartment prices have surged due to strong demand and limited supply (up 22.3% to 36% YoY), while Ho Chi Minh City's market is correcting and facing supply constraints, creating different types of opportunities.

- Industrial is King: The industrial and logistics sector is the market's growth engine, fueled by the "China+1" strategy and attracting massive Foreign Direct Investment (FDI), with occupancy rates in key southern hubs remaining stable at 89%.

- Foreign Buyers Welcome (With Rules): New laws clarify that foreigners can purchase property on a 50-year leasehold but are limited to 30% of units in a condo building. Mergers & Acquisitions (M&A) are also becoming a popular entry route for foreign capital.

TL;DR

Vietnam’s real estate market is at a pivotal juncture, set to enter a new growth cycle supported by landmark legal reforms and strong economic fundamentals.

For global investors and market observers, conditions present both significant opportunities and notable risks.

This guide delivers a data-driven analysis of key trends, pricing, and regulatory shifts shaping the market.

You’ll gain strategic insights to navigate one of Southeast Asia’s most promising property landscapes with confidence.

What Makes Vietnam an Attractive Investment Destination?

Why is everyone suddenly talking about Vietnam? It's not just a passing trend. The country is fundamentally reshaping itself into a modern, transparent, and high-growth hub right in the heart of Asia. Several key factors are coming together in 2026 to create what many experts are calling a "golden window of opportunity."

Structural Growth and a Young Population

Vietnam has one of the fastest-growing economies in Asia, powered by export-oriented manufacturing and rising domestic consumption. With a population of over 100 million and a homeownership rate exceeding 90%, domestic housing demand is enormous and unlikely to go away anytime soon.

This young, urbanizing population creates a resilient base for both end-user and rental demand. It's a country where owning a home is deeply ingrained in the culture, creating a uniquely stable floor for the market.

Game-Changing New Laws

For years, investing in Vietnam felt like the Wild West; the rules were confusing, and transparency was lacking. That's all changing. In 2025, a powerful trio of new laws, the Land Law, Housing Law, and Law on Real Estate Business, is coming into full effect, and the reform momentum is palpable.

Let's say a developer, "A," wants to build a new apartment complex. Before these new laws, the official value of the land was set by a rigid government price list updated only every five years, creating a significant gap between the official and market prices. Now, the new Land Law mandates that land prices be updated annually to reflect their actual market value. This is a monumental step towards transparency, ensuring fairer transactions and reducing the risk of hidden costs and speculative pricing.

These reforms are designed to streamline project approvals, clarify foreign ownership rights, and demand more accountability from developers. According to Kiet Vo of CBRE Vietnam, these changes are creating a "legal corridor and a favorable premise for the next market period," thereby building a safer, more predictable environment for investors.

How is the Economy in Vietnam Performing Right Now?

A country's property market is only as strong as its economy, and right now, Vietnam's economic engine is firing on all cylinders. The macroeconomic story blends strong manufacturing FDI, a young and dynamic demographic, and steady domestic consumption, creating a durable foundation for the property market.

Powerhouse GDP Growth

Vietnam's economy grew by an impressive 7.09% in 2024 and kicked off 2025 with strong momentum, expanding 7.52% in the first half of the year, driven by a 9.2% surge in industrial output. This positions it among the world's fastest-growing economies. While different organizations have slightly different predictions due to global uncertainties, the overall picture remains incredibly positive.

Here’s a quick look at the 2025 GDP growth forecasts from major institutions:

2025 Vietnam GDP growth forecasts from major institutions

| Institution | Forecasted GDP Growth for 2025 | Note |

|---|---|---|

| Vietnam National Assembly | ≥8.0% (target) | The government's ambitious internal goal. |

| World Bank | 6.8% | Cites robust growth and supportive policies. |

| Asian Development Bank (ADB) | 6.6% | A strong, positive regional outlook. |

| International Monetary Fund (IMF) | 6.5% | Projecting a slowdown from 7.1% in 2024. |

Metric 1

Metric 2

Metric 3

Metric 4

A Magnet for Foreign Investment (FDI)

Foreign Direct Investment (FDI), money from foreign companies investing in Vietnam, is pouring into the country. In 2024, disbursed FDI reached a record high of US$25.4 billion. This momentum has continued into 2025, with realized FDI hitting 11.7 billion in the first half of the year, the highest H1 figure in five years.

Crucially, real estate consistently ranks among the top three sectors attracting this capital. This is not just through direct project development; Mergers & Acquisitions (M&A) are increasingly popular.

For instance, the first half of 2025 saw major deals like CapitaLand's US$553 million acquisition of a project from Becamex IDC and Nishi Nippon Railroad's purchase of a 25% stake in Nam Long's Paragon Dai Phuoc project. This signals deep confidence from sophisticated international players.

What's Happening in the Vietnam Property Market in 2026?

The story of Vietnam's property market in 2025 is complex and multi-layered, with different trends shaping its major cities and various property sectors.

A Tale of Two Megacities: Deep Diving into Hanoi and HCMC

There's a clear divergence between the country's two largest markets. IQI Vietnam describes it as a "northern revival; southern depth." This means Hanoi is experiencing a sharp recovery driven by supply shortages, while HCMC offers a deeper, more mature rental market and attracts more international buyers.

Hanoi: The Red-Hot Market

Hanoi is currently in an intense growth phase. With fierce demand clashing with minimal new supply, prices are soaring. In late 2024 and early 2025, apartment prices shot up by a staggering 22.3% to 36% year-on-year. The market's momentum is undeniable. In a rush to meet this demand, developers doubled the new apartment supply to around 7,100 units in Q2 2025.

This surge in new launches has kept prices at new highs, with expert reports for the first half of 2025 placing the average primary asking price for new apartments between US$2,836 and US$3,284 per square meter. This significant price level reflects both the scarcity of available land and the high quality of new projects entering the market.

Ho Chi Minh City (HCMC): The Market of Constraints and Opportunities

While Hanoi booms, HCMC's story is one of stabilization and significant supply constraints. The market saw only 350 condominium units launched in the early months of 2025. Legal bottlenecks have delayed many projects, though authorities are making "notable improvements" in resolving them.

Approximately 38,000 apartments are expected to finally receive their title deeds ("pink books") in 2025, a move that will help restore buyer confidence. Investor interest is now shifting to the city's western region and neighboring provinces, such as Long An, where large-scale urban township projects are set to launch.

At-a-Glance: Hanoi vs. HCMC:

Comparison between Hanoi vs. HCMC IQI Global

| Feature | Hanoi | Ho Chi Minh City (HCMC) |

|---|---|---|

| Market Trend | Strong Growth / "Hot" | Stabilizing / Correcting |

| Avg. Apartment Price (Q2 2025) | ~US$2,836 -$3,284 / sqm | ~US$3,000 / sqm |

| Recent Price Growth (YoY) | +22.3% to +36% | -2.5% (2024) to +1.5% |

| Key Driver | Low supply, high demand | New infrastructure (Metro Line) |

Metric 1

Metric 2

Metric 3

Metric 4

Long-Term Price Trends and Market Cycles

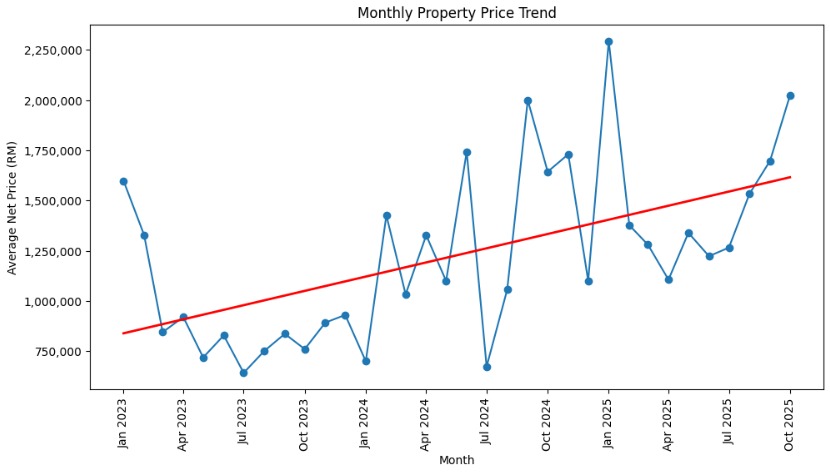

While monthly prices can be volatile, the long-term trend in Vietnam is undeniably upward. Proprietary data from IQI Global, tracking average net property prices from January 2023 to October 2025, shows significant monthly fluctuations but a clear, positive long-run trendline. This data illustrates that while there are corrections, the market has consistently grown over a multi-year horizon, providing a valuable benchmark for investors setting their expectations.

Furthermore, transactional data from 2019 to 2025 underscores the market's growing scale. In 2025 alone, over 1,093 new project units were sold for a total value exceeding RM 1.6 billion.

Vietnam property transaction data from 2019 to 2025 IQI Global

| Years | Project Sales (RM) | Project Units Sold | SubsaleSales (RM) | SubsaleUnits Sold | Rentals (RM) | Units Rented |

|---|---|---|---|---|---|---|

| 2019 | 23,620,879.40 | 16 | - | - | - | - |

| 2020 | 110,078,861.22 | 92 | 4,540,800.00 | 3 | - | - |

| 2021 | 218,200,105.82 | 161 | 170,466,850.12 | 12 | - | - |

| 2022 | 329,829,677.80 | 342 | 11,372,800.00 | 5 | - | - |

| 2023 | 212,601,130.46 | 254 | 25,428,213.88 | 26 | 894,080.00 | 3 |

| 2024 | 749,264,849.58 | 515 | 59,166,123.71 | 52 | 11,619,767.68 | 108 |

| 2025 | 1,602,987,046.17 | 1,093 | 11,012,397.29 | 8 | 2,489,923.20 | - |

Metric 1

Metric 2

Metric 3

Metric 4

Metric 5

Metric 6

Metric 7

The Commercial Sector: Retail Space is Gold Dust

While residential markets fluctuate, HCMC’s prime retail space is proving to be a landlord’s dream. According to Dustin Trung Nguyen, Head of IQI Vietnam, retail occupancy in HCMC is near 100%, even as rental rates hit record highs

Prime malls in District 1, like Saigon Centre and Diamond Plaza, are nearly full. This intense demand has pushed retail rents in District 1 to a staggering US$275-300 per square meter per month as of Q3. In the office market, there's a clear "flight to quality," with strong absorption of newly completed Grade A buildings. In Q1 2025 alone, over 4,000 square meters were leased in new Grade A buildings as tenants relocate for higher quality and better services.

Industrial & Logistics: Still the Undisputed Champion

Vietnam's industrial land market remains the darling of foreign investors. In southern Vietnam, the industrial land market maintained a stable 89% occupancy rate in Q1 2025. The ready-built factory and warehouse segments saw occupancy rates climb to 89% and 72% respectively, up 3 and 14 percentage points year-on-year. This highlights the relentless demand from manufacturers and logistics companies shifting their supply chains to Vietnam.

How Much Can You Earn from Property Investment in Vietnam?

For many investors, this is the million-dollar question, or rather, the billion-dong question. Your return on investment in Vietnam comes from two primary sources: capital appreciation (the increase in your property's value over time) and rental yield (the income you earn from renting it out). In 2025, both aspects present a compelling, though complex, picture.

Capital Appreciation

Vietnam's rapid economic development has translated into remarkable capital gains for long-term property investors. While past performance is no guarantee of future results, the historical data reveal a market with explosive growth potential.

In Hanoi, the market has been exceptionally hot. Over the past five years, property prices surged by an astonishing 112%. More recent data from 2024-2025 shows year-on-year increases for new apartments as high as 36%, fueled by intense demand meeting limited supply.

Ho Chi Minh City has also shown strong long-term performance, with new apartment prices appreciating 52% over five years, even with a recent market correction.

A fascinating trend highlighting this value shift is that high-end apartments in prime locations are now rivaling, and sometimes even surpassing, the price of traditional landed houses nearby.

For example, an 85-square-meter apartment at The Metropole in HCMC’s An Khanh ward is selling for VND 130-180 million (US$4,925-6,820) per square meter. Incredibly, this is more expensive per square meter than an 80-square-meter private house in the nearby Thao Dien Ward, which costs around VND 150 million per square meter.

This demonstrates a clear market shift towards valuing the modern amenities, security, and lifestyle offered by integrated condominium developments.

Rental Yields

While capital appreciation offers long-term gains, rental income provides immediate cash flow. As property prices have climbed faster than rental rates, a phenomenon known as "yield compression" has occurred. The national average gross rental yield stood at 3.16% in early 2025.

However, this national average masks a wide range of opportunities depending on the location, property type, and target tenant. Specific segments offer significantly higher returns, especially those catering to specific, high-demand niches.

Here’s a breakdown of potential gross rental yields you can expect in 2026 across different market segments:

Breakdown of potential gross rental yields in Vietnam IQI Global

| Location / Property Type | Average Gross Rental Yield (%) | Example Monthly Rent (1-BR Apt) | Key Drivers & Target Tenants |

|---|---|---|---|

| HCMC Urban Condo (e.g., District 2, 7) | 3.5% - 8% | US$550 - $800 | Young professionals, expatriates, and corporate tenants. |

| Hanoi Urban Condo (e.g., Tay Ho, Ba Dinh) | 2.9% - 7% | US$400 - $650 | Government officials, corporate tenants, and a stable long-term rental pool. |

| Da Nang Tourist Condo | 8% - 12% | US$420 - $550 | High seasonal demand from international and domestic tourists; short-term rentals. |

| Industrial Zone Housing (e.g., Binh Duong) | 15% - 20% | US$300 - $400 | Massive and consistent demand from factory workers, managers, and engineers. |

| Serviced Apartments (Expat Hubs) | 8% - 10% | US$800 - $1,200+ | Foreign executives and professionals seeking premium, fully-managed living. |

Metric 1

Metric 2

Metric 3

Metric 4

Metric 5

Note: The table provides estimated gross yields. Actual net yields will be lower after accounting for taxes, fees, and potential vacancies.

An Expert's Guide to Calculating Your Real Return

Seeing these numbers is one thing, but how do you apply them to your own investment decision? Savvy investors in Vietnam adopt a practical, conservative approach to calculating potential returns, moving from speculation to strategy.

Here’s a simple methodology recommended by market experts:

Target a Conservative Yield: Instead of relying on optimistic brochure numbers, start your calculation with a conservative mid-single-digit gross yield (e.g., 3-5%) for a standard prime city condo.

Stress-Test for Vacancy: A property is rarely rented out 365 days a year. A prudent strategy is to stress-test your numbers with 1 to 2 months of vacancy to ensure your investment remains profitable even in a slow month.

Model Your Real Costs: Remember to subtract all expenses. This includes building management fees, service charges, maintenance costs, and the initial investment in furniture and fit-out if it’s a new unit.

Use Live, Hyper-Local Data: The most accurate way to benchmark value is to analyze real-time data. Look at current rental listings and recent rental transactions in the same building or one right next door. Compare that income potential to the latest resale prices for similar units.

By following this disciplined approach, you can build a realistic financial model for your investment, grounded in data rather than hope.

Where Are the Best Places to Invest in Vietnam Right Now?

While Hanoi and HCMC dominate, some of the smartest money is moving into specific districts and emerging economic corridors.

New Projects

Ho Chi Minh City

As Vietnam's economic engine, it has the deepest rental demand. Experts recommend focusing on core districts and areas linked to new infrastructure, such as Thủ Thiêm in District 2 and the western region, where major new township projects are underway.

Hanoi

The capital is a hotspot for capital appreciation. Look towards the suburbs where major developers like Vinhomes are launching large-scale projects at more accessible price points.

Da Nang

This coastal city is a hybrid play on tech and tourism. Its clean environment, high quality of life, and growing tech parks make it ideal for both long-term residential and short-term vacation rentals.

Industrial Hubs (Binh Duong, Long An, Hai Phong, Bac Ninh)

These provinces are the engines of Vietnam's FDI boom. Investing in residential projects here caters to the massive, growing demand for housing among factory workers, engineers, and foreign experts, offering potentially higher, more stable rental yields.

What Do Our Local Experts Say About the Market?

To truly understand the nuances of Vietnam’s 2025 real estate market, it’s essential to listen to the experts on the ground from global consultancy heads to local analysts and even top industry leaders.

A More Transparent Market Cycle Ahead

There’s broad consensus that Vietnam is entering a new, more transparent cycle supported by regulatory reforms and improving investor sentiment.

Vietnam’s housing market continues to grapple with relentless price increases, but the government’s push for tighter regulation, transparency, and affordable housing is critical to ensuring a more balanced and sustainable landscape ahead.

Balancing Growth and Investor Confidence

From a macroeconomic perspective, Shan Saeed, Chief Economist of IQI, echoed this optimism while highlighting the importance of structural balance across Asia’s property markets:

The world economy stands at a macroeconomic crossroads; fragility and instability remain embedded in the global financial tapestry. Yet Asia, including Vietnam, is better positioned due to strong domestic demand, urbanisation, and resilient monetary policy.

This perspective reinforces the view that despite global volatility, Vietnam’s fundamentals, rising middle-class demand and supportive policy are setting the stage for sustained growth.

As Asia enters a new phase of financial easing and policy reform, markets like Vietnam stand out for their long-term fundamentals a young population, strong domestic demand, and growing international confidence. While short-term challenges remain, these are the kinds of cycles that create real opportunity for investors who plan ahead.

Can Foreigners Buy Property in Vietnam? What Are the Rules?

Yes. The legal framework is becoming clearer, making it a more secure time for foreign investment. However, there are some important rules to know.

The 30% Rule: Foreigners can collectively own a maximum of 30% of the total units in any single condominium building.

The 250 House Limit: For landed properties like villas or townhouses, foreign ownership is capped at 250 houses within a single ward-level administrative area.

The 50-Year Lease: Foreigners typically receive a 50-year leasehold, not permanent (freehold) ownership. This lease is often renewable. If you are married to a Vietnamese citizen, you may be eligible for freehold ownership.

These rules ensure a healthy balance in the market. Always confirm with the developer or your agent that the "foreign quota" is still available before you buy.

A Practical Guide for Foreign Buyers: Checklist and Tips

Navigating the market for the first time can be intimidating. This checklist combines best practices from multiple expert sources to keep you safe and successful:

Verify the Foreigner Quota:

This is the first and most crucial step. It is a non-negotiable legal limit

Confirm Title and Tenure:

Make sure you fully understand the 50-year leasehold and its renewal conditions

Partner with Reputable Players:

Stick with well-known international or local developers (like Vinhomes, CapitaLand, Keppel Land) and professional real estate agencies.

Cross-Check Market Pricing:

Don't just trust the brochure. Compare the asking price with historical data and current resale values in the area to avoid overpaying.

Budget for All Costs:

Remember that your total purchase price will be the property cost plus about 10-15% more for VAT, registration fees, fit-out costs, and a buffer for initial vacancy

Plan Your Exit Strategy:

Know how you plan to sell the property. Selling to a local Vietnamese buyer is often the most liquid and straightforward route.

Frequently Asked Questions

1. What is the average price per square meter for an apartment in Vietnam in 2025?

Nationally, the average price for a new residential property is around VND 74 million/sqm (US2,918). However, it varies significantly by city. In Hanoi, it’s about US$2,836/sqm, while in HCMC, it’s closer to US$3,000/sqm. In luxury city centers, prices can easily exceed US

8,000/sqm, with some prime HCMC apartments hitting US$4,925-6,820 per square meter.

2. Can I, as a foreigner, get a mortgage from a Vietnamese bank?

It’s challenging but not impossible. Local banks are often hesitant to lend to foreigners without local income or residency. Most foreign buyers use cash or secure financing from a bank in their home country. Developers usually offer flexible payment plans over several years, which is a popular alternative to a traditional mortgage.

3. Besides Hanoi and HCMC, what are the following up-and-coming cities for real estate investment?

Da Nang is a strong contender due to its growth as a tech and tourism hub. For higher rental yields, industrial-focused cities like Binh Duong, Hai Phong, and Bac Ninh are excellent choices due to strong, consistent demand for housing from workers and expatriates.

4. Is it better to invest in a new-build project or a resale property?

New-build projects often come with attractive payment plans, modern amenities, and the potential for high appreciation once the area is fully developed. Resale properties, however, are located in established neighborhoods, and you can start earning rental income immediately. The choice depends on your strategy: new-builds for long-term growth, and resales for steady, immediate income.

5. How will Vietnam's new Land Law 2024 make my investment safer?

The new law introduces an annual market-based land-pricing system, making valuations more transparent and reducing the risk of inflated prices based on outdated information. It also provides more straightforward guidelines for compensation and project approvals, helping reduce the risk of projects stalling due to legal issues.

6. What are the key differences between investing in Vietnam vs. Thailand or Malaysia?

Vietnam offers higher GDP growth potential and is at an earlier stage of its development cycle, suggesting greater room for capital appreciation. While Thailand and Malaysia have more mature legal frameworks for foreign ownership (like freehold options), Vietnam’s new laws are closing that gap, making it a compelling high-growth alternative.

7. What’s the first step to finding a reliable real estate agent in Vietnam?

Start by researching large, reputable international firms with a local presence, such as IQI, Savills, JLL, CBRE, or Knight Frank. Also, look for licensed local agencies with a strong track record and positive online reviews. Always verify that they have experience working with foreign clients and can provide support for all legal paperwork.

Need help to get started

Let our agents help you find the ideal land for you

Disclaimer:

The information provided is for general market insight only and does not constitute financial, investment, tax, or legal advice. IQI does not solicit or compel any purchase or investment. Property values and rental returns may fluctuate; please conduct your own due diligence and consult licensed professionals before making any decisions.

References & Citations

- https://achievereal.com/real-estate-market-report-q22025-promising-new-trends-on-the-rise/ – Achieve Realty VN. (April 7, 2025)

- https://bambooroutes.com/blogs/news/average-price-per-sqm-vietnam – Bamboo Routes (August 26, 2025)

- https://www.cbre.com/insights/reports/2025-asia-pacific-real-estate-market-outlook-mid-year-review – CBRE Research (August 7, 2025)

- https://www.globalpropertyguide.com/asia/vietnam/price-history – Delmendo, L. C (July 14, 2025)

- https://fiingroup.vn/NewsInsights/Detail/11535451 – FiinGroup (August 21, 2025)

- https://fulcrum.sg/is-vietnam-headed-for-a-property-market-crisis/ – Hiep, L. H. (October 3, 2025)

- https://www.imf.org/en/News/Articles/2025/09/15/pr-25296-vietnam-imf-executive-board-concludes-2025-article-iv-consultation – International Monetary Fund (September 15, 2025)

- https://www.jll.com/en-sea/webinars/vietnam-property-market-outlook-2025 – JLL (March 13, 2025)

- https://www.knightfrank.com/research/report-library/vietnam-real-estate-market-quarterly-market-highlights-q2-2025-12281.aspx – Knight Frank Vietnam Research (July 17, 2025)

- https://vietnamnet.vn/en/cooling-vietnam-s-real-estate-bubble-can-new-policies-control-prices-2451642.html – Minh, L. Q (October 15, 2025)

- https://blog.investvietnam.co/the-vietnamese-property-market-an-in-depth-analysis-and-outlook-for-2025/ – Neo, G, Invest in Vietnam (July 7, 2025)

- https://blog.investvietnam.co/vietnams-property-market-in-2025-trends-forecast-and-key-growth-drivers/ – Neo, Invest in Vietnam (August 5, 2025)

- https://blog.investvietnam.co/top-59-real-estate-in-vietnam-statistics-data-trends-for-2025/ – Neo, Invest in Vietnam (September 17, 2025)

- https://iqiglobal-web-revamp.s3.ap-southeast-1.amazonaws.com/wp/blog/wp-content/uploads/2025/06/09110207/FA_IQI-Monthly-Newsletter-June-2025.pdf – Nguyen, D. T. (June 3, 2025)

- https://iqiglobal-web-revamp.s3.ap-southeast-1.amazonaws.com/wp/blog/wp-content/uploads/2025/06/09110207/FA_IQI-Monthly-Newsletter-June-2025.pdf – Nguyen, D. T (June 3, 2025)

- https://iqiglobal-web-revamp.s3.ap-southeast-1.amazonaws.com/wp/blog/wp-content/uploads/2025/10/01121828/OCT_Newsletter.pdf – Nguyen, D. T (October 3, 2025)

- https://viettonkinconsulting.com/legal-and-compliance/vietnam-real-estate-market-overview/ – Nguyen, L | Viettonkin Consulting (September 18, 2025)

- https://www.numbeo.com/property-investment/country_result.jsp?country=Vietnam – Numbeo (November 4, 2025)

- https://www.thestar.com.my/aseanplus/aseanplus-news/2025/09/23/vietnam-pm-calls-for-more-housing-to-cool-real-estate-prices – Reuters (September 23, 2025)

- https://www.vietnam-briefing.com/news/vietnam-real-estate-market-2025-prime-investment-destination-southeast-asia.html/ – Singh, S | Vietnam Briefing (March 26, 2025)

- https://thele.blog/real-estate-investment-destinations-in-vietnam-for-2025/ – Thele (September 8, 2025)

- https://www.jll.com/en-sea/insights/vietnam-property-market-brief – Trang, L. | JLL Vietnam (November 13, 2025)

- https://www.thestar.com.my/business/business-news/2025/10/10/property-market-remains-resilient – Viet Nam News / ANN | The Star (October 25, 2025)

- https://vir.com.vn/vipf-2025-highlights-vietnams-evolving-real-estate-landscape-139694.html – Vietnam Investment Review (October 29, 2025)

- https://en.vietnamplus.vn/vietnams-real-estate-market-sees-opportunities-from-three-key-shifts-post330176.vnp – Vietnam Plus (October 10, 2025)

Why Do Smart Investors Choose IQI as Their Real Estate Partner?

Get your financial planning right by using our simple mortgage loan calculator to find out estimates of monthly instalments, applicable interest rates and the principal amount that best suit your financial capacity

Exclusive market insights

powered by on-ground teams in 30+ countries

Data-driven strategies

using our proprietary IQI Atlas system for returns, yields, and forecasting

Award-winning agents

trained to serve local and international investors with integrity and expertise

Secure investment processes

with verified partners, legal guidance, and full transparency

Diverse project portfolios

across residential, commercial, and international markets