Australia Real Estate Guide: Market, Rules and Investment Tips

Get a clear overview of Australia’s property market. Learn about top cities, buying rules for foreigners, financing, taxes and rental yields to plan your next investment.

Table of contents

- Introduction

- What Makes Australia an Attractive Investment Destination

- How Is the Economy in Australia Performing Right Now?

- What’s Happening in the Australia Property Market in 2025?

- What to Expect and What to Look for in 2026?

- How Much Can You Earn From Property Investment in Australia?

- Where Are the Best Places to Invest in Australia Right Now?

- What Do Our Local Experts Say About the Market?

- Can Foreigners Buy Property in Australia? What Are the Rules?

- Tools, Tips and FAQs for Foreign Buyers

- Frequently Asked Questions

Key takeaway

- Current performance of Australia’s property market and the key factors driving it

- Investment hotspots by city and asset type

- Typical returns and the factors that influence yields

- Rules for foreign buyers, approvals required, and associated costs

Introduction

Australia stands out as one of the world’s most stable and transparent real estate markets. With a high-income economy, strong legal protections, and globally recognized education and healthcare systems, the country continues to attract both long-term migrants and international investors.

Cities such as Sydney, Melbourne, Brisbane and Perth remain highly connected economic hubs, supported by steady population growth, skilled migration and deep rental demand. These fundamentals create an environment of clarity and resilience that appeals to investors seeking long-term stability, well-regulated processes and sustained market confidence.

What Makes Australia an Attractive Investment Destination

Rule of law and transparency: Australia boasts a mature legal system, strong title protection, and a deep network of trusted agencies and banking institutions, giving investors confidence in property ownership and transactions.

Population growth and rental depth: High levels of migration, combined with persistent housing supply shortages, continue to support strong rental demand and high occupancy rates across major cities and regional centres

Resilient property values: National property values are still rising, though the pace has moderated due to affordability pressures. According to ABC and PropTrack, monthly gains continued through late 2025, with growth strongest in mid-sized capitals like Adelaide, Canberra, and Hobart.

Balanced, sustainable outlook: Rather than boom-and-bust cycles, KPMG forecasts modest national price growth over the next one to two years, supported by easing interest rates and improved housing supply. This suggests a stable environment for both long-term investors and those seeking rental income.

Strong rental yields in select markets: While capital growth may be moderate, certain cities and regional hotspots continue to offer competitive rental yields, particularly for apartments in high-demand areas and houses in growth corridors.

Global connectivity and lifestyle appeal: Australia’s major cities offer high-quality education, healthcare, and infrastructure, attracting both domestic and international tenants, which underpins long-term property demand.

(Sources: ABC News, PropTrack, KPMG Residential Property Market Outlook 2025)

How Is the Economy in Australia Performing Right Now?

Australia’s economy in 2025 is showing steady momentum, driven by strong domestic activity and a resilient labour market. Population growth through migration continues to fuel demand for housing, creating exciting opportunities for investors across both major cities and high-growth regional areas.

The property market remains lively, with prices continuing to rise and mid-sized capitals like Adelaide, Canberra, and Hobart leading the way. Supportive financing conditions also make it easier than ever for buyers and investors to access credit, while high rental demand ensures attractive income potential.

Overall, Australia’s economic stability, ongoing population growth, and vibrant housing market make it a compelling and reliable destination for property investment in the years to come.

(Sources: ABC News, PropTrack, KPMG Residential Property Market Outlook 2025)

What’s Happening in the Australia Property Market in 2025?

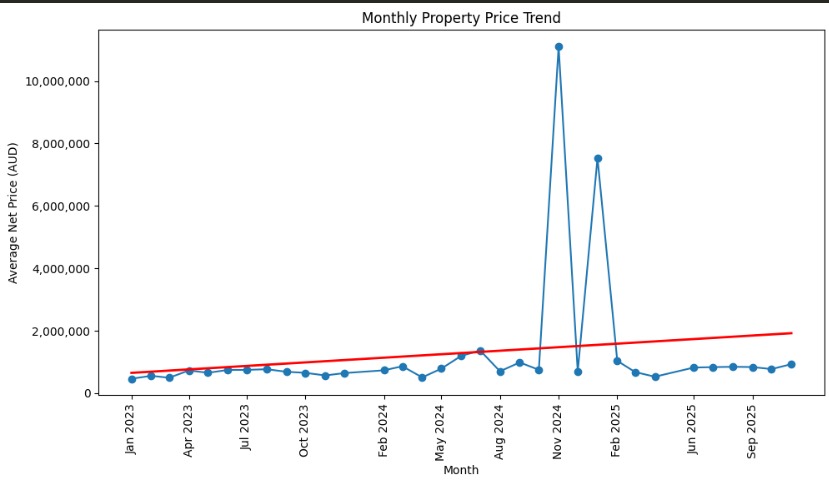

IQI Australia internal data highlights (2023–2025 YTD)

Upward price trend: Our monthly series shows a steady rise in average net price from early 2023 to late 2025, with the fitted trendline moving upward.

High-value spikes: Two notable spikes appear around Nov 2024 and Jan 2025. These are driven by a small number of very large transactions rather than broad market movement, so it is useful to present median values alongside the averages.

Post-spike normalisation: After these peaks, monthly averages return to the longer-run trend, reinforcing the view that Australia’s market is rising but not overheating.

Investor takeaway: The 2024–2025 period should be seen as high-dispersion. Price discipline, due diligence on building condition and neighbourhood rent comparisons matter more than headline averages.

At-a-glance:

A quick snapshot of Australia’s latest housing indicators, giving a top-line view of price movement, affordability pressures and what analysts expect for 2025. These figures help frame the broader context behind our internal IQI Australia trends.

| Indicator | Latest read | Why it matters |

|---|---|---|

| National home prices | Up 0.6 percent in Oct 2025 and 7.5 percent year-on-year | Signals a continued upswing although the pace is easing as interest rate pressures stabilise (Realestate) |

| Median dwelling value | AUD 848,858 as at Aug 2025 | Provides a benchmark for national pricing and supports valuation accuracy across markets (Global Property Guide) |

| November price pulse | Another monthly increase with Perth driving the gains | Highlights the growing strength of mid-sized capitals which are now outperforming traditional leaders (Reuters) |

| Affordability | Worst on record with more than ten years needed to save a 20 percent deposit in most capitals | Acts as a cap on price growth and increases renter demand as buyers stay out of the market longer (ABC) |

| Forecasts | KPMG projects house prices to rise +4.9 percent in 2025 and units +4.5 percent | Suggests units may see stronger demand as buyers shift towards more affordable options (KPMG Assets) |

Metric 1

Metric 2

Metric 3

Metric 4

Metric 5

What This Means For Investors

i) Momentum stays positive but regional divergence is real

The macro-trend across 2023–2025 shows rising average (and median) prices. That indicates the overall market is still going up. However, not all cities are equal.

Some capitals (especially smaller or mid-sized ones) are outperforming major coastal markets. That means picking the right location is more important than hoping “all of Australia” goes up.

ii) Tight rental demand + stretched purchase affordability = opportunity for yield, but only with discipline

With vacancy rates extremely low nationwide and rents rising, demand for rental properties remains firm. At the same time housing affordability is very stretched for many buyers. That tends to push more people into renting rather than buying, which is good news for landlords.

But because prices are high and varied, investors need to choose stock carefully. It’s not the time to buy at any price. Focus on properties with good rental yield potential, stable demand (near infrastructure, employment, schools, migration-driven growth) and realistic valuations — not just momentum.

iii) Mean vs median: use the right benchmark

Internal data shows spikes (from a few big deals) distort the monthly average price.

Meanwhile median prices are more stable. For investment decisions - especially at the suburb or building level - benchmark against median prices or comparable properties rather than citywide means. This gives a more conservative, realistic baseline for yield and growth projections.

What to Expect and What to Look for in 2026?

Based on recent forecasts from property analysts and market data, several trends and hotspots are emerging.

Likely Winners: Capitals with Upward Momentum & Relative Affordability

| City / Region | Why It Looks Promising |

|---|---|

| Perth (WA) | Already among the strongest performers, with ongoing migration, resource-sector support, affordability relative to east-coast capitals and tight vacancy |

| Brisbane /wider South-East Queensland (QLD) | Growing population inflows, high rental demand, supply constraints. Good for both houses and units. |

| Adelaide (SA) | Emerging as a value-driven alternative to expensive capitals. Relative affordability + rising demand creates upside. |

| Select outer / suburban corridors in bigger cities (e.g. certain suburbs around Melbourne or Sydney) | As central-city houses become expensive, well-located suburbs (good infrastructure, commute lines, amenities) become the “value play”. |

Metric 1

Metric 2

Metric 3

Metric 4

What to Expect in Numbers

According to a recent forecast, national dwelling prices could rise 6–10% in 2026. ABC

For “affordable but high-demand” cities like Perth, Brisbane and Adelaide, growth could be stronger — creating potential for both capital gains and rental yield. ABC, Bamboo Routes

The unit / apartment market may outperform the house market in many areas. Because affordability is stretched, smaller homes are often more accessible — and demand (owners or renters) remains high. KPMG

Investor Strategy for 2026: What I’d Do If I Were Investing

Target mid-sized capitals or growth-oriented suburbs (e.g. around Perth, Brisbane, Adelaide) rather than expensive big-city core suburbs.

Focus on units/townhouses or smaller homes — easier entry price, still high demand, better yield potential.

Use median price benchmarks and building-level comps for valuation, not headlines.

Prioritise properties near infrastructure, transport, jobs, population growth areas — these will sustain demand even if interest rates rise or supply picks up.

Think longer term (3-5+ years) — 2026 likely brings continued growth, but sharp short-term swings possible if the economy, rates or supply change.

How Much Can You Earn From Property Investment in Australia?

Your returns will depend on careful selection, realistic assumptions and strong micro-market fundamentals:

Mind the mean–median gap: A handful of high-value transactions can lift the monthly average, so the model yields using building-level rental comparisons and, where possible, median purchase prices in the specific micro-market.

Stress-test your returns: Use conservative rent estimates, allow for one to two months of vacancy and factor in strata fees, council rates, insurance and management costs when running your cash-flow projections.

What the data suggests: Although some months contain outlier transactions, the underlying trend remains upward. This aligns with national indices showing continued gains into late 2025, though at a slower pace. Together, this supports targeted purchases in well-connected areas across cities that are still recording growth such as Perth, Brisbane and Adelaide.

Indicative gross yields vary by city, building quality and service charges. A practical underwriting range for mainstream apartments:

| City and asset | Typical ticket | Monthly rent | Gross yield guide |

|---|---|---|---|

| Brisbane 2-bed inner ring | AUD 650k–800k | AUD 2,800–3,400 | 4.5–5.5 percent |

| Perth 3-bed townhouse fringe | AUD 650k–750k | AUD 3,000–3,500 | 5.0–6.0 percent |

| Melbourne 1-bed CBD-fringe | AUD 500k–600k | AUD 2,100–2,600 | 4.2–5.2 percent |

| Sydney 2-bed rail-linked suburb | AUD 900k–1.1m | AUD 3,500–4,200 | 3.8–4.6 percent |

Metric 1

Metric 2

Metric 3

Metric 4

Tip: stress-test with 1 to 2 months’ vacancy and include strata, council rates, insurance and management fees.

Where Are the Best Places to Invest in Australia Right Now?

New Projects

Perth: Continues to lead monthly price growth, supported by low stock levels, strong interstate migration and resilient rental demand. Reuters

Brisbane: Benefits from steady population inflows and relative affordability compared with Sydney and Melbourne, which strengthens both rental yields and buyer interest. Realestate

Adelaide: Limited supply and consistent local demand underpin stable value growth. Its affordability advantage makes it attractive for investors seeking balanced capital gain and yield. Realestate

Select Sydney and Melbourne suburbs: Opportunities remain in well-connected suburbs, particularly near rail lines. Family-sized apartments and townhouses in areas with clearer price stabilisation offer better value than tightly held inner-core markets. ABC

What Do Our Local Experts Say About the Market?

Growth remains broad-based, with every capital city and regional market recording gains over the month, quarter, and year. Yet, the pace of expansion continues to diverge

Perth (+4.0%) and Brisbane (+3.5%) led the capitals through September onwards, supported by strong demand in the unit segment. Darwin (+5.9%) outperformed all capitals, posting the fastest quarterly growth rate. Overall, most cities are still seeing stronger appreciation in house values, though Brisbane, Perth, and Hobart stand out as markets where unit prices are outpacing houses due to ongoing supply shortages.

SQM Research projects up to 10 per cent price growth in 2026, highlighting a confident outlook for Australia’s property market.

2025 has been a year of resilience for the Australian property market, driven by strong population inflows and initial monetary policy easing, plus in recent months, the First Home Buyer Deposit Scheme. However, as we look to 2026, the outlook is shaped by a range of potential economic paths, from a sluggish economy to sticky inflation or even a robust economic rebound.

Australia’s uptrend is still broad based across capitals and regions, but the tempo is different by city. Since September, Perth and Brisbane have led the gains, with units attracting the strongest demand. Darwin has posted the fastest quarterly rise, while most cities still show firmer appreciation for houses. Three markets stand out on the unit side because of tight supply and migration tailwinds: Brisbane, Perth, and Hobart. SQM Research sees room for up to 10 percent national price growth in 2026, although the path will depend on how growth, inflation, and policy unfold.

What this means for you as an investor: target stock where demand is deepest and new supply is slow to arrive. Priorities transport-linked units in Brisbane and Perth for rental momentum, and family-sized townhouses or well-located houses where vacancy is tight. Underwrite with conservative rents, 1 to 2 months of vacancy, and full running costs. IQI has navigated 14 years of global real estate market cycles, so we can benchmark building-level comps, screen developer quality, and line up options that match your yield or capital growth goal while keeping risk in check.

Can Foreigners Buy Property in Australia? What Are the Rules?

Yes. Foreigners can buy property in Australia, but approvals and restrictions apply. The framework is overseen by the Treasury and the Australian Taxation Office (ATO).

Key rules for foreign buyers:

Established homes

A temporary two-year ban applies to foreign purchasers of established dwellings from 1 April 2025 to 31 March 2027 unless an exemption is granted.

New dwellings and off-the-plan units

Generally permitted with approval. Applications are lodged through ATO Online Services for foreign investors. Exemption certificates can simplify the process if you intend to make several purchase attempts.

Vacant residential land

Usually allowed but subject to conditions, including commencing construction within a specified time frame.

Notification requirements

Foreign buyers must normally notify the ATO and secure approval before acquiring any form of residential land.

Costs to prepare for

Expect FIRB application fees, state transfer duty, foreign buyer surcharges in certain states, plus legal fees, inspections and ongoing strata or community charges.

Tools, Tips and FAQs for Foreign Buyers

Quick checklist

Confirm eligibility: Check that the property is new, off-the-plan, or foreign-buyer approved before proceeding.

Secure FIRB approval: Apply through the ATO, and factor in FIRB application fees plus any state stamp duty surcharges. Foreign investment in Australia

Assess rental strength: Compare building-level rents, vacancy trends, and yields against your mortgage repayments and running costs.

Prioritise high-demand locations: Favour transport-connected suburbs, employment hubs, and family-friendly areas where supply remains tight.

Choose the right dwelling type: Larger apartments and townhouses often attract more stable tenants and stronger rentability.

Benchmark prices: Cross-check asking prices with national indices, valuation tools and independent market outlooks to ensure fair value. Realestate

Plan for currency transfer: Lock in FX rates early or use trusted remittance channels to manage transfer timing and costs.

Engage the right professionals: Work with a qualified solicitor/conveyancer, tax advisor, and local agent to streamline your purchase.

Frequently Asked Questions

Is the Australian property market at risk of a downturn?

Most outlooks point to moderate, steady growth rather than a sharp correction. Affordability may cap the pace of gains, but strong population inflows, tight supply, and stable economic conditions continue to support prices. Which Real Estate Agent

Which cities look best for yield today?

Perth and Brisbane remain among the strongest for gross rental yields, supported by attractive entry prices, high rental demand, and tight vacancy rates. Always cross-check with up-to-date rent comps and suburb-level data.

Which cities show the strongest capital growth potential?

Mid-sized capitals like Adelaide, Brisbane, Perth, and Canberra continue to lead annual price gains, supported by strong migration, employment growth, and supply constraints.

Are foreigners allowed to buy Australian property?

Yes. Foreigners can typically purchase new properties, off-the-plan units, or vacant land for development, subject to FIRB (Foreign Investment Review Board) approval. Fees vary based on price.

How long does FIRB approval take?

Most applications are processed within 30 days, though faster approvals are possible. Developers of new projects sometimes secure “pre-approved FIRB status,” simplifying the process for buyers.

What are the main upfront costs?

Foreign buyers should budget for FIRB application fees, stamp duty (plus any foreign buyer surcharge in select states), legal fees, valuation reports, and currency transfer costs.

How do I start the process?

Shortlist preferred cities and price ranges, confirm foreign-eligible stock, arrange pre-approval or funds verification, and have a solicitor review all contracts before paying any holding deposit.

Is it easy to rent out my property?

Australia maintains strong rental demand, especially in inner-city and employment hubs. Vacancy rates remain low in many markets, supporting consistent rental income.

Should I choose a house or an apartment?

Houses tend to offer stronger long-term land value growth, while apartments, especially in Perth, Brisbane, and Hobart can provide appealing yields due to unit undersupply and rising preference for urban living.

What’s the typical rental yield in major cities?

Yields vary, but units in Perth and Brisbane can range around 5–6%, while houses in mid-sized capitals generally range 3–4% depending on suburb and price point.

Need help to get started

Let our agents help you find the ideal land for you

Why Do Smart Investors Choose IQI as Their Real Estate Partner?

Get your financial planning right by using our simple mortgage loan calculator to find out estimates of monthly instalments, applicable interest rates and the principal amount that best suit your financial capacity

Exclusive market insights

powered by on-ground teams in 30+ countries

Data-driven strategies

using our proprietary IQI Atlas system for returns, yields, and forecasting

Award-winning agents

trained to serve local and international investors with integrity and expertise

Secure investment processes

with verified partners, legal guidance, and full transparency

Diverse project portfolios

across residential, commercial, and international markets