Send me my property transaction fees result

The calculation is intended for reference only. Actual amount may vary.

Learn

Tips and Guides

Everything You Need To Know About The Memorandum Of Transfer (MOT) (2026)

Everything You Need To Know About The Memorandum Of Transfer (MOT) (2026)

Purchasing a property, especially for first-time homebuyers, can be overwhelming with all the paperwork involved. Out of the many documents that enable the sale of a property, one of the most important is the Memorandum of Transfer (MOT). However, starting 1 July 2025, major changes to MOT fees and foreign buyer rates in Johor could cost you thousands more if you’re not prepared. In this post, we’ll outline everything you need to know about the MOT (Form 14A) and the upcoming updates so you can plan wisely. Understanding Memorandum of Transfer (MOT):1. What is a Memorandum of Transfer?2. What are the Stages Involved Before the Registration of MOT?3. What if the Individual or Strata Titles are Not Ready Yet at the Time of Purchase ?4. What are the Fees Associated with the MOT?5. When Do I Pay The Stamp Duty Fee For The Memorandum of Transfer? 1. What is a Memorandum of Transfer? A Memorandum of Transfer (MOT) is a document that stipulates the transfer of ownership from the developer or seller to the buyer. The MOT consists of the details of the buyer, seller, and land title details for the state authorities’ reference. In short, this is the document that represents a significant step on your journey to becoming the legal owner of this property. Once this is duly registered with the relevant state authority, the property is officially yours! i. [Updated]: New MOT Registration Fees (Effective 1 July 2025) *Applies to properties valued above RM500,000 Property ValueNew FeeRM500k–RM600kRM2,500RM600k–RM700kRM3,000RM700k–RM800kRM3,500RM800k–RM900kRM4,000RM900k–RM1 millionRM4,500Above RM1 millionRM4,500 + RM250 per additional RM50k ii. [Updated]: Foreign Buyer Rates Also Increased Foreign buyers purchasing property in Johor will face higher MOT charges, especially for residential and serviced apartments. Property TypeOld RateNew Rate (From 1 July 2025)Residential2% (min RM20,000)3% (min RM30,000)Commercial2%3%Serviced Apartment (<RM1mil)2%3% (min RM50,000)Industrial2%4% Note: Love & Affection Transfers: Remain at 2% (min RM20,000). Inheritance / Beneficiary Transfers: Still exempt. iii. [Updated]: Expanded Sales and Service Tax (SST) Coverage Starting 2025, the SST scope has expanded to include more service sectors. Providers must register if their taxable services exceed RM500,000 per year. Service TypeSST RateRental & Leasing8%Construction6%Financial Services8%Beauty Services8%Private Healthcare & Education6% Note: *Exemptions apply to Malaysians, OKU (Persons with Disabilities), selected B2B services, and other relief services. 2. What are the Stages Involved Before the Registration of MOT? Before registering for the MOT, there are a few stages that a buyer needs to go through. i. Finding a suitable home loan and lawyer As a buyer, it’s important that you find the best mortgage loan (in the event you need to finance your purchase of property) for you, and a lawyer is required to assist you in the whole transaction, including: Drafting the Sales and Purchase Agreement (SPA) Loan documents Stamping of the relevant documents Filing to LHDN Application for state authority’s consent approval (if any) Registration of your new ownership with the relevant state authority The appointment of a representing lawyer is required by the banks and you don’t have to go through all the hassle and headache of documentation, especially if you’re in the dark about it. ii. Letter of Offer (LO)/Booking Form/Letter of Confirmation for Sale This document is the first step in your property purchasing journey. This is the document that indicates the buyer’s desire to purchase and the seller’s willingness to sell. This letter accounts for the relevant furnishings that come with the property, the agreed selling price, the agreed earnest deposit, the timeframe on when the SPA should be signed and any other pre-agreed conditions between the buyer and the seller. iii. Sales and Purchase Agreement (SPA) The SPA is an important document that lists down the terms and conditions of the sale and purchase transaction such as the timeframe of transfer, condition of the property’s title, ownership of the property, guarantees and warranties by the parties, as well as other terms relevant to the sale of the property. iv. Facility Agreement The Facility Agreement is the main loan agreement that you sign with your bank to confirm your mortgage loan. This would be separate from the SPA and may require the involvement of a different lawyer. We recommend checking with your designated bank for their panel lawyer list before making an appointment. v. Memorandum of Transfer Finally, you get to sign the Memorandum of Transfer (MOT), also known as Form 14A! The MOT is the official instrument for transferring ownership of the property on the title deed to your name. Upon successful registration of the MOT with the relevant state authority, a new title deed reflecting your ownership will be issued. This process legally confirms your ownership of the property. 3. What if the Individual or Strata Titles are Not Ready Yet at the Time of Purchase? In case the Master title has not been divided into individual title or strata title at the time of purchase, a Deed of Assignment (DOA) will be signed by the seller and buyer as a transfer of beneficial ownership. Kindly keep all the principal agreements that you have signed prior to the issuance of individual title or strata title as they served as the supporting proof of the transfer of beneficial ownership. Failure to keep the chain of beneficial ownership complete may result in failure of registration with the relevant state authority when the individual title or the strata title has been issued. Upon issuance of the individual title or strata title, both the seller and buyer would need to sign the MOT prepared by the lawyer. The MOT will then be registered with the relevant state authority. 4. What are the Fees Associated with the MOT? As with everything, the MOT comes with a cost. Being one of the most important documents in the property purchase process, the MOT comes with an ad valorem stamp duty charge. The stamp duty is payable upon stamping of the MOT, which will happens before transfer of the title deeds to your name. Here’s a breakdown of the stamp duty fees due upon stamping of the MOT: House priceStamp duty feeFirst RM100,0001%The next RM400,000: RM100,001 - RM500,0002%RM500,001 - RM1,000,0003%RM1,000,001+4%Breakdown of the stamp duty fees To paint a clearer picture of the calculation, let’s say a property was purchased at RM800,000. What will be the stamp duty fee imposed on the buyer? For the first RM100,000 = RM100,000 x 1% = RM1,000 For the next RM400,000 = RM400,000 x 2% = RM8,000 For the remaining amount = RM300,000 x 3% = RM9,000 Total stamp duty imposed: RM1,000 + RM8,000 + RM9,000 = RM18,000 In this case, the buyer has to pay RM18,000 for the stamp duty. As evident, the stamp duty fee can be quite a hefty sum. Luckily, the government currently provides stamp duty exemption, which is also given for the transfer of property by way of love and affection, which will be briefly mentioned below. 5. When Do I Pay The Stamp Duty Fee For The Memorandum of Transfer? In most cases, the MOT is prepared alongside the Sales and Purchase Agreement (SPA) and relevant loan documents when a bank loan is taken out to purchase a property. However, it is important to note that if you are purchasing from a developer and the property is still under construction, the developer may not issue this MOT at the time of purchase until the land titles have been issued. The buyer is responsible for the stamp duty fee, and not the seller. If the stamp duty is not paid, the transfer of ownership cannot be executed. i. Property Transfer Between Family Members Although it sounds romantic, the transfer of ownership of property between family members is legally recognized in Malaysia under the consideration of ‘love and affection’. In this case, stamp duty fees can either be partially or fully waived! Property transfers between spouses get to benefit from a 100% stamp duty exemption. Transfers between (i) parents and child, and (ii) grandparents and grandchild, are subject to a different exemption. The first RM1,000,000 of the property value is exempt from stamp duty, the remaining balance receives a 50% exemption. Unfortunately, there is no stamp duty exemption for transfers between siblings and/or relatives. The MOT is still required to be stamped and adjudicated in these cases, just as it would in a property purchase. Learning about the Memorandum of Transfer can be a lot to take in, but once you’ve gone through the process, you’ll find that it’s simpler than you think. If you’re interested to become a successful real estate negotiator, don’t hesitate to be a part of our amazing team! [custom_blog_recruit_form] Continue reading: 10 Simple Steps to Buy a New House in Malaysia – Your Ultimate Guide Tenancy Agreement in Malaysia: Fees, Stamp Duty and More! How To Do a REN Check Before Appointing them to Sell or Rent your Property

Continue Reading

Stamp Duty Malaysia Increased in 2025! What You Need to Know!

Stamp Duty Malaysia Increased in 2025! What You Need to Know!

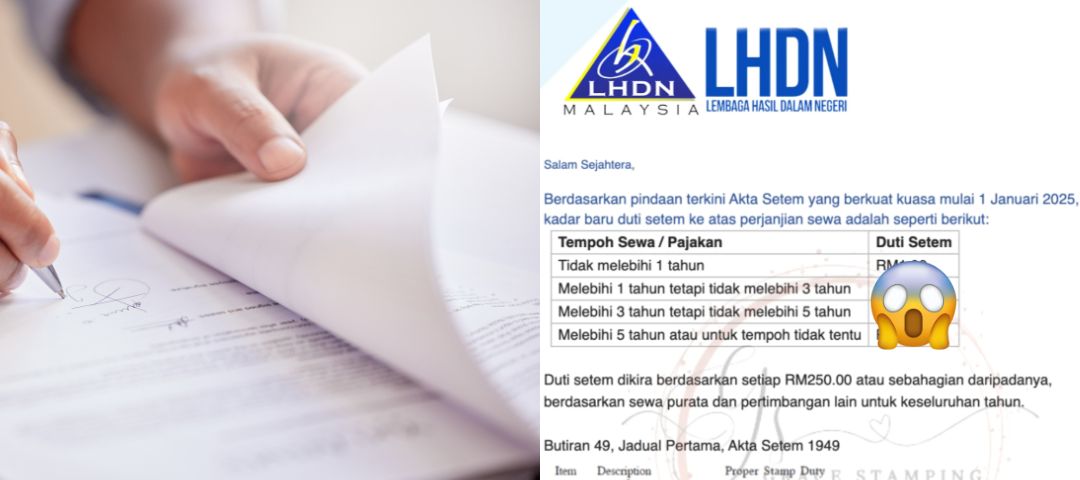

Are you feeling lost in the maze of stamp duty or property transaction costs in Malaysia? The ever-changing rules and calculations surrounding stamp duty can feel overwhelming, leaving you anxious about making a costly mistake. But fear not! This comprehensive guide will demystify stamp duty, providing you with the clarity and confidence to navigate your property journey in Malaysia. Stamp Duty Malaysia1. Tenancy Agreement Stamp Duty (NEW)2. Deadlines and Penalties for Late Stamping (NEW)3. Understanding Stamp Duty4. Why Should You Care About Stamp Duty?5. The Different Shades of Stamp Duty: Ad Valorem and Fixed Duties6. Who Foots the Bill? Determining Liability for Stamp Duty7. Stamp Duty Rates on Instruments of Transfer in Malaysia (2025)8. Stamp Duty on Loan Agreements9. Stamp Duty Exemptions and Remissions in Malaysia10. Paying Your Stamp Duty: The STAMPS System11. Significant Changes to Stamp Duty in 2025 and Beyond12. Frequently Asked Questions (FAQs) about Stamp Duty in Malaysia: 1. Tenancy Agreement Stamp Duty (NEW) When it comes to rental properties, stamp duty is calculated based on the monthly rental and the duration of the tenancy. As of January 1, 2025, the tenancy agreement stamp duty increased in 2025. The new rates for stamp duty on rental agreements are as follows: Rental PeriodStamp DutyNot exceeding 1 yearRM1.00Exceeding 1 year but not exceeding 3 yearsRM3.00Exceeding 3 years but not exceeding 5 yearsRM5.00Exceeding 5 years or for an indefinite periodRM7.00 Source: Finance Act 2024 Stamp duty is calculated based on every RM250.00 or part thereof, depending on the average rent and other considerations for the entire year. a. Example Calculation (Based on old calculation): Let's say you're renting a property for RM1,800 per month for 3 years. Calculate Annual Rent: RM1,800 x 12 months = RM21,600 Subtract the Exemption Threshold (if applicable): RM21,600 - RM2,400 = RM19,200 (The RM2,400 threshold is no longer applicable as of January 1, 2025) Divide by RM250 and Round Up: RM21,600 ÷ RM250 = 86.4, rounded up to 87 Multiply by the Applicable Rate (RM3 for 3-year tenancy, based on old rates): 87 x RM3 = RM261 Add Stamp Duty for Tenant's Copy: RM261 + RM10 = RM271 b. Important Note The tenant is responsible for paying the stamp duty on the tenancy agreement, not the landlord. 2. Deadlines and Penalties for Late Stamping (NEW) It's crucial to pay stamp duty within the stipulated timeframe to avoid penalties. Instruments executed within Malaysia: Must be stamped within 30 days of execution. Instruments executed outside Malaysia: Must be stamped within 30 days after it has been first received in Malaysia. a. Penalties for Late Stamping (Effective from January 1, 2025): DelayPenaltyNot exceeding 3 monthsRM50 or 10% of the unpaid stamp duty, whichever is higherExceeding 3 monthsRM100 or 20% of the unpaid stamp duty, whichever is higher Source: Finance Act 2024, The Sun b. Before January 1, 2025, the old penalty rates are: DelayPenaltyNot exceeding 3 monthsRM25 or 5% of the unpaid stamp duty, whichever is higherExceeding 3 months, not exceeding 6 monthsRM50 or 10% of the unpaid stamp duty, whichever is higherExceeding 6 monthsRM100 or 20% of the unpaid stamp duty, whichever is higher Source: LHDN Malaysia, Cleartax, Finance Act 2024 c. Consequences of Unstamped or Insufficiently Stamped Instruments: Inadmissible in Court: The document will not be accepted as evidence in a court of law. Cannot Be Acted Upon by Public Officer: A public officer will not act upon an unstamped or insufficiently stamped instrument. 3. Understanding Stamp Duty Stamp duty is a tax levied on legal documents, specifically those related to the purchase or transfer of real estate, as well as tenancy, etc. in Malaysia. It's governed by the Stamp Act 1949 and overseen by the Lembaga Hasil Dalam Negeri Malaysia (LHDN), the Inland Revenue Board of Malaysia. Think of it as a mandatory fee that validates your property-related documents, making them legally binding and admissible in court. It is not merely a formality but a cornerstone of secure and legal property transactions. 4. Why Should You Care About Stamp Duty? Understanding stamp duty is not just about ticking a legal box but making informed decisions. No matter you're a first-time homebuyer, a seasoned investor, or simply transferring property to a loved one, knowing the ins and outs of stamp duty can save you significant sums of money and prevent legal headaches down the road. It directly impacts your financial planning and ensures a smooth, legally sound property transaction. 5. The Different Shades of Stamp Duty: Ad Valorem and Fixed Duties In Malaysia, stamp duty comes in two primary forms: Ad Valorem Duty: This is the most common type for property transactions. The amount payable is calculated as a percentage of the property's value or the consideration stipulated in the instrument, whichever is higher. The higher the property value, the higher the stamp duty, although there are some exemptions that we will discuss later. Fixed Duty: This type of duty applies a predetermined amount, regardless of the property's value. It's typically levied on specific legal documents, such as certain types of agreements, as outlined in the First Schedule of the Stamp Act 1949. 6. Who Foots the Bill? Determining Liability for Stamp Duty The responsibility for paying stamp duty isn't arbitrary. The Third Schedule of the Stamp Act 1949 clearly outlines who is liable for specific instruments. In most property transactions, the buyer is responsible for paying the stamp duty on the instrument of transfer (MOT) and SPA. The borrower is responsible for paying the stamp duty on the loan agreement. 7. Stamp Duty Rates on Instruments of Transfer in Malaysia (2025) The cost of stamp duty on the transfer of property, excluding shares, stock, or marketable securities, depends on whether the buyer is a Malaysian citizen/permanent resident or a foreigner/foreign company. a. For Malaysian Citizens and Permanent Residents: Price TierStamp Duty RateFirst RM100,0001%RM100,001 to RM500,0002%RM500,001 to RM1,000,0003%Above RM1,000,0004% Source: iProperty Malaysia b. For Foreign Companies, Non-Citizens, and Non-Permanent Residents: Price TierStamp Duty RateAll Price Tiers4% Source: PwC c. Example Calculation Let's say you're a Malaysian citizen buying a property for RM600,000. Here's how the stamp duty is calculated: First RM100,000: RM100,000 x 1% = RM1,000 Next RM400,000: RM400,000 x 2% = RM8,000 Remaining RM100,000: RM100,000 x 3% = RM3,000 Total Stamp Duty: RM1,000 + RM8,000 + RM3,000 = RM12,000 8. Stamp Duty on Loan Agreements When you take out a loan to finance your property purchase, the loan agreement is also subject to stamp duty. a. Standard Rate Generally, a flat rate of 0.5% of the total loan amount applies. b. Reduced Rate For specific Malaysian Ringgit loan agreements or instruments without security and repayable on demand or in a single bullet repayment, a reduced rate of 0.1% may apply. c. Example Calculation If you take out a loan of RM540,000 (90% of the RM600,000 property), the stamp duty on the loan agreement would be: RM540,000 x 0.5% = RM2,700 9. Stamp Duty Exemptions and Remissions in Malaysia Fortunately, the Malaysian government offers several exemptions and remissions to ease the financial burden of stamp duty, particularly for first-time homebuyers and specific property transfers. a. First-Time Homebuyers Exemption (i-MILIKI): This initiative aims to encourage homeownership among Malaysians. Properties valued up to RM500,000: Full stamp duty exemption on both the instrument of transfer and loan agreement. This applies to Sale and Purchase Agreements executed between 1 January 2021 and 31 December 2025. Properties valued between RM500,001 and RM1,000,000: 75% stamp duty exemption on the instrument of transfer for SPAs executed by December 31, 2023. Starting from 2024, first-time homebuyers purchasing homes above RM500,001 will not benefit from any stamp duty exemption. b. Eligibility Criteria for First-Time Homebuyers Exemption: Malaysian citizen. Must not already own a residential property (including inherited or gifted property). Applicable to residential properties only (excluding SOHO/SOFO/SOVO types and serviced residences built for commercial use). c. Transfer Between Family Members: Parent and Child: Before April 1, 2023: 50% remission of stamp duty. From April 1, 2023: Full exemption for the first RM1 million of the property's value; 50% remission on the ad valorem stamp duty for the remaining value. This applies only to Malaysian citizens. Grandparent and Grandchild: From April 1, 2023: Full exemption for the first RM1 million of the property's value; 50% remission on the ad valorem stamp duty for the remaining value. This applies only to Malaysian citizens. Husband and Wife: 100% exemption. Siblings: No exemption. d. Other Exemptions and Remissions: Abandoned Housing Projects: Stamp duty exemption on instruments executed by a rescuing contractor or developer approved by the Ministry of Housing and Local Government, for loan agreements and transfer of revived residential properties in abandoned projects. This exemption is valid for instruments executed by December 31, 2025. Conversion of Conventional Partnership or Private Company to Limited Liability Partnership: Stamp duty exemption on all instruments of transfer of land, business, asset, and share. Micro Small and Medium Enterprises (MSMEs): Stamp duty exemption on loan/financing agreements executed between MSMEs and investors for funds raised on a peer-to-peer platform registered and recognized by the Securities Commission (SC). This is valid from January 1, 2022, to December 31, 2026. Stamp duty exemption on instruments for loan or financing up to RM50,000 (increased to RM100,000 for agreements executed from January 1, 2025) between MSMEs and participating banks or financial institutions under the National Small and Medium Enterprise Development Council. Stamp duty exemption on loan or financing instruments executed from January 1, 2025 to December 31, 2026 by MSMEs and investors through Initial Exchange Offering platforms registered with SC. e. Stamp Duty Order (Remittance & Exemption): You can check out the various stamp duty order for remittance & exemption from year 2002 until 2021 on LHDN Malaysia official website. 10. Paying Your Stamp Duty: The STAMPS System Gone are the days of manually stamping documents at the LHDN office. Now, you can conveniently pay your stamp duty online through the Stamp Assessment and Payment System (STAMPS) via the LHDN website (https://stamps.hasil.gov.my). This digital system streamlines the process, making it faster and more efficient. a. Step-by-Step Guide to Paying Stamp Duty Online via STAMPS: Register as a STAMPS User: If you are not already registered, create an account on the STAMPS portal. Log in to STAMPS: Access the system using your registered ID and password. Select "Sistem Duti Setem": Choose the stamp duty system from the available options. Choose "Penyeteman" and then select the type of instrument: For example, select "Perjanjian Sewa" for tenancy agreement and "Pindah Milik Tanah/ Harta" for the instrument of transfer (e.g., MOT). Fill in the Required Information: Provide details about the instrument, property, and parties involved. Upload Supporting Documents: You may need to upload scanned copies of the relevant documents (e.g., SPA, loan agreement, tenancy agreement). Make Payment: Pay the stamp duty online using FPX or other available online payment methods, such as CIMB BizChannel and Public Bank. Print Stamp Certificate: Once the payment is successful, you can print the stamp certificate. Affix this certificate to the original instrument as proof of payment. b. Important Note A stamp certificate is issued electronically for online applications through STAMPS. The certificate should be affixed or attached to the instrument, and the instrument is considered duly stamped. 11. Significant Changes to Stamp Duty in 2025 and Beyond The Malaysian government is implementing significant changes to the stamp duty regime, transitioning towards a self-assessment system. a. Key Changes Mandatory Stamping: From 2026, stamp duty will be mandatory for all instruments under the Stamp Act, including intercompany agreements. Self-Assessment System: This will be implemented in phases: Phase 1 (from January 1, 2026): Rental or lease, general stamping, and securities. Phase 2 (from January 1, 2027): Instruments of transfer of property ownership. Phase 3 (from January 1, 2028): All other instruments not covered in Phases 1 and 2. IRB Audit Power: The IRB will have the authority to audit agreements up to five years after the duty is paid or would have been paid. Increased Penalties: The maximum penalty is RM100 or 20% of the deficient duty, whichever is higher. If the matter goes to court, the fines can range from RM1,000 to RM10,000, and may have to pay a special penalty equivalent to the underpaid duty. b. Expert Insights Source: KPMG "The amendments will make stamp duty mandatory and grant the Inland Revenue Board (IRB) the authority to audit agreements up to five years after payment," says Soh Lian Seng, Head of Tax at KPMG in Malaysia. He further emphasizes the importance of accurate calculations and classifications under the self-assessment system to avoid hefty penalties. 12. Frequently Asked Questions (FAQs) about Stamp Duty in Malaysia: a. How much is stamp duty in Malaysia 2025? The stamp duty rates for property transfers in 2025 depend on the property value and the buyer's status (Malaysian citizen/permanent resident or foreigner). For Malaysian citizens and permanent residents, the rates are tiered: 1% for the first RM100,000, 2% for the next RM400,000, 3% for the next RM500,000, and 4% for the value exceeding RM1,000,000. For foreigners and foreign companies, a flat rate of 4% applies. For loan agreements, the general rate is 0.5% of the loan amount. Tenancy agreement stamp duty rates have also changed - refer to the "Stamp Duty on Tenancy Agreements" section above. b. Is there any stamp duty exemption for first-time homebuyers in 2025? Yes, first-time homebuyers purchasing properties valued up to RM500,000 can enjoy a full stamp duty exemption on both the instrument of transfer and loan agreement if the SPA is executed between January 1, 2021, and December 31, 2025. However, for properties valued between RM500,001 and RM1,000,000, the 75% exemption on the instrument of transfer was only valid for SPAs executed by December 31, 2023. c. What are the stamp duty rates for properties in Malaysia 2025? The rates are the same as mentioned in question 1. Refer to the tables provided in the "Stamp Duty Rates on Instruments of Transfer" section above. d. How to calculate stamp duty on a loan agreement in Malaysia 2025? The stamp duty on a loan agreement is generally 0.5% of the total loan amount. For example, if you take out a loan of RM450,000, the stamp duty would be RM2,250. However, certain exceptions and reduced rates may apply as mentioned in the "Stamp Duty on Loan Agreements" section. e. Is there any change in stamp duty in Malaysia 2025? Yes, there are several changes, including the introduction of a self-assessment system, mandatory stamping for all instruments under the Stamp Act (from 2026), increased audit powers for the IRB, revised penalty rates for late stamping, and changes to stamp duty rates for tenancy agreements. f. What documents are subject to stamp duty in Malaysia? Documents related to the sale, transfer, and lease of property, loan agreements, and other instruments listed in the First Schedule of the Stamp Act 1949 are subject to stamp duty. This includes Sale and Purchase Agreements (SPA), Memorandum of Transfer (MOT), Deed of Assignment (DOA), Loan Agreements, and Tenancy Agreements. g. How to pay stamp duty online in Malaysia LHDN? You can pay stamp duty online through the Stamp Assessment and Payment System (STAMPS) on the LHDN website (https://stamps.hasil.gov.my). You need to register as a user, log in, select the type of instrument, fill in the required information, upload supporting documents, and make the payment online. h. How to do tenancy agreement stamp duty? To pay stamp duty for a tenancy agreement in Malaysia, calculate the amount based on rental and lease duration: RM1 per RM250 of annual rent (≤1 year), RM2 per RM250 (1-3 years), and RM3 per RM250 (>3 years). Submit the agreement for stamping within 30 days via LHDN STAMPS online portal (https://stamps.hasil.gov.my) or at an LHDN branch with required documents (tenancy agreement, NRIC/passport, and property details). Payment can be made online or at the counter, and once approved, both parties should keep a stamped copy for legal reference. F Stamp duty is an integral part of property transactions in Malaysia. Understanding its nuances, from rates and calculations to exemptions and payment procedures, is crucial for a smooth and cost-effective property journey. By staying informed about the latest regulations and leveraging available exemptions, you can navigate the complexities of stamp duty with confidence and make informed decisions that safeguard your financial well-being. Remember, this guide serves as a starting point, please always consult with legal and financial professionals for personalized advice tailored to your specific circumstances. The upcoming changes in 2025 and beyond underscore the importance of staying updated and seeking expert guidance to ensure compliance and optimize your property transactions in Malaysia. Version: CN, BM Are you a first-time homebuyer or need expert guidance on purchasing a house? We are here to assist you! Fill out the form below, and our representative will approach you soon! [custom_blog_form] Continue Reading: Tenancy Agreement in Malaysia: Fees, Stamp Duty and More! i-MILIKI Stamp Duty Exemption for First-Home Buyers Is Ended But Here’s What Government Are Giving! Everything You Need To Know About The Memorandum Of Transfer (MOT) Citation, Reference and Related Information about Stamp Duty in Malaysia 2025 LHDN Malaysia Stamp Duty 2. iProperty Malaysia Memorandum of Transfer (MOT) and Stamp Duty in Malaysia. Sale and Purchase Agreement in Malaysia: What is SPA in property? Stamp duty and legal fees calculation for SPA when buying a house in Malaysia. 3. PwC 2024/2025 Malaysian Tax Booklet: Stamp Duty. 4. Cleartax Stamp Duty in Malaysia: Rates, Exemptions & Penalties. 5. DWG Malaysia What is Memorandum Of Transfer (MOT) in Malaysian Property? 6. 小晴天~房产报报看 How to calculate the new stamping fee 2025! Year 2025 | Late stamping fine adjustment. 7. Propertyguru Malaysia Tenancy Agreement In Malaysia: 6 Things You Should Know! 8. The Sun Tax Matter - Expect significant Changes to Stamp Duty from 2025. 9. KPMG Tax experts: Stamp duty reform must come with stronger enforcement, stiffer penalties

Continue Reading

Tenancy Agreement in Malaysia: Fees, Stamp Duty and More!

Tenancy Agreement in Malaysia: Fees, Stamp Duty and More!

Version: CN Renting is the most popular mode of obtaining accommodation, mostly for shorter stays but also for longer stays in countries where one lives outside their native country. There are rules and procedures in place for safeguarding both parties. In order to ensure the safety of the people involved, some specific documentation has been made mandatory prior to handling a rental. Things to know about tenancy agreement1. What is a tenancy agreement?2. What is included in a tenancy agreement?3. What are the deposits tenants need to pay?4. How much is the stamp duty for a tenancy agreement in Malaysia?5. What are the other fees involved in the rental agreement?6. Tenancy Agreement Templates 1. What is a tenancy agreement? Tenancy Agreement A tenancy agreement is a legal treaty between a landlord and a tenant. It outlines everything – from duties to amenities in a detailed description – that a landlord and a tenant have agreed to about the tenancy. To comprehend the agreement thoroughly, the landlords can hire an attorney although it can be a bit costly. The potential tenants can consult their own lawyer to examine the contract carefully and demand a recheck before finalizing the contract. Malaysian landlords choose to draft their own tenancy agreement mostly. Then they ask their prospective tenants to accept it. 2. What is included in a tenancy agreement? Here are the basic documents that need to be obtained prior to renting a property in Malaysia. 1. Property details and purpose of use Mention the address of the home and the purpose of its rental. In addition, indicate what kind of residential property is being leased. The unit number of apartments or condos must be stated, and whether the entire house or only specific room(s) is to be rented. If the house is partially or fully furnished/fitted, the owner should attach an inventory in the rental contract, which the tenant needs to verify before signing. The landlord may include clauses to provide for routine inventories during and at the end of the contract. 2. Duration of Tenancy State the start and end dates of the intended tenancy duration. In Malaysia, leases usually range from 1 to 3 years. Monthly leases are also common. Either party may specify terms and conditions to allow the occupant to extend/renew the tenancy. 3. Rental amount and deposits State the exact rent per month in the contract, alongside the due date and its manner or payment (bank deposit/transfer/cash). Also state the exact amount the tenant needs to pay for Security Deposit, Earnest Deposit, and Utility Deposit. 4. Obligations of landlord The owner is obliged to pay all necessary charges for maintaining the property like quit rent, assessment fees, maintenance fees, charges to maintain or repair infrastructure like wiring, piping, posts, and beams. The landlord must respect the rights of the tenant to privacy and provide the tenant exclusive usage of the property for the duration of the contract. Annual property tax comes in this section. This tax has to be paid to the relevant authorities. For this, insuring the property and paying insurance premiums are a must. Also, the furniture and other tools that were provided must be in good working condition. For the landlords, there is another tax called rental income tax. This tax is paid for the money you make from renting out your properties. Then comes real property gains tax (RPGT). As a landlord, when you are profited from selling a property, you have to pay RPGT. However, you can ask for a 50% income tax exemption on your rental income. The following criterias are for this income tax exemption – Valid only for residential properties Valid only for Malaysian residents Rental income earned must not exceed RM2,000 per month per property The property is leased under a lawful tenancy agreement between owner and tenant Tax exemption is permitted for a maximum period of 3 years of assessment in a row Applicable for tenancies made in the year of assessment 2018 to 2020 5. Obligations of tenant General obligations of the tenant are paying rent on time, in addition to the deposits and utility fees. The tenant is responsible for maintaining safety and cleanliness, and following necessary laws. 6. Rules, prohibitions, and limitations on the property It specifies the impermissible activities on the property. If, for instance, renovations or modifications are disallowed without permission. The use of property for entrepreneurial purposes, gambling or drugs may be forbidden. The landlord may also add other clauses, such as limiting the occupants to a certain number or a single family. 7. Dispute resolution This part states the dispute resolution process, if there are any misinterpretations in the agreement, or if there is dispute between the parties, unless clearly stated in the rest of the documentation. 8. Special terms, conditions, or sub-clauses Miscellaneous conditions and clauses that either the landlord or the tenant wants to incorporate in the rental agreement in Malaysia. For expatriate tenants, concerned parties may want to include a clause giving the tenant the right to terminate the contract before full term if the tenant must relocate away from the current holding. Many of the details have to be clearly documented and explained to prevent misunderstandings and disputes. 3. What are the deposits tenants need to pay? Alongside the monthly rent, landlords in Malaysia ask the tenants to pay some deposits – Earnest deposit: Payment to hold booking of the property for 7 days and is accompanied by letter of offer from tenant. It can be used towards payment of first rent. Security Deposit: Is a safety deposit for landlords in case of violation of terms by the tenant. Utility deposit: Typically, half a month's rent and is used to pay any outstanding bills the tenant incurs. 4. How much is the stamp duty for a tenancy agreement in Malaysia? After including all the above points, in the presence of a lawyer, and making appropriate payments, the contract is signed by the tenant and the owner. Both the parties have to attend the ‘ink the deal’. Even if each party signs the deal, it has to be stamped by the Malaysia Inland Revenue Authority or Lembaga Hasil Dalam Negeri Malaysia (LHDN). The agreement will not be legally approved without it. Nevertheless, before it is sealed by LHDN, you have to pay the Stamp Duty. Who is responsible to pay the stamp duty fees? The tenant pays for the stamp duty fees in Malaysia. The third schedule of Stamp Act 1949 shows it. Stamp duty for a tenancy agreement varies with rent and duration. Usual yearly rates are RM1 for every RM250 above RM2400.For 1-3 yearly rates, it rises to RM2.For 3 years, it becomes RM4. 5. What are the other fees involved in the rental agreement? Administration fees and legal fees are the two other fees that you have to know about while drafting your tenancy agreement. The administration fees are based on the monthly rental amount. It is a one-time charge, and the tenant has to pay this fee to the seller. The general recommended guidelines for admin fees are: Rental Per MonthProbable Admin Fees<RM1,000RM100> RM1,000 to RM1,999 RM150> RM2,000 to RM3,000RM200> RM3,000 to RM4,000 RM250> RM4,000 RM300 However, the final amount will be decided after the consideration of the landlord or real estate agency. The legal fees are somewhat different from the stamp duty and admin fees. This fee depends mainly on the duration of the tenancy. The baseline of this duration is 3 years (either less or more than 3 years). So, how to calculate legal fees for a tenancy agreement in Malaysia? Below is a basic guideline for this – When the rental period is less than three years: 25% of the monthly rent for the first RM10,000 of annual rent 20% of the monthly rent for the next RM90,000 of annual rent Negotiable where the annual rent is in excess of RM100,000 When the rental period is more than three years (lease): 50% of the monthly rent for first RM10,000 of annual rent 20% of the monthly rent for the next RM90,000 of annual rent Negotiable where annual rent is in excess of RM100,000 Usually in Malaysia, both tenant and landlord split the legal fees as they see fit. 6. Tenancy Agreement Templates Download the tenancy agreement templates here: Appointment Letter: Rental Rental Authorization Form Confirmation Letter: Rental In simple terms, a convenient tenancy agreement will help you as a landlord to deal successfully with the tenants while avoiding future disputes. So make this document ready before getting into the rental market! Still confused about what makes up a tenancy agreement? Not to fret, IQI has a number of real estate professionals ready to help you solve your confusions! Submit your details below to get connected to an expert today! [hubspot portal="5699703" id="85ebae59-f425-419b-a59d-3531ad1df948" type="form"]

Continue Reading