Finding the best house loan interest rates in Malaysia can be challenging, especially with various options available.

Critical terms like home loan, housing loan, and loan tenure are crucial for making informed decisions.

This guide will help you navigate the different types of loans, their interest rates, and other essential aspects to consider when looking for a dream home.

In December 2024, several financial institutions in Malaysia offer competitive house loans and home financing options. Here’s a quick overview:

1. Best House Loan Interest Rates in December 2024

| Bank Name | House Loan Name | Profit Rate | Financing Type | Tenure | Lock-In Period |

|---|---|---|---|---|---|

| Maybank Islamic | HouzKEY | From 2.88% p.a. | Term Islamic Financing | Up to 35 years | 1 Year |

| Bank Islam | Baiti Home Financing-i | From 3.8% p.a. | Term Islamic Financing | Up to 35 years / age 70 | None |

| Standard Chartered | MortgageOne | From 3.9% p.a. | Full-Flexi loan | Up to 35 years | None |

| Bank of China | Housing Loan | From 3.88% p.a. | Term loan | Up to 35 years | 3 Years |

| Public Bank | 5 Home Plan | From 4.22% p.a. | Semi-Flexi loan | Up to 35 years | 3 Years |

These banks offer a range of housing and home loans that cater to different needs, whether you’re looking for a flexible or term loan.

Table of Contents

1. Maybank Islamic HouzKEY

| Requirements | Criteria |

| Age | 18 to 70 years old |

| Eligibility | Malaysian citizen only Must not have more than one (1) home financing at the point of application Salaried employee, Self-employed Up to 3 guarantors allowed |

| Fees & Charges | Criteria |

| Late Penalty Fee | 1% p.a. on the outstanding amount |

| Processing Fee | No Fee |

| Early Settlement Fee | No Fee |

| Benefits | Description |

| Full 100% Financing | Get full financing with no downpayment required |

| No Payment During Construction | We help to finance the cost during construction. |

| LOWEST Monthly Payment | Enjoy the lowest monthly payments with the best rates. |

You may visit the Maybank website for more information.

2. Bank Islam Baiti Home Financing-i

| Requirements | Criteria |

| Age | Age 18 and above |

| Minimum Annual Income | RM24,000 |

| Eligibility | Malaysian Citizen Not a bankrupt or have any legal action Gainfully employed or Profitable business for at least 3 years Minimum 1-year good payment track record |

| Fees & Charges | Criteria |

| Late Penalty Fee | 1% p.a. on the overdue installments until the date of full payment, and this applies to the Facility before maturity. If after maturity, you will be charged with a sum equivalent to the prevailing daily overnight Islamic Interbank Money Market Rate on the outstanding balance i.e., outstanding Sale Price less Ibra’, if any |

| Processing Fee | Waived |

| Early Settlement Fee | There is no ‘lock-in period’ for this Facility, and Bank Islam shall grant Ibra’ on the deferred profit after full settlement is made. |

| Redemption Letter Fee | There is no ‘lock-in period’ for this Facility, and Bank Islam shall grant Ibra’ on the deferred profit after full settlement. |

| Letter for EPF Withdrawal Fee | RM20 per request |

| Insurance Types | MRTT MLTT Houseowner/Householder Takaful |

| Benefits | Criteria |

| Margin of financing | High Margin of financing up to 90% |

| No compounding elements | – |

| No penalty for early settlement | – |

| Tenure | up to 35 years or age 70 |

| No lock-in period | – |

You may visit Bank Islam website for more information.

3. Standard Chartered MortgageOne

| Requirements | Criteria |

| Age | 21 to 70 years old |

| Minimum Gross Income | RM4,000 / month |

| Eligibility | Malaysians only Salaried employee, Self-employed |

| Fees & Charges | Criteria |

| Late Penalty Fee | 1% p.a. of the outstanding amount |

| Processing Fee | RM200 setup fee for MortgageOne™ |

| Early Settlement Fee | NIL |

| Redemption Letter Fee | RM50 per request |

| Letter for EPF Withdrawal Fee | RM20 per request |

| Cancellation Fee | 2.25% of the loan amount if the bank bears the entry cost. Otherwise, it’s 0.5% |

| Insurance Types | Fire Insurance MRTA |

| Benefits | Description |

| Redraw Facility | Withdraw excess cash paid into your home loan account for personal use at any time without restrictions and penalty. |

| Priority Banking privilege | If you’re a Standard Chartered Priority Banking customer, the bank might offer you lower interest rates (subject to approval). |

You May visit the Standard Chartered website for more information.

4. Bank of China Housing Loan

| Requirements | Criteria |

| Age | 18 to 70 years old |

Minimum Annual Income | RM60,000 |

| Eligibility | Malaysians Permanent Residents, Foreigners working in Malaysia Salaried employee, Self-employed |

| Fees & Charges | Criteria |

Late Penalty Fee | 1% p.a. on the amount in arrears causing the total outstanding to increase |

| Processing Fee | Waived |

| Early Settlement Fee | 2.25% Prepayment/Full settlement within the first 3 years from the date of first release of the loan |

| Insurance Types | Fire Insurance (Mandatory) Houseowner Insurance (Optional) MRTA (Optional) MLTA (Optional) |

You may visit the Bank of China Malaysia website for more information

5. Public Bank 5 Home Plan

| Requirements | Criteria |

| Age | 21 to 70 years old |

| Minimum Annual Income | RM24,000 |

| Eligibility | Any nationality Salaried employee, Self-employed |

| Fees & Charges | Criteria |

| Late Penalty Fee | 1% p.a. of the outstanding amount |

| Withdrawal Fee | RM50 |

| Processing Fee | RM50 to RM200, depending on the financing amount |

| Early Settlement Fee | 2% to 3% within 3-year retention period, depending on loan size |

| Redemption Letter Fee | RM50 per request |

| Letter for EPF Withdrawal Fee | RM20 per request |

| Insurance Types | MRTA |

You may visit the Public Bank website for more information

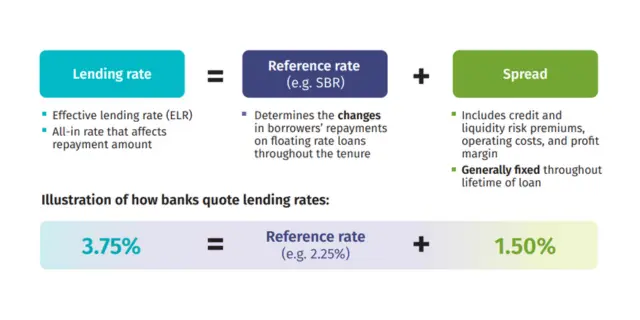

2. Understanding the Effective Lending Rate (ELR)

The Effective Lending Rate (ELR) is a critical component when evaluating home loans. It represents the total cost of borrowing, expressed as an annual percentage rate. The ELR includes the reference rate and the spread, which collectively impact your monthly repayments.

- Reference Rate: This is the base rate, like the Standardised Base Rate (SBR), which is influenced by Bank Negara Malaysia’s policies.

- Spread: Additional charges include credit and liquidity risk premiums, operating costs, and the bank’s profit margin.

The ELR is crucial as it affects the total repayment amount and helps borrowers compare different loan products effectively.

What is the Reference Rate?

The reference rate is a benchmark interest rate used by Malaysian banks to determine the changes in borrowers’ repayments on floating-rate loans throughout the tenure.

This rate can vary between institutions but is a foundation for setting the lending rate.

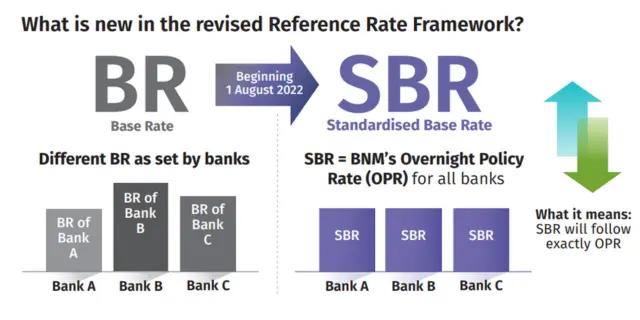

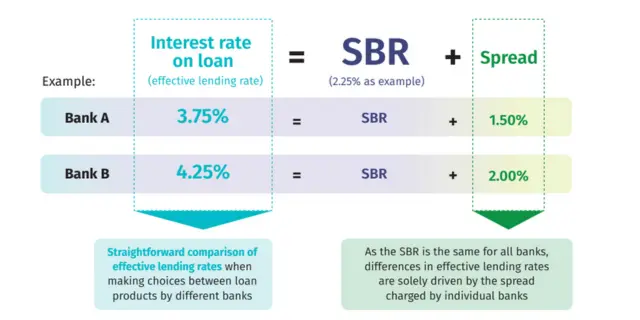

Is the Reference Rate Equal to the Standardised Base Rate (SBR)?

No, the reference rate differs from the Standardised Base Rate (SBR). The SBR is a specific reference rate that standardizes the base rate across all banks.

Introduced on 1 August 2022, the SBR is directly linked to the Overnight Policy Rate (OPR) set by Bank Negara Malaysia.

This standardization aims to simplify the comparison of loan rates across different banks.

Is the Reference Rate Equal to the Overnight Policy Rate (OPR)?

The reference rate can include the OPR as a component, especially when the SBR is used.

The OPR is the interest rate at which banks lend to each other overnight and is set by the central bank.

Changes in the OPR directly influence the SBR, affecting the reference rate used for loans.

What is Spread?

The spread is an additional percentage added to the reference rate to arrive at the ELR. It covers various costs and risks incurred by the bank, including:

- Credit Risk Premium: Compensation for the risk that a borrower might default.

- Liquidity Risk Premium: Compensation for the risk associated with the bank’s liquidity.

- Operating Costs: Day-to-day costs of running the bank.

- Profit Margin: The bank’s earnings from the loan.

The spread is generally fixed for the duration of the loan unless there is a significant change in the borrower’s credit risk profile.

3. Understanding House Loan Interest Rates

Understanding the mechanics of interest rates and how they impact repayments is essential for making informed decisions about Malaysian house loans.

What are House Loan Interest Rates?

House loan interest rates are the percentage banks charge on the loan’s principal amount.

These rates determine the cost of borrowing and are influenced by various factors, including the central bank’s policies and the individual bank’s cost structures.

How to Calculate House Loan Interest Rate?

Calculating your home loan interest rate is essential for understanding how much you will pay over time.

Use a home loan calculator to determine your monthly instalments and total repayment. Here’s an example:

Example Calculation:

- Bank’s Base Rate (BR): 2.00%

- Spread: 1.50%

- ELR: BR + Spread = 2.00% + 1.50% = 3.50%

For a loan amount of RM300,000 over 30 years, the monthly instalment would include the interest and principal repayment. Understanding these calculations can help you save money and manage your loan tenure effectively:

- Annual Interest Amount: RM300,000 x 3.50% = RM10,500

- Monthly Interest Amount: RM10,500 / 12 = RM875

Thus, the monthly repayment would include RM875 in interest plus the principal repayment.

What Can Affect Your House Loan Interest Rate?

Several factors can influence your house loan interest rate, including:

- Central Bank Policies: Changes in the Overnight Policy Rate (OPR) by Bank Negara Malaysia can directly impact interest rates.

- Economic Conditions: Inflation and economic stability can influence interest rates.

- Borrower’s Credit Score: Higher credit scores often result in lower interest rates.

- Loan Tenure: Longer loan tenures can sometimes attract higher interest rates.

4. How Should You Compare Lending Rates Across Banks as Borrowers?

Comparing lending rates across banks involves more than just looking at the ELR. Consider the following steps:

- Review the ELR and Spread: Compare the total cost of borrowing.

- Understand Additional Fees: Be aware of any extra fees that might apply.

- Read the Product Disclosure Sheet (PDS): This document provides crucial details about the loan.

5. How to Plan and Compare Your House Loan Interest Rates?

When planning a home loan, consider the property value, loan amount, and loan tenure.

Use a loan calculator to estimate your monthly instalments and ensure you understand all associated fees.

Planning and comparing Malaysia house loan interest rates require a strategic approach:

- Research Different Lenders: Identify potential lenders and their offerings.

- Interest Rates: Compare the interest rates offered by different banks.

- Additional Features: Evaluate foreclosure charges and other loan features. Some loans include extra funds withdrawal or linked current accounts for easier management.

- Read Reviews: Learn from the experiences of other borrowers.

- Seek Professional Advice: Consult with financial advisors if needed.

- Maximum Loan Tenure: Most banks offer up to 35 years.

- Prepayment Options: Check if the bank allows for additional payments without penalties.

- Insurance Requirements: Most housing loans require Mortgage Reducing Term Assurance (MRTA) or other types of insurance.

- Flexibility: Compare loans that offer flexible repayment options, like a flexi loan or semi-flexi loan (make sure to understand the terms and conditions).

Critical Terms in Home Financing

Understanding key terms related to home financing is crucial for navigating the market:

- Outstanding Principal Balance: The remaining amount you owe on your loan, excluding interest.

- Home Loan Balance: The total amount left to pay on your home loan.

- Basic Term Loan: A standard loan with fixed interest rates and repayment terms.

- Loan Period: The total time over which you will repay the loan.

- Mortgage Reducing Term Assurance: Insurance that decreases as your loan balance decreases.

Choosing the right house loan or home loan in Malaysia requires careful consideration of several factors, including the interest rate, loan tenure, and associated fees.

By understanding the options available and using tools like a home loan calculator, you can make a more informed decision that aligns with your financial goals and helps you secure your dream home.

Are you looking for a dream house after getting the best house loan interest rates? We can assist you! Send us your details, and we will contact you soon!

Continue Reading: